The last inflation report, which came in worse than expected, had investors worried about the Federal Reserve’s plans for interest rates this year. The central bank held rates steady in its most recent decision, cooling fears that a hike is in the offing. When combined with moderate gains in the Q1 earnings reports, it makes sense that we saw stocks rebounding as confidence in the market was restored.

However, according to JPMorgan’s chief market strategist Marko Kolanovic, we’re not out of the woods just yet. “We remain concerned about the repeat of last summer’s drawdown, where the Growth-Policy tradeoff could move away from the Goldilocks narrative, together with a continued risk of concentration reversal, too steep projections for earnings acceleration this year, and positioning unwind,” Kolanovic opined.

So, there are indications that we could see a stronger market heading into the end of Q2 – but the risks still remain. In a situation like that, investors will be drawn to dividend stocks, the natural defensive play. These stocks promise reliable passive income streams, providing a measure of stability even in the face of market downturns.

With this in mind, we’ve used the TipRanks database to pinpoint two stocks that match a solid defensive profile: a Buy rating from the analyst’s collective wisdom and up to 8% dividend yield. Let’s take a closer look.

Energy Transfer LP (ET)

We’ll start in the hydrocarbon industry, where Energy Transfer is one of North America’s largest midstream companies. Energy Transfer boasts a market cap of $53.5 billion, and a wide-ranging network of assets for the transport and storage of crude oil, refined products, natural gas, and various liquids. The network includes pipelines, tank farms, and terminal and transfer facilities, and is centered on the Gulf Coast.

A brief look at Energy Transfer’s operations shows the scale of the company. Its crude oil segment includes 14,500 miles of pipeline across 20 states; for natural gas liquids, the company has another 5,700 miles of pipelines. For refined products, the company moves product through 3,760 miles of pipeline, has 37 active refined products marketing terminals with approximately 8 million barrels of storage capacity. All of this puts Energy Transfer in a leading position in the North American midstream scene.

Despite that leading position, Energy Transfer reported mixed results in its last quarterly report, covering 4Q23. Revenues for the quarter missed the forecast, coming in at $20.53 billion. This was flat year-over-year, and $970 million below expectations. Earnings and cash flow showed a more unequivocally positive story. The non-GAAP EPS of 37 cents was 3 cents better than had been anticipated, and the distributable cash flow, which supports the dividend payment, came to $2.03 billion for the quarter, up 6.2% year-over-year.

On the dividend, Energy Transfer has been making regular, mostly small quarterly increases to the payment for the past few years. The most recent dividend declaration, for 31.75 cents per common share, represents a 0.8% increase from the previous quarter, and the 10th consecutive bump. The payment annualizes to $1.27 per share, and gives a forward yield of 8%.

Mizuho’s Gabe Moreen, who ranks amongst the top 3% of Street stock pros, notes that ET, already large, has potential to continue growing. “ET is poised to ‘thread the needle’ on growth as net capex expectations ($2-3bn/yr) have not inflated to the same degree as peers in ’24,” the 5-star analyst explained. “ET has no shortage of growth opportunities and has been discerning prioritizing balance sheet flexibility. ET’s improved leverage outlook should allow more aggressive capital return beyond the current 3-5% distribution growth rate, and initiation of larger scale unit repurchases could potentially help address ET’s steep valuation discount.”

Getting to the specifics that should attract investors, Moreen adds, “With an attractive FCF yield, growth outlook and discounted valuation, ET is our new top pick following strong YTD performance from TRGP. More aggressive acquisition history could be a plus in the current backdrop.”

