Shares of luxury furniture retailer Restoration Hardware (RH) have crashed quite violently over the past few quarters, nosediving more than 65% from peak to trough. On Tuesday’s upbeat session of trade, RH stock soared over 10% on the back of lower rates. Though a recession may very well be on the table for 2023, dip-buyers seem more than willing to jump in now that the stock trades at less than 10 times trailing earnings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furnishings are a discretionary good that tend to see demand evaporate at the first signs of an economic slowdown. To make matters worse, higher interest rates have weighed on housing sales. Higher rates mean higher costs associated with mortgage loans and less eligible applicants. Indeed, a severe housing downturn would spread to RH stock, potentially amplifying downside relative to the S&P 500 (SPX).

With many pundits calling for an economic slowdown or mild recession, RH stock doesn’t seem so toxic. Still, investors are sure to prepare for the worst when it comes to downturns. Though it’s hard to tell if RH stock has overshot to the downside quite yet, those who aren’t expecting a 2008-style recession may have a lot to love about the Warren Buffett holding.

Despite the dark economic storm clouds up ahead, I am bullish on RH stock.

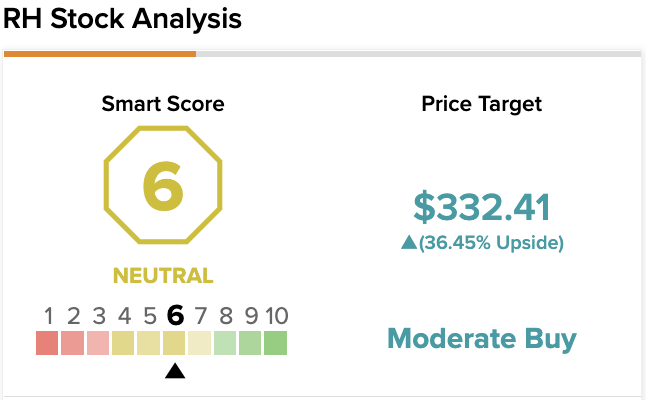

On TipRanks, RH scores a 7 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

Why a Recession Isn’t Lights Out for RH Stock

RH stock is no stranger to the boom and bust nature of discretionary retail goods. Big-ticket couches and sectionals just aren’t hot buys when the cost of everything else is going up while pundits and CEOs — think Mark Zuckerberg, who recently warned of a tech sector meltdown — issue dire warnings of a coming recession. Hiring freezes, layoffs, and all the sort have weighed heavily on the “nice to have” part of retail.

Still, RH is a luxury retailer that caters to affluent clientele less likely to be affected by higher food or fuel prices and budget cuts primarily concentrated in the tech sector. For affluent consumers, inflation has been more of an annoying thorn and less of a detriment.

For such deep-pocketed consumers, pricey purchases of furnishings may not be entirely out of the question. As a high-end furnishings play, RH may not be as impacted by a mild recession as its stock price collapse suggests.

While tough times and higher rates will take a bite out of sales and earnings going into year’s end, the bite may not be as hard as investors and analysts expect.

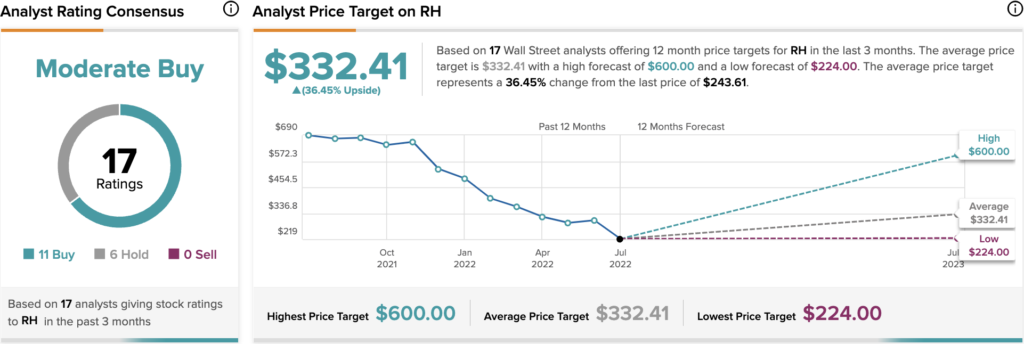

Looking to Wall Street, many analysts have been busy lowering their price targets on RH stock. The latest is courtesy of Guggenheim, which slashed its price target to $400 from $600 due to weaker macro prospects. Though Guggenheim is standing by its “Buy” rating, other analysts may be inclined to downgrade to “Hold” if the share slide continues over the coming months.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, RH stock comes in as a Moderate Buy. Out of 17 analyst ratings, there are 11 Buy recommendations and six Hold recommendations.

The average RH price target is $332.41, implying an upside of 36.45%. Analyst price targets range from a low of $224 per share to a high of $600 per share.

Long-term Growth Prospects Still Sound

Looking past the economic headwinds, things look very bright. RH stock is known to crumble fast and hard, but it tends to also recover sharply. Indeed, the next boom could be just as jarring as the latest bust.

With such a strong brand and the ability to command high prices to its wealthy customers, the company has the luxury (pardon the pun) of selling Veblen goods. These are goods that tend to experience stronger demand when prices increase. Amid inflation, being a retailer of Veblen goods comes with its perks.

It’s not a mystery why Warren Buffett was a fan of the furnishings company. As the company looks to position itself for the next expansionary economic cycle, while potentially considering expansion opportunities beyond the U.S., I do think the next boom could be a rewarding one for contrarians.

The international market could help RH add fuel to its next boom. And although international brand awareness could use some work, I think the firm is on the right track, even as it enters one of the toughest environments as a publicly-traded company.

The Bottom Line on RH Stock

RH stock has sold off viciously over the one-two punch of higher rates and a potential economic downturn. As the company grasps onto its rich margins amid inflation, there are reasons to keep an eye on the stock as its multiple contracts further.

Few luxury-goods firms have as much pricing power as RH.

Read full Disclosure