Investor sentiment has been upbeat for months now, as markets are rebounding strongly from recent troughs. The gains are real, amounting to ~15% on the S&P 500 and 30% on the Nasdaq. A recent note from Wells Fargo, however, reminds investors to keep a disciplined stance – the bull, while real, may be more fragile than it looks.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

As the investment bank puts it, “Following the recent equity market rally, investors may have reason to be optimistic. On June 8, S&P 500 Index gains exceeded 20% from their October 2022 lows — the conventional yardstick to determine a bull market. This upsurge was bolstered by perceived tailwinds, including a pullback in inflation and pause in the Federal Reserve’s (Fed) rate-hiking campaign. Yet, we see more volatility ahead as the descent of inflation is likely to be uneven, potentially necessitating further Fed action. The economic slowdown that we anticipate would put further pressure on an earnings recession already underway, while wage costs would likely weaken margins.”

A cautious approach would naturally pull investors toward dividend stocks, the classic defensive play. Dividends offer a steady, passive income stream, providing investors with a degree of protection – and usable cash – for an uncertain market environment.

The stock analysts from Wells Fargo have taken that cue, and are going bullish on two dividend stocks in particular. These are dividend payers that offer high yields of 8% or better. In fact, Wells Fargo analysts are not the only ones singing these stocks’ praises. According to the TipRanks platform – they are rated as Strong Buys by the rest of the Street. Let’s take a closer look.

Energy Transfer LP (ET)

We’ll start with a look at one of North America’s largest hydrocarbon midstream companies, Energy Transfer. This firm is huge; its market cap is just over $40 billion, its pipeline network exceeds 120,000 miles, and the company maintains its network with a $740 million maintenance budget. The company’s main operations are in or near the Gulf Coast, in the states of Texas, Louisiana, Arkansas, and Oklahoma, but its network also stretches into Florida, the Great Lakes and Mid-Atlantic regions, and the northern Great Plans.

Energy Transfer works actively to expand its network, and in March of this year it announced its acquisition of Lotus Midstream, a move that brought another 3,000 miles of pipelines, for both gathering and transport of crude oil, under the Energy Transfer umbrella. The transaction was valued at $1.45 billion and was completed in May of this year.

In May, Energy Transfer released its Q1 financial results, which showed that the company had generated $19 billion in revenues. This represented a 7% decline compared to the same period the previous year and fell short of expectations by $2.49 billion. Both the GAAP and non-GAAP quarterly earnings of the firm were reported at 32 cents EPS. However, the GAAP earnings missed the forecast by 3 cents, while the non-GAAP earnings exceeded expectations by 2 cents.

Dividend-minded investors should note that Energy Transfer also reported $2.01 billion distributable cash flow. This total was down 3.3% y/y, but was up from $1.9 billion in Q4 and $1.58 billion in Q3. In addition, the current cash flow was enough to cover the regular dividend payment.

In another announcement of note for dividend investors, the company in April announced an increase to its regular share dividend payment from 30.5 cents to 30.75 cents per share. At the new annualized rate of $1.23, the dividend gives a strong yield of 9.6%.

This stock is covered by Michael Blum, one of Wells Fargo’s 5-star analysts. The analyst is impressed by the dividend and by the recent strength in cash flows. He writes, “We have an Overweight rating on ET given the partnership’s high distribution yield, robust free cash flow growth, and the potential for additional capital return over time… We see ET’s 3-5%/yr distr. growth target as sustainable through 2028.”

In addition to his Overweight (i.e. Buy) rating on the stock, Blum gives ET a $16 price target, implying a one-year upside potential of 25%. Based on the current dividend yield and the expected price appreciation, the stock has ~35% potential total return profile. (To watch Blum’s track record, click here)

