Every market rally can have a bad day, and that’s what we saw yesterday. After a tremendous run, both long and short term, the NASDAQ had its worst day since December 2022, dropping almost 3% and falling to a two-week low. A drop in the mega-cap tech stocks has powered that decline, as worries over tighter trade restrictions with China and investor moves toward broadening the base have pulled money out of the major tech companies.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

While the market consensus would tell us that this bad day is not likely to push the bulls off track, a turndown like this makes it a good time to look at defensive stock plays.

The natural defense, of course, rests with the dividend stocks. These shares pay out a regularly scheduled income stream, regardless of market conditions, and the best of them ensure a sound return no matter how the markets turn.

So, if yesterday’s bad day has you seeking out high-yield dividends, the Street’s analysts are suggesting two div stocks to buy right now. These are shares that offer dividend yields of up to 12%, a yield that should turn heads in any economic environment.

We’ve used the TipRanks database to look up the broader view on both; these are Buy-rated shares, offering investors a strong defensive return as a portfolio foundation. Here are the details.

Dynex Capital (DX)

The first stock that we’ll look at is a real estate investment trust, a REIT. These companies are perennial dividend champs, and for good reason: in response to tax regulations, they typically pay out a high percentage of their profits directly to shareholders. Dynex Capital is a fairly typical REIT, with a portfolio composed mainly of MBSs, or mortgage-backed security instruments, mainly in the residential market although the company does have exposure to commercial mortgages as well. Dynex also maintains a significant portfolio position in both commercial and securitized single-family residential mortgage loans.

Dynex maintains a consistent strategic stance in putting its portfolio together. The starting point is a focus on preserving capital while seeking out stable long-term returns. Dynex is careful to manage risks, especially at the enterprise level. The company follows a policy of portfolio diversification and invests in Agency and non-Agency assets.

All of this leads to Dynex’s dividend payment, which does bear some extra attention from investors. For starters, Dynex pays out the dividend on a monthly schedule. While this has the immediate result of making for lower individual dividend payments, it brings the advantage of a more frequent payment – on the same schedule as most people’s regular expenses. Dynex’s current common share dividend has been held steady at 13 cents since mid-2020 and will next be paid out on August 1. At this rate, the dividend pays out 39 cents per quarter and $1.56 annually. The annualized rate gives a high yield of 12.35%.

Dynex’s Q1 financial results, the last reported, show that the company can support this dividend. The company’s EPS came to 64 cents per common share, well above the quarterly dividend total – and well above the 39 cents reported in the prior quarter. The company’s book value per common share came to $13.20 for the first quarter, roughly in line with the $13.31 reported in 4Q23.

