Publicly traded since 2015, Shopify (SHOP) is a Canadian-based tech company that provides affordable e-commerce tools to merchants, including inventory management, sales and payments management, financial reporting, consumer analytics, and more.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I am bullish on the stock. (See SHOP stock charts on TipRanks)

Another Earnings Beat

The two predominant factors to look at when analyzing growth stocks are earnings growth, and earnings consensus. Shopify has managed to beat its revenue estimates for 16 straight quarters and its EPS targets for six consecutive quarters.

Shopify reported $1.11 billion in second-quarter revenue, a 55.4% year-over-year increase. Subscription-based revenue grew by 70% due to an intense increase in new merchants. In addition, revenue from merchant solutions grew by 52%, primarily due to Gross Merchandise Volume.

Shopify posted an EPS beat of $1.28, and EPS is anticipated to extend its exponential growth trend for FY2021, as the digitalization of businesses shows no sign of slowing down.

Value Drivers

Research firm eMarketer predicts that 20.4% of all retail sales will occur online by the end of 2022. Adding to the statistic is the forecasted 22.9% CAGR in the e-commerce market from 2020 to 2027. Both of these statistics will be incorporated into asset pricing models by Wall Street analysts, and shouldn’t be underestimated.

Shopify has positioned itself to take advantage of the growing market by continuously developing its business model. The integration of Shopify Payments, Shipping, and Capital has made it easier for merchants to manage their businesses, and obtain working capital when required.

Critical to Shopify’s success has been its partner ecosystem, which has provided its platform with a wide range of payment gateways, applications, and turnkey solutions.

Finally, third-party sales partnerships with the likes of TikTok, Amazon (AMZN), Alibaba (BABA), and Facebook (FB) are expected to attract new vendors and buyers, which could further bolster top-line earnings.

Key Metrics

Shopify’s price to sales (49.1) and price to cash flow (358.8) multiples are way out of range, but history shows that value multiples have little to no effect on the stock.

The company’s sublime stock performance has really been due to its robust earnings. As mentioned before, the stock has beaten earnings estimates on nearly every reported occasion, and growth stocks thrive on such events.

Shopify’s revenue growth outshines its sector by 590.6%, and its free cash flow per share growth beats sector averages by 1,596.6%. These two metrics alone indicate that Shopify is still in a hypergrowth phase, and unless something completely erodes the viability of e-commerce, this will not change.

Wall Street’s Take

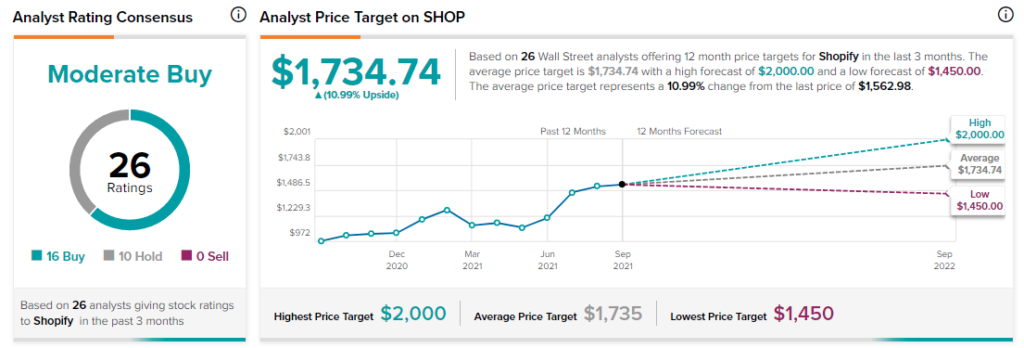

Wall Street thinks the stock is a Moderate Buy, with 16 buy ratings, 10 hold ratings, and no sell ratings. The average SHOP price target of $1,734.74 implies 11% upside potential.

Wells Fargo analyst Timothy Willi thinks Shopify stock is just beginning to scratch the surface of its potential. He believes customer retention, expansion of its product range, and a potentially significant financial services footprint could lead the stock higher.

Bottom Line

Shopify investors should benefit for some time to come, due to synergies formed with product partnerships, and the continued expansion of sales channels, both leading to top-line growth.

Disclosure: On the date of publication, Steve Gray Booyens had no position in any of the companies discussed in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.