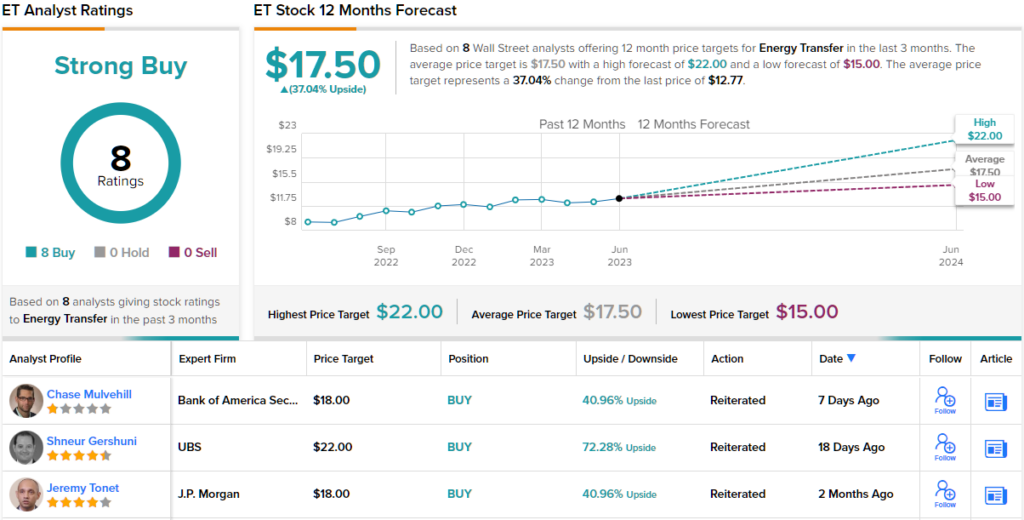

Overall, this major-league midstream company has picked up 8 recent positive analyst reviews, for a Strong Buy consensus rating. ET shares are selling for $12.77 and their average price target of $17.50 suggests that a 37% gain lies ahead. (See ET stock forecast)

Crescent Capital BDC (CCAP)

From the energy midstream we’ll change our focus to the world of business development companies (BDCs). Crescent Capital, based in LA, operates as a specialty finance company, investing in the private debt small- to mid-market firms in the US economic landscape, as well as originating new debt for these enterprise clients.

A look at some of Crescent’s macro-level data will show the importance of BDCs like this in the small business ecosystem. Crescent’s portfolio is valued at $1.6 billion, with investments in 187 companies. 89% of the total portfolio consists of first lien investments, and 98.6% of the portfolio is in floating rate debt. Additionally, more than 89% of the portfolio is located in the US. The three leading business sectors among Crescent’s investments are Health Care Equipment and Services (28.1%), Software and Services (18.6%), and Commercial and Professional Services (13.8%).

All of this adds up to a BDC with a strong foundation, and Crescent’s recent 1Q23 financial release bears that out. The company reported $39.28 million at the top line, a total that was up more than 48% y/y and beat the forecast by ~$3.1 million. At the bottom line, Crescent’s non-GAAP net investment income EPS figure of 54 cents per share, was 8 cents ahead of the estimates. The total adjusted NII of $17.5 million was up 16.6% quarter-over-quarter.

Of particular note for investors is Crescent’s solid net asset value per share, which was listed at $19.38 as of March 31 this year. Also at the end of 1Q23, Crescent had a sound liquidity situation, with $34.5 million in cash and liquid assets on hand, along with undrawn credit capacity of $297.3 million.

Crescent has already declared its Q2 dividend, for a July 17 payout. The common share dividend payment of 41 cents annualizes to $1.64 and gives a yield of 11.1%, nearly triple the current annualized rate of inflation.

In his notes of the stock for Wells Fargo, analyst Finian O’Shea points out the company’s strength in underwriting debt, and the solid prospects it has for improving its portfolio. O’Shea says of Crescent, “We view CCAP as a capable underwriter, as evidenced by NAV stability and its largely successful (and relatively quick) roundtrip in and out of the Alcentra portfolio… In our view, CCAP’s liability profile can only improve from here, which stands in stark contrast with the rest of the industry, where ’21 era liabilities are likely to reprice higher for most…” For O’Shea, this points to an Overweight (i.e. Buy) rating on CCAP stock. (To watch O’Shea’s track record, click here)

Overall, there are 4 recent analyst reviews for CCAP, and they are all positive – making the Strong Buy consensus rating unanimous. The stock is trading for $14.67 and the $17.33 average price target suggests an 18% one-year upside from current levels. (See CCAP stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.