The second half of 2024 is well underway, making it the perfect time to delve into analysts’ top picks. The team at Rosenblatt Securities has been putting together their ‘best ideas’ for the upcoming months, with a strong emphasis on tech-related investments.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Those picks include interesting plays in video content, networking, and AI, three technologies that are poised to lead the way into the next generation of digital connectivity. These are stocks that deal with the leading edge of tech – and Rosenblatt projects potential upsides of up to 83%.

We’ve opened up the TipRanks database to get the latest scoop on all three and to find out how they look in the broader view from the Street. Let’s take a closer look.

Harmonic (HLIT)

The first of Rosenblatt’s tech stock picks that we’ll look at here is Harmonic, an industry leader in virtualized broadband and video delivery solutions. The company provides solutions for media firms and digital service and content providers, allowing them to deliver the best in high-end video streaming and broadcast services on the global market. Using Harmonic’s tech, cable operators can deploy gigabit internet services with greater flexibility, connecting homes and mobile devices. The company simplifies video delivery through cloud and software platforms, and changes the way that media and service providers can monetize on-demand content.

More than 5,000 companies around the world trust Harmonic to provide the latest in video delivery technology, including names like CNN and Comcast. Harmonic operates out of 20 international offices, and has 25 years of experience in the business of simplifying online video streaming.

While Harmonic has a leading position in its niche, the company’s total revenues were down year-over-year in 1Q24. The top line was $122.1 million, down more than 22% from 1Q23 – although it did exceed the forecast by $470,000. Harmonic’s bottom line earnings, the non-GAAP EPS, broke even and was a penny better than the pre-release expectations.

For Harmonic, the key point is the company’s leadership position; that fact caught the eye of Rosenblatt’s Steve Frankel, who wrote, “Harmonic continues to dominate the march to next generation broadband, setting the stage for a multi-year product cycle that should deliver accelerating revenue growth and expanding margins. Harmonic’s cOS remains the clear leader in the vCMTS space, driving upgrades of internet infrastructure across the industry. As of Q1, Harmonic had 113 live deployments powering more than 28M cable modems. The company has won 13 Tier-1s with Charter and Comcast like to remain significant customers for the foreseeable future as each works through a multi-year rollout process…”

Looking ahead from that, Frankel goes on to explain why investors should take a bullish view of Harmonic, adding, “Combined, the company has laid out a goal of reaching $1.0B in revenue and $254M in Adj. EBITDA in 2026, up from our forecast for 2024 of $660.0M/$113.2M. We believe management’s assumptions, especially in the Broadband business are appropriately conservative. Upside could come from higher than anticipated node share and/or a faster than anticipated ramp of fiber.”

These comments add up to a Buy rating from Frankel, whose $18 price target implies a 51% upside potential for HLIT over the coming months. (To watch Frankel’s track record, click here)

