Amidst volatility, the world of cryptocurrency has continued to grow. A direct way of exposure is to consider buying Bitcoin or altcoin. Another way to consider exposure to cryptocurrencies is by buying crypto stocks.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Riot Blockchain (RIOT), a Bitcoin miner, looks like an attractive option to consider. Riot stock has declined by almost 32% in the last six months. I am bullish on Riot for the medium-to-long term.

It’s important to understand the reasons for the stock correction.

First and foremost, Bitcoin has been jittery with a downward bias. After peaking out near $69,000, the cryptocurrency has trended lower. Geo-political tensions coupled with rate hike fears have translated into this correction. Riot stock has corrected in line with the correction in Bitcoin.

Further, in November 2021, Riot completed a $600-million at-the-market offering. This resulted in significant equity dilution and a subsequent stock correction.

However, it seems that the correction is overdone. As a matter of fact, Riot touched lows of $12.9 in January 2022. The stock has been on a gradual uptrend after the lows and it’s likely that the uptrend will sustain.

Robust Growth to Sustain

Riot Blockchain has been on a high-growth trajectory. For Q3 2021, the company reported revenue of $64.8 million. On a year-over-year basis, revenue increased by 2,532%. For the same period, the company reported an adjusted EBITDA of $37.6 million. This implied an adjusted EBITDA margin of 58%.

It’s also worth noting that for Q3 2021, the company reported hashing capacity of 2.6EH/s. The company recently provided an update on January 2022 Bitcoin production and the hashing capacity for the month increased to 3.4EH/s.

However, the mining capacity expansion is still at an early stage. Riot is expecting to increase hashing capacity to 12.8EH/s by the end of 2022. This would be a five-folds growth in mining capacity as compared to Q3 2021.

For a simplistic assumption, if Bitcoin price averaged the same as Q3 2021, Riot is positioned for quarterly revenue of $325 million from Q1 2023. It would imply an annualized revenue potential of $1.3 billion.

Also, if adjusted EBITDA margin is assumed to remain at 58%, the company is positioned for annualized EBITDA of $750 million. Clearly, the best part of growth is still to come for Riot and the stock is likely to trend higher as revenue and EBITDA surge.

From a growth perspective, there are two more important points to note.

First, Riot had a total of 5,347 Bitcoin in its balance sheet as of January 2022. Further, the November 2021 capital raise ensures that there is ample financial flexibility to invest in mining capacity expansion through 2022.

Further, at a mining capacity of 3.4EH/s in January 2022, Riot mined 458 Bitcoins. Once mining capacity increases to 12.8EH/s, the company can possibly mine 1,700 Bitcoins in a month.

Riot can hold these digital assets in the balance sheet. Additionally, these digital assets will provide flexibility for the next stage of expansion.

Wall Street’s Take

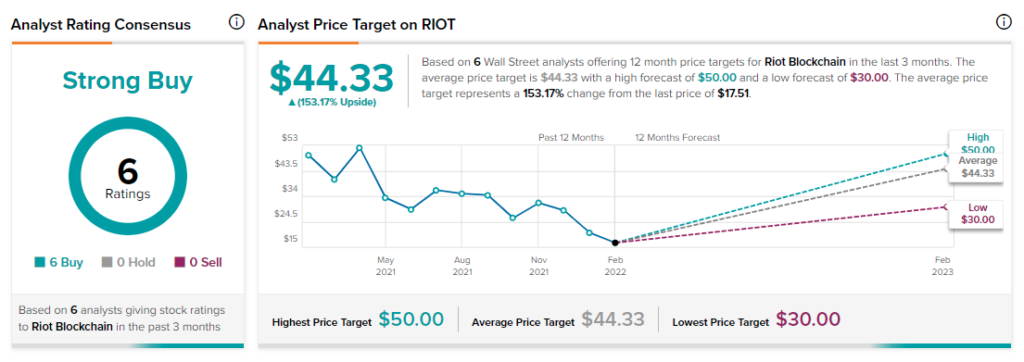

Turning to Wall Street, Riot has a Strong Buy consensus rating, based on six Buy ratings assigned in the past three months. The average Riot price target of $44.33 implies 153.2% upside potential.

Concluding Views

In December 2021, Riot acquired ESS Metron. The latter is a manufacturer of engineered electrical equipment solutions. Some of these solutions are critical for deployment of Bitcoin mining at scale. The key point here is that Riot has also been pursuing inorganic growth.

Considering the current financial flexibility and the prospects of a significant increase in digital assets in the next 12-24 months, it’s likely that the company will pursue further acquisitions.

Overall, Riot stock looks attractive and poised for a rally from current levels. Bitcoin has already recovered from recent lows as geo-political tensions decline on a relative basis.

Further, the rate hike factor seems to be discounted in the cryptocurrency world. The next leg of the rally for Bitcoin might imply meaningful returns from Riot stock from current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure