Nvidia (NASDAQ:NVDA) is poised to capitalize on a surge in AI infrastructure spending over the next few years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

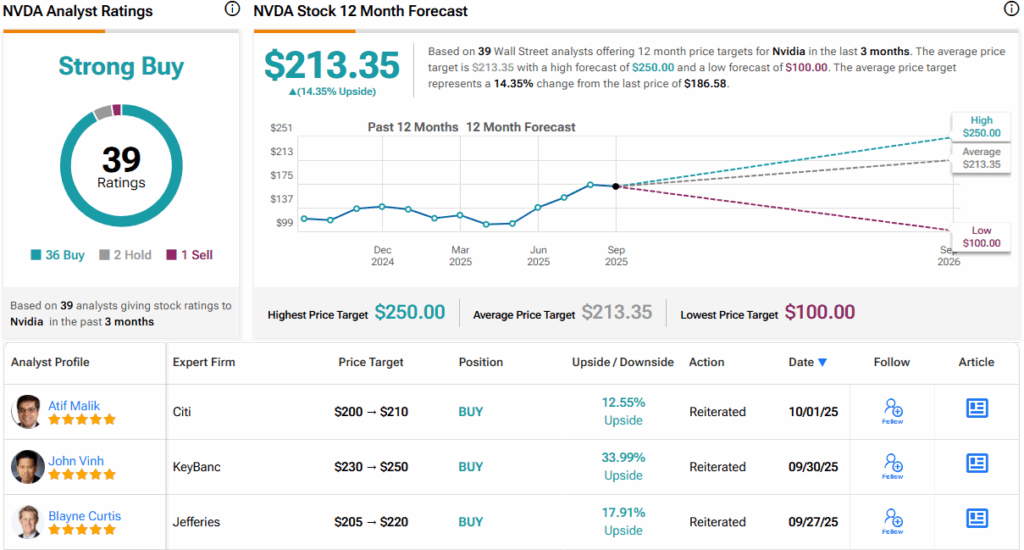

That’s the rationale behind the latest price target hike from Citi’s Atif Malik, an analyst ranked in 3rd spot among the thousands of Wall Street stock experts. Malik has now increased his price target for the chip giant from $200 to $210, suggesting the shares will gain 15.5% in the months ahead. Malik’s rating stays a Buy. (To watch Malik’s track record, click here)

Citi has lifted its outlook for AI-related infrastructure spending by the major tech players, now expecting it to exceed $2.8 trillion by 2029, up from its previous $2.3 trillion estimate, pointing to hefty early bets from hyperscalers and rising demand from enterprises. As the undisputed AI chip king, Nvidia will likely sell more GPUs and related hardware as AI infrastructure spending ramps up.

Malik recently held conversations with the semi giant, and these have left the 5-star analyst “incrementally positive on the company’s roadmap and competitive positioning post Rubin CPX GPU launch.”

Management stressed that its one-year product cycle remains unchanged, and the recent Rubin CPX announcement “does not imply anything different.” Rubin CPX will launch after Vera Rubin, slated for late 2026, and will be available as a standalone GPU that can sit alongside Vera Rubin. The Rubin CPX is a new class of GPU purpose-built for massive-context processing, enabling AI systems to tackle million-token coding tasks and generative video with unprecedented speed and efficiency. Its role is to address large-context inference and augment the existing roadmap rather than replace it.

As for the recent $100 billion OpenAI investment, the company explained that it is structured around milestones rather than tied to product shipments. If OpenAI goes ahead with building one gigawatt of capacity, Nvidia will take an equity stake in the company. For context, Nvidia has previously noted that historically, developing one gigawatt of capacity requires roughly $50 billion in total capital expenditure. “We believe OpenAI came to NVIDIA asking for help as NVIDIA has a very compelling product, and as the number of users and compute being consumed per user basis is growing; according to NVIDIA, OpenAI has challenges when it comes to securing data centers, land and power and needs support,” Malik said on the matter.

Nvidia stated that there is no preferential treatment or special pricing, with allocation determined solely by purchase orders and data center readiness. Each product carries a single set price, but if Nvidia were to work with OpenAI directly – rather than through its current partners – the economics for OpenAI could differ.

On the Intel partnership, Nvidia said that its roadmap and ARM commitment remain unchanged. The move simply expands customer choice with x86, offering HGX boards and DGX systems where CPUs connect to GPUs via PCIe or NVLink (for GB and Vera Rubin). Pairing Intel server CPUs with Nvidia GPUs should boost x86 performance, particularly in high-frequency financial services apps. The x86 still has “strong stickiness,” and this is purely a product announcement with no foundry element, though the company said it would consider Intel as a foundry partner if it proves competitive.

Turning now to the rest of the Street, where the Citi view gets the backing of 35 other analysts while an additional 2 Holds and 1 Sell can’t detract from a Strong Buy consensus rating. The forecast calls for 12-month returns of 14%, considering the average target clocks in at $213.35. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.