To mitigate bearish sentiment, investors often look to traditional safe-haven assets such as gold, silver, or the U.S. Dollar. Investors also buy shares of loyal dividend payers with above-average dividend yields, such as high-quality real estate investment trusts (REITs). These two retail REITs — Realty Income Corporation (NYSE: O) and National Retail Properties (NYSE: NNN) — offer strong dividend returns and excellent opportunities for significant stock price appreciation. Nonetheless, for the reasons mentioned below, O stock could be better in the current environment.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Realty Income Corporation (O)

Realty Income Corporation manages 11,427 properties in the U.S., Puerto Rico, the UK, and Spain, leased to 1,125 clients across 72 industries.

A well-diversified portfolio of commercial properties listed for rent under long-term leases is a key attribute of a resilient portfolio.

Some sectors are less exposed to the current headwinds than others, and the company’s leasing portfolio covers both. The negative impact of lower profitability with certain tenants is offset by the positive impact of other tenants. Thus, its portfolio continues to generate strong revenue and margins despite the economic slowdown.

Realty Income’s real estate portfolio shows solid performances in terms of occupancy (the ratio of rented area to the total area available for rent) and rent recovery rate (the annual rental yield for newly-rented properties compared to the year-ago rent for the same properties).

As of Q2 2022, the occupancy rate was 98.9%, a 10-year high, while the rent recovery rate was 105.6%.

The portfolio’s average remaining lease term is almost nine years, which should be long enough to protect the portfolio from the risk of difficult lease negotiations during an economic slowdown. Barring new acquisitions, Realty Income could have more room to maneuver than National Retail Properties from this perspective.

It looks like an economic slowdown is imminent because the Federal Reserve and European Central Bank continue to pursue a monetary policy of aggressively raising interest rates to slow down inflation.

However, the resulting rise in the cost of money will logically lead, at least initially, to a greater demand for renting commercial space rather than buying space to build offices, shops, factories, or warehouses.

This early stage will benefit REITs — which thrive off the rents they receive on real estate.

Then, there will be a second phase in which the sector will have to adjust rents upwards. This second phase will also benefit REITs.

To fully capitalize on the emerging scenario, it is imperative that REITs’ portfolios have sufficient rentable space and that lease agreements do not hamper market opportunities.

A suboptimal combination of the two aspects could result in a loss of portfolio competitiveness and negatively impact the consistency of the dividend, which is the shareholder’s primary return.

From a dividend-consistency standpoint, Realty Income and National Retail Properties are on par. However, the former equity REIT is slightly favored over the latter in terms of leasable area and average lease length.

Looking ahead to 2022, Realty Income is targeting an acquisition volume in excess of $6 billion, raising its expectations by $1 billion over its previous guidance. Year-to-date allocation for commercial real estate acquisition has reached $5 billion.

On October 14, Realty Income Corporation will pay $0.248 per share in a monthly dividend (up 5.08% year-over-year). At writing, Realty Income Corporation’s dividend generates a dividend yield of 5.2%, and it has paid and increased its dividend for 25 straight years.

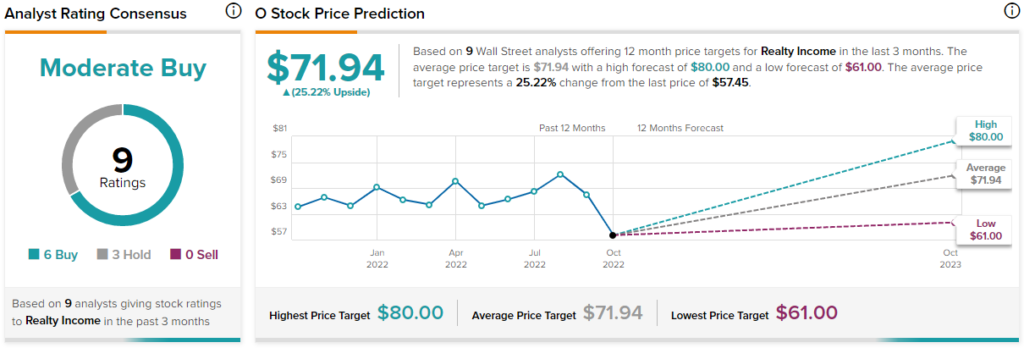

Is O a Good Stock to Buy, According to Analysts?

On Wall Street, Realty Income Corporation has a Moderate Buy consensus rating based on six Buys, three Holds, and zero Sells assigned over the past three months. At $71.94, the average O stock price target implies upside potential of 25.2%.

At writing, Realty Income trades at $57.42, with a market cap of approximately $35.45 billion and a 52-week range of $55.50 – $75.40. The stock is well below its long-term 200-day moving average of $68.06, suggesting a discount from a technical perspective. The stock has a price/earnings ratio of 45.5x versus the sector median of 26.6x and a price/sales ratio of 10.5x versus the sector median of 4.5x.

National Retail Properties (NNN)

Headquartered in Orlando, Florida, National Retail Properties manages 3,305 high-quality retail stores in 48 states across the United States.

This portfolio had approximately 33.8 million square feet of space available for lease as of June 30, 2022, with an average remaining lease term of approximately 10 years and seven months.

The company is committed to new property acquisitions, having acquired 43 new properties valued at nearly $154 million in the second quarter of 2022. NNN added another 348,000 square feet of GLA (gross leasable area) to its portfolio.

At writing, National Retail Properties’ commercial real estate portfolio has an occupancy rate of 99.1%.

In terms of available leasable space and average lease length in years, National Retail Properties’ REIT portfolio appears less well-positioned than Realty Income to benefit from expected higher demand for commercial leases followed by higher rents.

Nonetheless, National Retail Properties also returns a sizeable portion of its cash flow through quarterly dividends.

On August 15, National Retail Properties paid shareholders $0.55 per common share (up 3.77% year-over-year). At writing, National Retail Properties’ dividend yield is 5.6%, and the company has paid and increased its dividend for 31 straight years.

Is NNN a Good Stock to Buy, According to Analysts?

On Wall Street, National Retail Properties has a Moderate Buy consensus rating based on three Buys, two Holds, and zero Sells assigned over the past three months. At $47.20, the average NNN price target implies upside potential of 20%.

At writing, shares are trading at $39.35, near the low end of their 52-week range of $38.05 – $48.90. The stock is also well below its long-term 200-day moving average of $44.17 and has a price-earnings ratio of 22.1x versus the sector median of 26.6x. However, its price/sales ratio of 9x is higher than the sector median of 4.5x.

Conclusion: Realty Income Looks Better Positioned Than National Retail

Realty Income Corporation and National Retail Properties are two loyal dividend payers with yields above the market average. Currently, the S&P 500’s (SPX) dividend yield is 1.7%. These two REITs provide a good hedging tool against the current headwinds of bearish sentiment.

However, between Realty Income Corporation and National Retail Properties, the first retail REIT portfolio appears better positioned to benefit from expected tailwinds from the industry.