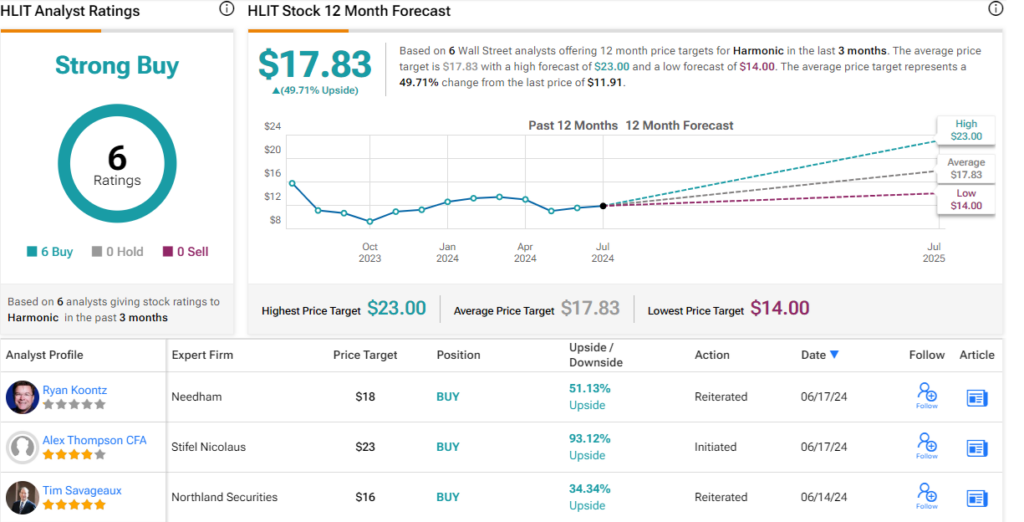

Harmonic has earned a Strong Buy consensus rating from the Street’s analysts, based on 6 unanimously positive reviews set recently. The stock is selling for $11.91 and its $17.83 average target price suggests that a gain of 50% is in the offing over the next year. (See HLIT stock forecast)

Applied Optoelectronics (AAOI)

The second stock on our Rosenblatt-backed list is Applied Optoelectronics, an innovator in the field of digital connectivity. The company produces semiconductors and laser components, along with advanced optical transceivers and RF solutions. All of these are essential products for top-end digital networking.

Getting to specifics, Applied Optoelectronics’ product lines include semiconductor lasers and DFB chips; optical components for next-generation communication systems; optical transceivers for optical computing and networking; and HFC system amplifiers, line extenders, booster amplifiers, and other high-end networking solutions. Applied Optoelectronics’ products have found homes in a wide range of communication applications, including telecom, FTTH, sensing, wireless, datacenter, and cable broadband technologies.

Applied Optoelectronics is based in Texas, one of the fastest growing state economies in the US. The company’s headquarters are located in Sugar Land, just outside of Houston, an area that was recently impacted by Hurricane Beryl. The company announced on July 9 that its headquarters suffered no damage from the storm, and that its production facilities have been able to maintain operations.

The hurricane was not the only bullet that this company has dodged recently. The company in June announced that it had reached an agreement with Molex to settle a patent infringement dispute and other related litigation.

On the financial side, Applied Optoelectronics missed the targets in its 1Q24 results. The top line of $40.7 million was down more than 23% year-over-year and missed the forecast by $2.92 million. The company ran a net loss in the quarter of 31 cents per share, by non-GAAP measures, a figure that missed expectations by 2 cents per share.

Despite these misses, analyst Michael Genovese takes a bullish view of this tech firm. Genovese particularly notes AAOI’s potential for growth in a high-demand industry: “We are pounding the table and reiterating our Buy rating on this high risk/high reward ‘show me’ story. Over the next few quarters, we think the company can demonstrate that it is a primary beneficiary of the very strong multi-year secular demand for 800+G Optical transceivers used to interconnect all the computing (accelerated servers) and networking (switches) resources within AI Data Centers. Proof points of our thesis would be new Hyper Scale customer announcements, such as Amazon and Tesla, and strong above-consensus results and guidance by the end of 2024.”

Along with his Buy rating, Genovese set a $16 price target that indicates an upside of 70.5% on the one-year horizon. (To watch Genovese’s track record, click here)