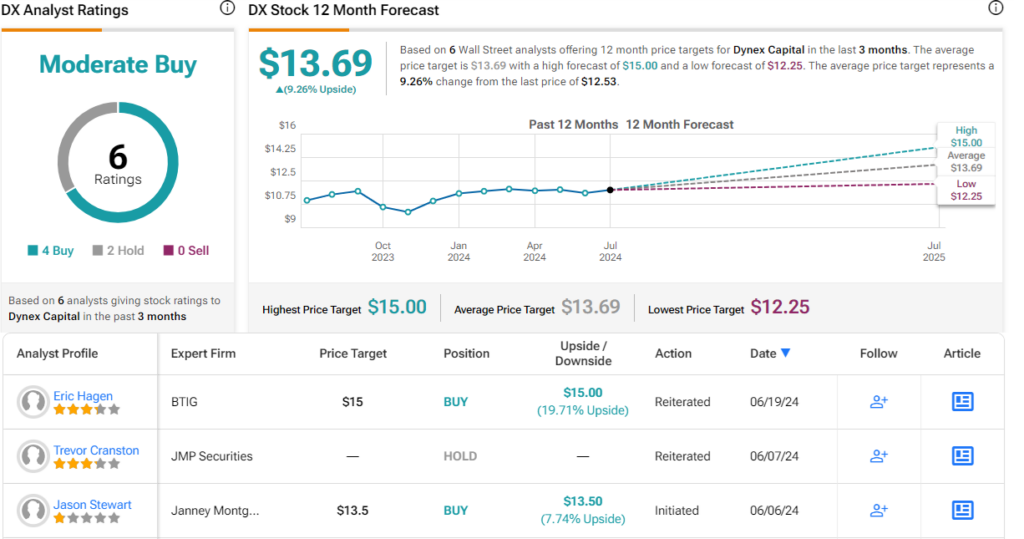

This high-yield dividend payer caught the eye of BTIG’s Eric Hagen, who sees the company’s strong exposure to Agency MBSs as a positive strength. He says, “DX is our top pick among the Agency mortgage REITs. We think the stock offers the cleanest and most transparent way for investors to be long the mortgage basis versus Treasuries. With Agency MBS spreads over Treasuries around +140 bps, we think the risk is tolerable using 7-9x leverage, especially while funding conditions are relatively supportive of levered MBS investors. We estimate 10 bps of spread tightening or widening is worth around 5% of mark-to-market net asset value.”

Based on this stance, Hagen rates DX shares as a Buy, and his $15 price target indicates room for a 20% upside on the one-year horizon. With the dividend yield added in, the total return can reach 32%. (To watch Hagen’s track record, click here)

Overall, Dynex has picked up a Moderate Buy consensus rating from the Street, based on 6 recent analyst reviews that include 4 Buys to 2 Holds. The shares are trading for $12.53 and their $13.69 average target price implies a one-year upside potential of 9%. (See Dynex stock forecast)

Enterprise Products Partners (EPD)

From REITs we’ll move over to the energy industry, another economic sector known for its high dividend payments. Enterprise Products Partners is a midstream company, moving crude oil, natural gas, and natural gas liquids from production fields across the US to storage and terminal facilities on the Gulf Coast. The company is one of North America’s largest midstream firms, with a $64 billion market cap and almost $50 billion in revenue during 2023.

The operations that generate success on this scale are enormous. The company controls pipeline assets that total more than 50,000 miles and stretch from several regions – the Rocky Mountains, the northern Plains, the Great Lakes, Appalachia, and the Southeast – into Texas and the Gulf Coast. Enterprise’s network includes natural gas gathering and processing, and the company has storage facilities with capacity for more than 300 million barrels of liquid products as well as 14 billion cubic feet of natural gas. In addition, Enterprise has terminal facilities throughout its network, and deepwater docks in the Gulf state export hubs.

These extensive operations led to solid revenues in 1Q24. The company’s top line came to $14.76 billion, up more than 18% year-over-year and $940 million ahead of the forecast. At the bottom line, EPD brought in a 66-cent GAAP EPS, missing the forecast by a mere penny.

Enterprise reported a distributable cash flow of $1.9 billion, in line with the prior-year period. This should interest dividend investors, as the distributable cash flow directly supports the common share dividend – and in the company’s most recent dividend declaration, announced on July 10, Enterprise made it known that the upcoming Q2 dividend will be raised from 51.5 cents to 52.5 cents per common share. At the new rate, the common share dividend annualizes to $2.10 per share, and gives a yield of 7.06%.

Watching this stock for RBC Capital, 5-star analyst Elvira Scotto is optimistic about Enterprise’s ability to maintain growth and to continue providing returns, saying, “We continue to believe EPD can comfortably handle the expected growth outlay, including additional 2025 growth capex and associated SPOT construction spend if FID’d, and think normalized capex in 2026 would enhance financial flexibility for incremental investor returns including higher unit buybacks.”

Scotto, who ranks in the top 1% of Street stock experts, goes on to rate EPD as Outperform (Buy), with a $35 price target that implies a one-year upside of nearly 18%. Add in the dividend yield, and this stock may return almost 25% over the next 12 months. (To watch Scotto’s track record, click here)

The 11 recent analyst reviews here break down to 9 Buys and 2 Holds, for a Strong Buy consensus rating. Shares in EPD are priced at $29.71 with an average target price of $32.90 pointing toward an 11% gain over the next year. (See EPD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.