We often think of stock exchanges as simple marketplaces, whether physical or digital, where investors buy and sell stocks. However, beyond serving as platforms for transactions, stock exchanges are corporate entities in their own right, managing trading operations and profiting from them.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

And there is plenty of profit in that business. The big exchanges are multi-billion concerns – and they are publicly traded. This has piqued the interest of RBC analyst Ashish Sabadra, who has been keeping a close eye on US exchange stocks and believes they present compelling opportunities for investors looking to take a long-term position.

“Exchanges are high-quality all-weather businesses with solid moat, high margins, and robust free cash flow,” Sabadra opined. “As the gatekeepers of financial markets, exchanges benefit from industry macro and secular tailwinds, including 1) increased allocation of global investments into the markets, 2) a rebound in capital markets/listings activity expected in FY25; 3) increased macro and geopolitical uncertainty that adds volatility to markets; 4) the expanding globalization of investment needs; and 5) an increasingly complex regulatory environment governing trading operations.”

Against this backdrop, the RBC expert lays out some new plays for investors, US exchange stocks that he sees as having double-digit upside potential. We’ve used the TipRanks database to find out what the rest of the Street has to say about his picks. Let’s take a closer look.

Intercontinental Exchange (ICE)

We’ll start with Intercontinental Exchange, a company that offers traders access to a wide range of financial exchanges in North America and Europe. Through ICE, traders and customers can access twelve regulated marketplaces, and can deal in stocks, equity options, energy, and credit instruments. The company also owns and operates several clearing houses, in the US, Europe, Singapore, and the Netherlands, as well as one for credit. ICE has offices around the world, starting in Atlanta where it was founded, but including the major financial centers of New York, Chicago, London, Amsterdam, Singapore, and Washington DC, among others.

All of this adds up to global access to a multitude of trading instruments – exactly what investors need to find the right places to put their money. ICE got its start as a company in the energy utility business before expanding into international marketplace services, so it’s not surprising that investors can use it to trade in commodities such as oil and gas on the global scene, but the company also gives access to agricultural commodities, interest rate and credit instruments, mortgage securities, and even international stock market indices. This is big business, and ICE brought in some $8 billion in revenue during calendar year 2023, up 10% from 2022.

Intercontinental Exchange has reaped a clear benefit from the bullish stock markets in recent years, and the company’s shares are up more than 24% so far this year – outperforming the S&P 500’s 20% gain. The company has also continued its strong revenue generation, and brought in $2.3 billion in revenue for the last reported quarter, 2Q24. This was a company record for the quarterly top line, and was up an impressive 21% year-over-year, although it was a hair under the forecasts, missing by $10 million. At the bottom line, ICE shares realized a non-GAAP EPS of $1.52, beating the forecast by 3 cents and growing 6% y/y. The company saw an operating cash flow through 2Q24 of $2.2 billion, with an adjusted free cash flow of $1.8 billion.

These sound results reflect Intercontinental Exchange’s successful business model, as well as its ability to integrate acquired operations. The company conducted an $11.9 billion acquisition one year ago, when it closed on the purchase of the financial software, data, and analytics company Black Knight. The move has been especially pertinent to ICE’s mortgage technology segment.

This company’s combination of outperformance and strong prospects caught the attention of RBC’s Sabadra, who said of ICE, “Mortgage technology should deliver accelerated double-digit growth driven by cross-selling and revenue synergies from the BKI acquisition, along with sustained new win momentum further propelled by the mortgage market recovery. ICE Bonds should benefit from the secular trends of digitization, while the shift to passive fixed income investing and the strong franchise bode well for accelerated growth in ICE Indices. We expect Energy to sustain solid double-digit revenue growth as the increased volatility from macroeconomic, geopolitical, and regulatory uncertainty drives greater demand for hedging.”