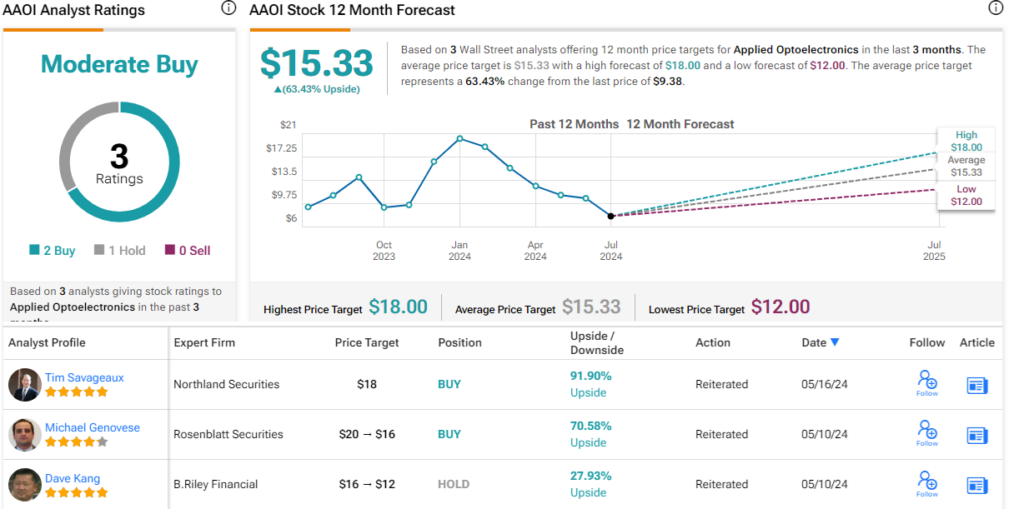

The three analyst reviews on Applied Optoelectronics include 2 Buys and 1 Hold, for a Moderate Buy consensus rating. The stock’s $9.38 selling price and $15.33 average target price together imply a 12-month gain of more than 63%. (See AAOI stock forecast)

Five9 (FIVN)

Last up, we have Five9, a software developer that creates cloud platforms for contact centers. The company’s cloud-based software offers a range of capabilities, including campaign management, monitoring, real-time and historical reporting, and call recording – all vital operations in the call center niche. The company is a leader in contact center software, and its platform is used in a wide range of industries, from telemarketing to financial services to customer service to retail to healthcare. The company counts such names as Wyndham Hotels & Resorts, Teladoc Health, and Alaska Airlines among its user base.

Call centers are big business, and their software systems are equally big. Some of Five9’s numbers will give the story: 20-plus years of cloud software experience, more than 2,600 employees, and over 3,000 clients – enterprise, mid-market, and SMB – around the world. Five9’s platform facilitates over 14 billion recorded call minutes every year.

AI, especially generative AI, has been taking the tech world by storm in the past year – and Five9 has been at the forefront of applying AI technology to the call center ecosystem. The company has made use of AI to handle the simple, repetitive questions that take up too much agent time, and to develop chatbots that will quickly deliver impressive customer contact results. Five9 announced last month that it has entered into a collaboration with Salesforce, to jointly develop AI-powered customer experience solutions.

Five9’s operations led to a company record for quarterly revenue in 1Q24. The quarterly top line, of $247 million, was up 13% year-over-year and was almost $7 million better than had been anticipated. Five9’s non-GAAP EPS came to 48 cents, beating the estimates by 9 cents per share.

Rosenblatt analyst Catharine Trebnick is upbeat on Five9 and lays out a clear case for the stock. She writes, “Five9 presents a compelling investment opportunity, demonstrating a balanced outlook that acknowledges current economic challenges while positioning for a strong second-half recovery… Five9 has secured major upmarket deals like Wells Fargo, showcasing its capabilities in AI, scale, reliability, and complex migrations.”

“This, combined with industry-leading retention rates in the mid-90s, demonstrates the company’s ability to attract and retain high-value customers even in challenging economic conditions,” Trebnick says, and adds of the company’s outlook, “Overall, Five9’s solid foundation, promising growth trajectory, and strong differentiation in AI position it well for potential investors seeking exposure to the growing CCaaS market.”

Trebnick’s stance supports her Buy rating on FIVN shares, and her $80 price target implies an 83% upside potential in the coming year. (To watch Trebnick’s track record, click here)

Overall, Five9 has a Moderate Buy consensus rating from the Street’s consensus, based on 18 recent reviews that include 14 Buys, 3 Holds, and 1 Sell. The shares are trading for $43.74 right now, and the average price target of $76.69 indicates room for a one-year upside of 75%. (See FIVN stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.