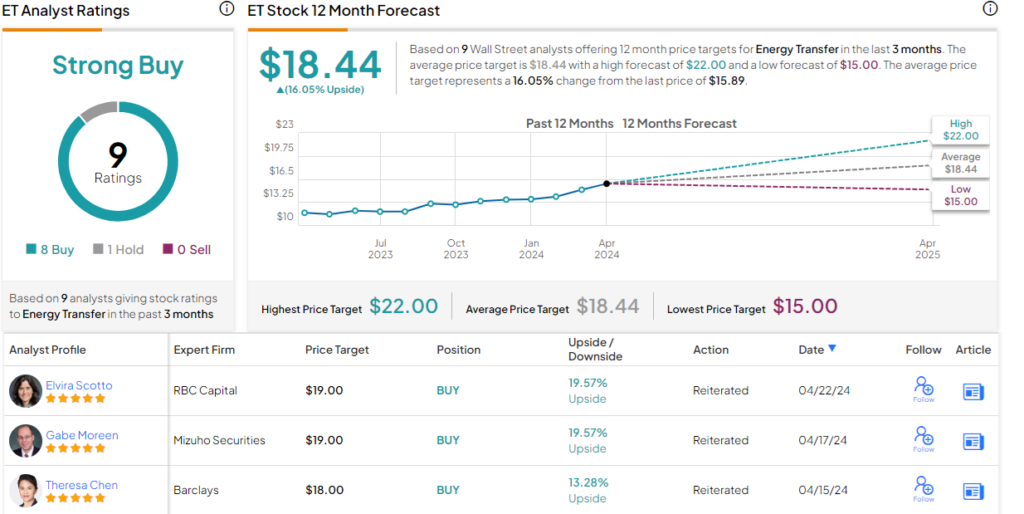

What this means for the analyst is a Buy rating, with a $19 price target that implies a 19.5% upside potential on the one-year horizon. (To watch Moreen’s track record, click here)

Overall, Energy Transfer supports its Strong Buy consensus rating with 9 recent analyst reviews that split 8 to 1 favoring Buy over Hold. The shares are trading for $15.89, and their $18.44 average price target suggests a 16% potential gain for the year ahead. (See ET stock forecast)

Black Stone Minerals LP (BSM)

Next on our list is a limited partnership mineral rights company, Black Stone. This firm derives its income from the energy industry, specifically from the royalties on land holdings in energy-rich hydrocarbon production regions. Black Stone’s land holdings are the most extensive in the Gulf states of Texas, Louisiana, Mississippi, and Alabama.

Black Stone’s holdings are not just built up randomly. The company’s acquisition activities are targeted, based on the expertise of numerous experts, including geologists and technical engineers, land and business developers, and energy investment experts, teams that provide the firm with the specific knowledge needed to generate solid returns from the land holdings. Those returns come mainly in the form of royalties, paid by energy extraction companies to Black Stone as the landowner. As of the end of 2023, Black Stone’s land holdings were hosting 63 active operational rigs.

The royalties on those rigs’ activities brought Black Stone $190.8 million in total revenue in 4Q23, for a 17% decrease year over year – but beating the forecast by over $64 million. At the bottom line, Black Stone realized a Q4 EPS of 65 cents per share, 24 cents per share better than expected.

Dividend-minded investors will be interested to know that Black Stone has seen seven quarters in a row with distributable cash flow above $100 million. The Q4 figure fell 4% from the prior quarter, but still came in at $119.1 million.

That distributable cash flow supported a Q1 div payment of 37.5 cents per common share, declared this past April. The payment was annualized to $1.50, and even though the declaration represented a quarter-over-quarter decline of 21%, the dividend still provides a forward 9.15%.

This stock has caught the eye of Stifel analyst Derrick Whitfield, who is impressed by Black Stone’s overall position, writing, “In our view, BSM provides investors a unique combination of investment themes, including valuation, return of capital, and organic value creation. Qualitatively, Black Stone Minerals is the largest pure-play oil and gas mineral and royalty owner in the United States, with peer leading positions in the Williston and Haynesville. We believe the stock offers below-average leverage and under-appreciated exposure to the Haynesville (one of the most capital-efficient dry gas plays in the Lower 48). Fundamentally, we believe the value of BSM’s Haynesville royalty position should re-rate due to an increasingly constructive natural gas macro backdrop starting in late 2024 and industry M&A, which could materially increase industry activity across its highest NRI acreage.”

For Whitfield, these comments all back up a Buy rating, and his $19 price target points toward a potential one-year gain of 16%. (To watch Whitfield’s track record, click here)

There are only 2 recent analyst reviews of BSM shares, and they split 1 Buy and 1 Hold for a Moderate Buy consensus rating. The stock is selling for $16.39 and its $18 price target suggests that it has a gain of 10% waiting for it over the next year. (See BSM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.