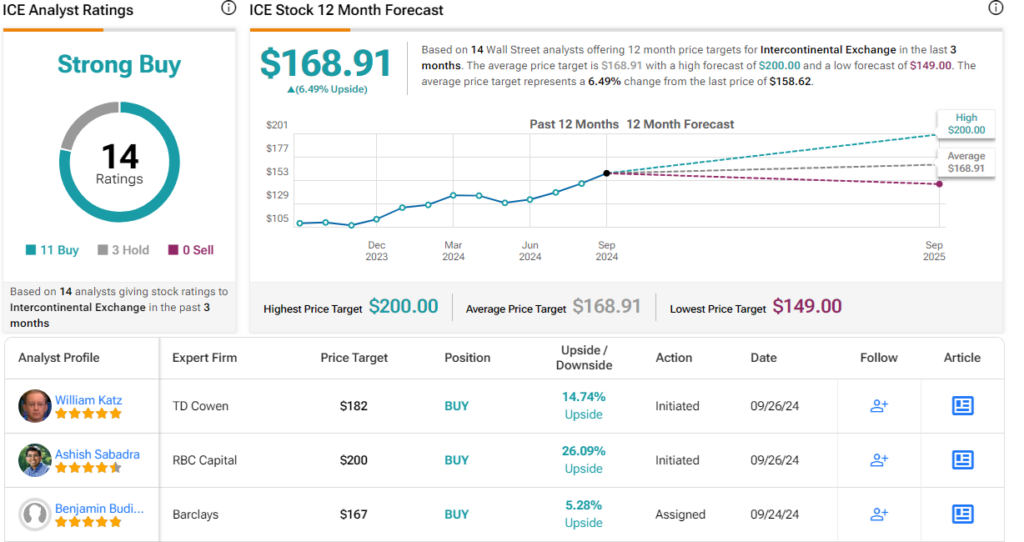

Sabadra’s stance backs up his Outperform (i.e. Buy) rating on the stock, while his price target, at $200, suggests that the shares will appreciate by 26% in the coming year. (To watch Sabadra’s track record, click here)

This view lines up with overall take on ICE, although RBC is somewhat more bullish going forward. The stock has a Strong Buy consensus rating, based on 14 reviews that include 11 Buys to 3 Holds, and its $158.62 trading price and $168.91 average target price together indicate a one-year upside potential of just about 6.5%. (See ICE stock forecast)

Nasdaq (NDAQ)

Next on our list is a familiar name, Nasdaq, Inc. This NYC-based financial services corporation stands behind the familiar NASDAQ stock exchange on Wall Street, the tech-heavy exchange that has been leading the bull markets of recent years, and also owns and operates the stock exchanges in Philadelphia and Boston. In addition, Nasdaq owns seven stock exchanges in Europe, in Scandinavia and the Baltic States: Copenhagen, Helsinki, Iceland, Stockholm, Riga, Tallinn, and Vilnius exchanges are among its assets.

In addition to trading activities in stocks, Nasdaq offers access to options, mutual funds, commodities, currencies, cryptos – a long list of possible transactions, as well as up-to-date news and insights on the global financial markets, their technology, and even their political impacts. Nasdaq, Inc. trades as NDAQ on its eponymous index in New York, so we have the opportunity to say here that Nasdaq has outperformed itself this year, with the shares gaining more than 26% compared to the NASDAQ Composite Index’s gain of 23% for the year-to-date.

As with ICE above, Nasdaq’s operations are solid revenue generators, reflecting the company’s firm connection to an active, bullish stock market environment. Last year, Nasdaq realized over $6 billion in total revenues, and the top line is on an upward trajectory this year. In 2Q24, the company recorded revenues of $1.2 billion, up more than 29% year-over-year and beating the estimates by $70 million. Nasdaq’s earnings came in at 69 cents per share by non-GAAP measures, beating the forecast by 5 cents per share. The company generated $460 million in cash flow from operations in Q2 and was able to return substantial capital to shareholders, including $138 million in dividend payments and $58 million in common share repurchases.

For RBC’s Sabadra, the key point here for investors is the company’s ability to maintain growing revenues while providing immediate returns for investors. He says of Nasdaq, “Solutions should sustain double-digit revenue growth driven by strong secular trends, cross-sell/ up-sell, and penetration opportunities in Financial Technology. Separately, recovery in capital markets activity should sustain accelerated growth for the Capital Access Platform. Cost synergies and operating leverage should drive margin expansion while deleveraging, opportunistic share repurchases, and dividend yield should help deliver low-to-mid-teens TSR (total shareholder return) annually.”

Sabadra quantifies his position on NDAQ with an Outperform (i.e. Buy) rating and an $88 price target that implies a gain of 21% on the one-year horizon.

These shares have earned a Strong Buy consensus rating on Wall Street, with 12 recent reviews breaking down to 9 Buys against 3 Holds. The stock is currently trading for $72.60 and has an average price target of $78, suggesting a one-year gain of 7.5%. (See NDAQ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.