Many people are looking for investments that can beat inflation, which sits at 6%. How about a dividend ETF yielding 7.5% that also gives you exposure to some of the world’s top international stocks? The ETF is the iShares International Select Dividend ETF (BATS:IDV).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What is the IDV ETF?

The IDV ETF comes from BlackRock’s popular iShares family of ETFs. It “seeks to track the investment results of an index composed of relatively high dividend paying equities in non-U.S. developed markets.” As the name suggests, the fund invests across a wide array of non-U.S., high-yield dividend stocks. Note that this ETF is not mainly focused on investing in so-called emerging markets such as China or India but developed markets outside of the U.S., such as the United Kingdom, Europe, Canada, and Australia.

As an investor, you want to be careful not to overgeneralize, but investing in emerging markets typically comes with higher risks (and higher rewards) than in developed markets. This ETF wouldn’t be the right fit for investors looking for that type of higher-risk, higher-reward investment profile, but there are plenty of emerging market ETFs like the Vanguard FTSE Emerging Markets ETF and the iShares MSCI Emerging Markets ETF that give investors more access to these markets.

Next, IDV features an expense ratio of 0.49%, which isn’t egregious but also isn’t as negligible as the expense ratios that some ETF investors have grown accustomed to, thanks to some of the broad-based SPDR and Vanguard ETFs.

Further, IDV’s dividend yield of 7.5% is attractive because not only does it help investors to stay ahead of inflation, but it also soundly beats the average yield of the S&P 500 and nearly doubles the yield of the 10-year treasury bond. An investor putting $10,000 into IDV stock at its current price would receive about $750 in dividend payments over the course of their first year as a holder (assuming the payouts remain stable).

Why Go International?

Diversification is an important part of investing, whether across asset classes, industries, or geography. This last type of diversification is sometimes overlooked by U.S. investors. Investing internationally not only allows U.S. investors to tap into some of the growth of international markets, but it also allows them to spread out their risk beyond the confines of their home market.

Because not all investors are familiar with international stocks, using an ETF to invest internationally makes sense. It allows these investors to diversify across a range of international markets and equities.

While the U.S. stock market has produced phenomenal long-term results for investors for many decades, it can’t hurt for U.S. investors to add some exposure to international equities in the event that they outperform the U.S. markets either in the short term or long term.

Look no further than last year, when the S&P 500 was down 19% for the year, but the iShares MSCI Turkey ETF, which invests in the Turkish stock market, gained a scorching 105.8% for the year. While timing an investment in a specific market like Turkey may be difficult, an ETF that invests across international markets allows you to capture some of this upside in a diversified way.

One other benefit of investing in international stocks is that many are cheaper than U.S.-listed stocks from a valuation perspective due to the premium that U.S. stocks receive from investors thanks to the historical strength and security of the U.S. stock market.

Worldwide Diversification

IDV gives investors broad diversification to international markets with 101 total holdings. IDV’s top 10 holdings make up 29.65% of the fund.

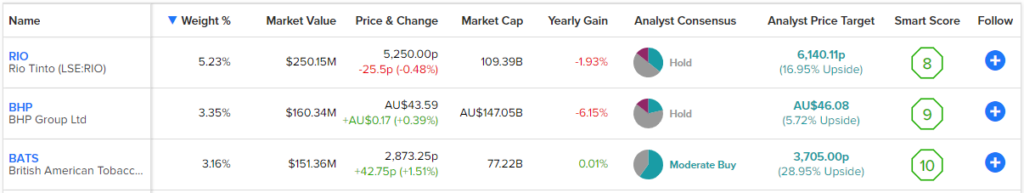

The largest position in this ETF is British mining giant Rio Tinto (which also has an NYSE listing), making up 5.2% of assets. U.S. investors may also be familiar with another top holding, British American Tobacco, which makes up 3.2% of assets. These two British companies feature significant dividend yields of 7.6% and 7.9%, respectively, making them attractive dividend stocks and giving investors a good idea of how IDV is able to generate a 7.5% dividend yield.

Other holdings that U.S. investors may be familiar with include European energy giants like TotalEnergies and ENI S.p.A, two of the world’s so-called “supermajor” oil companies.

Not all of the holdings here are far from home for U.S. investors — Bank of Nova Scotia, one of Canada’s “big five” banks, is an IDV holding, and it currently yields 6.2%.

Overall, the fund is heavily weighted towards typically lower-growth but higher-yielding sectors such as financials, materials, industrials, and utilities.

Below is a look at IDV’s top three holdings using TipRanks’ Holdings screen, which gives investors a comprehensive overview of an ETF’s components.

IDV’s Track Record

One thing that investors should be aware of is that IDV doesn’t have the best track record in recent times when it comes to performance. As of the end of last quarter, the ETF had a total return of -6.75% over the past year and a -0.42% return over the previous three years. Zooming out, it returned just 8% over a five-year time frame and 36.3% over a 10-year time frame. These returns all significantly lag major U.S. exchanges like the S&P 500 and the Nasdaq 100 over the same periods.

That said, past performance is no guarantee of future results. Just because IDV (and international stocks in general) has underperformed U.S. indices for the last decade doesn’t mean that this will be the case forever. In fact, it’s entirely possible that we are due for some reversion to the mean and that the next decade could look far more promising for international markets.

Investor Takeaway

From my perspective, I own plenty of U.S. stocks, but I also make a point to include some international names in my portfolio to diversify outside of my local market, both to spread out some risk and to potentially access different areas of higher growth.

I also own plenty of dividend stocks to generate recurring income. This ETF is appealing because it allows investors like me to achieve both of those investing goals through one vehicle. Furthermore, IDV’s yield of 7.5% is very compelling in the current market environment.

The ETF’s lackluster returns over time give me some pause. However, I do think it’s feasible that international stocks will revert to the mean in the decade ahead. My strategy for an ETF like this would be to keep a sizable allocation towards U.S. stocks and then split an international allocation between IDV for its developed market exposure and substantial dividend with an emerging market ETF to tap into more growth potential.