Ryder System (R) stock is breaking out as its Q2-2024 earnings release approaches on July 25th. The stock has been consolidating within a tightening triangle pattern, a technical formation often seen as a precursor to a significant move. The upcoming earnings release could be a catalyst that pushes Ryder’s stock higher. Analysts are projecting EPS estimates of $2.87, setting the stage for another potential earnings beat.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Personally, I am very bullish on Ryder. The company’s strength in supply chain solutions, dedicated transportation, and fleet management is a key driver. The company operates nearly 260,000 commercial vehicles and around 300 warehouses, offering comprehensive logistics solutions. If Ryder can replicate or surpass its Q1 performance, where it exceeded EPS estimates by $0.43, we could see a significant upward movement in the stock price.

Ryder’s Market Performance

Ryder has been showing impressive momentum in 2024, with the stock gaining 16% year-to-date. This strong performance echoes the bullish leg we saw following last quarter’s earnings release.

Ryder appears to be in an attractive position. The company has a trailing P/E ratio of 16.7 and a forward P/E ratio of 10.7x, suggesting solid earnings growth ahead. Ryder’s price-to-sales ratio also stands at just 0.48x, indicating value territory. Ryder’s dividend yield is currently at 2.2%, and it has a consistent track record of dividend growth over the past 19 years, making it appealing for income-focused investors.

Ryder’s Strong Start to the Year

Ryder System kicked off 2024 with a solid first quarter, delivering results that surpassed analyst expectations. The company reported earnings per share (EPS) of $2.14, beating the consensus estimate of $1.78 by a substantial margin.

This strong performance came despite a challenging freight environment, showcasing Ryder’s resilience and strategic execution. Following the earnings announcement, Ryder’s stock price jumped, reflecting investor confidence in the company’s strategic direction and growth prospects.

Total revenue for Q1 reached $3.1 billion, up 5% from the previous year, while operating revenue grew by an impressive 6% to $2.5 billion. Ryder’s Supply Chain Solutions (SCS) and Dedicated Transportation Solutions (DTS) segments were the stars of the show.

SCS posted an 8% increase in total revenue and an 11% rise in operating revenue. DTS was even more impressive, with total revenue surging 24% and operating revenue jumping 33%, largely due to the successful integration of the Cardinal Logistics acquisition.

CEO Robert Sanchez attributed the solid performance to the company’s balanced growth strategy, highlighting better-than-expected used vehicle results and maintenance cost savings. He emphasized Ryder’s business model transformation, noting, “The actions we’ve taken to de-risk the model, enhance returns, and drive profitable growth are delivering improved results relative to prior cycles.”

Despite the overall solid performance, Ryder faced challenges in Q1. Used tractor sales fell 34% year-over-year, and used truck prices dropped 30%, impacting the Fleet Management Solutions (FMS) segment.

The commercial rental market also proved challenging, with Ryder’s rental fleet shrinking by 13% year-over-year to 35,700 vehicles and utilization rates dropping to 66% from 75% in Q1 2023. These factors contributed to a 3% decline in total revenue for the FMS segment.

This decline put pressure on Ryder’s bottom line, but the company managed to offset some of these challenges through higher ChoiceLease results and maintenance cost savings.

CFO John Diez noted that Ryder is raising the lower end of their full-year forecast, reflecting its adaptability and strong performance despite a modest rental upturn.

What Could Trigger Upside?

Ryder’s Q2 earnings release on July 24th is shaping up to be the primary catalyst that could propel the stock higher. We could see significant upward momentum if Ryder can replicate its Q1 performance. Analysts are optimistic, with a consensus EPS estimate of $2.87 for Q2. Given Ryder’s track record of exceeding expectations, another earnings beat could be the spark that ignites a sustained breakout.

Ryder’s leadership in supply chain solutions and logistics is another potential trigger. Ryder’s scale provides a significant competitive advantage, with nearly 260,000 commercial vehicles and 300 warehouses under management. The company’s innovative solutions, like the RyderShare™ platform, position it well to capitalize on the ongoing shift towards e-commerce and the increasing demand for efficient, resilient supply chains.

Industry trends are also working in Ryder’s favor. The push towards nearshoring and onshoring due to geopolitical tensions and supply chain disruptions plays directly into Ryder’s strengths. Its recent acquisition of Cardinal Logistics further enhances its capabilities in this area.

Is Ryder System Stock a Buy, According to Analysts?

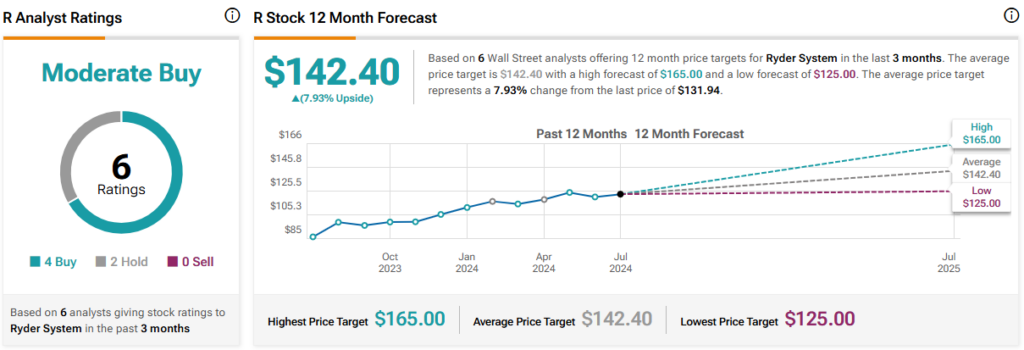

Ryder System stock has a Moderate Buy consensus rating. Out of six analysts covering the stock, four rate it a Buy and two a Hold, with no Sell ratings. The average R stock price target of $142.40 implies 7.9% upside potential, reflecting strong confidence in Ryder’s growth prospects.

The Takeaway

Ryder’s strong leadership in supply chain solutions, dedicated transportation, fleet management, and strategic acquisitions, along with its ability to navigate industry challenges, make it an outstanding investment opportunity. With the upcoming Q2 earnings release and favorable industry trends, Ryder is well-positioned for upside. This stock is certainly one to watch closely. I believe it’s a solid buy for investors with a medium to long-term investment horizon.