Cryptocurrencies may no longer be the hottest trend in the investing world, but Riot Platforms (NASDAQ:RIOT) has proven that there are still exceptional gains to be had in certain corners of this space. The digital currency mining and infrastructure firm has seen shares soar in value in the past year, and many Wall Street analysts believe there is still upside potential amid a broader digital token rally.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Seven out of eight ratings recommend RIOT as a Buy, with the highest price target of $22.50 representing upside potential of about 60% from current levels. Despite Riot’s stock’s massive gains of 244% in the last 12 months, I join analysts in their bullish assessment.

Certainly, a Bitcoin (BTC-USD) miner like Riot Platforms will see a boost in share price when the value of the world’s largest cryptocurrency increases—and in the last year, it has in a big way.

The price of Bitcoin has jumped by about 140% since December 2022. Still, investors would do well to dig deeper to see why Riot Platforms has solidly outperformed other publicly-traded Bitcoin mining outfits during that recent rally, as these reasons could point to the potential for future gains. Below, we take a closer look at some of the factors propelling Riot Platforms in recent months.

Massive Increases to Its Hash Rate

For Bitcoin mining operations ranging from the individual user working out of their home to significant coordinated efforts like those of Riot Platforms, hash rate is a key metric. A miner’s hash rate is the amount of computing power it dedicates toward solving the complex math problems necessary to earn newly-minted Bitcoin tokens. The greater the hash rate, the better the odds of successfully winning the next Bitcoin.

Riot Platforms has invested heavily in boosting its hash rate in the last year. In June, the company entered a long-term purchase agreement for over 33,000 Bitcoin miners with Chinese hardware maker MicroBT. This purchase contributed to hash rate growth of a whopping 71% year-over-year through October 2023.

Then, in December of this year, Riot announced the purchase of an additional roughly 67,000 miners from MicroBT. As this equipment becomes fully operational in the next year and a half, Riot Platforms expects to roughly triple its hash rate to 38 exahashes per second (EH/s), or 38 quintillion hashes every second.

The boost to its hash rate has already contributed to higher production levels. For November 2023, Riot mined 552 Bitcoins, up 21% compared to the prior month.

Industry-Leading Power Management

Bitcoin mining operations of all sizes are constantly trying to outgrow their competitors when it comes to hash rate. Therefore, while Riot’s targeted infrastructure investment is impressive, it’s not unique. Where the firm has set itself apart in the industry, however, is in its arrangements with power companies to turn off the power in certain situations.

Bitcoin mining is an incredibly energy-inefficient process, and the cost of powering the hardware necessary for mining is significant. Most firms opt to mine around the clock in an effort to maximize production levels. Riot has bucked the trend by shifting toward a model that prioritizes certain high-yield times for mining activity. During peak hours, the company actually receives credits from power companies for intentionally reducing its electricity consumption.

Of course, this does mean Riot’s overall production levels are lower than they might otherwise be. However, the company’s gross profit would be negatively impacted in that case by the resulting energy outlays. Ultimately, Riot has struck a balance between electricity costs and productivity to ensure it is running at maximum efficiency.

Bitcoin Halving in 2024

Bitcoin is structured such that there is a finite possible supply of tokens, and periodically, the token reward for miners is halved. There have been several prior “halvings,” each of which has prompted a massive spike in the price of the token as the balance of supply and demand shifted.

The next halving is likely to take place in Q2 2024, right when Riot’s additional miners will be activating. The company could be particularly well-positioned to ramp up production just as the value of Bitcoin is likely to spike.

What is the Price Target for RIOT Stock?

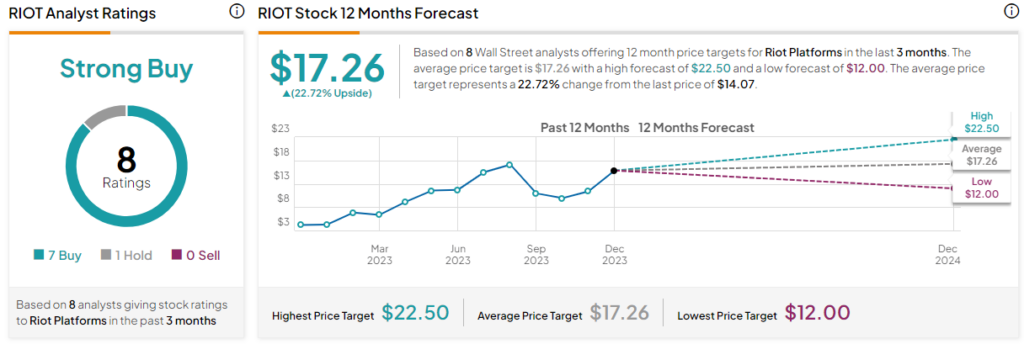

On TipRanks, RIOT comes in as a Strong Buy based on seven Buys and one Hold rating assigned by analysts in the past three months. The average Riot Platforms stock price target is $17.26, implying 22.7% upside potential.

Three analysts have reiterated their Buy ratings since the start of December, including Darren Aftahi of Roth MKM, who forecast the aforementioned price target of $22.50. Other reiterated Buy ratings in recent weeks predict 28% and 42% upside potential. Notably, no analysts have issued a Sell rating for RIOT.

Conclusion: Should You Consider RIOT?

Even though it has experienced a massive rally in the last year, Riot Platforms shares are widely favored by Wall Street analysts. Given the company’s ambitious infrastructure build-out, its savvy efforts to maximize efficiency, and the likelihood of a continued Bitcoin rally, it’s easy to understand why.