Chipmaker Qualcomm (NASDAQ:QCOM) had a difficult year, owing to macroeconomic pressures weighing on consumer spending. However, with the global smartphone market on the mend, things are starting to look up for QCOM. Wall Street also remains hopeful of Qualcomm’s future, given management’s belief in stabilizing market dynamics. Also, AI-driven opportunities may improve Qualcomm’s fundamentals in the coming years, which is why I am bullish on QCOM stock.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Macroeconomic Headwinds Strained Qualcomm’s Fiscal 2023

Qualcomm’s success has relied on its innovative chipsets, particularly the Snapdragon series. These chipsets power a vast range of devices, from smartphones, tablets, and wearables to automotive systems.

However, Fiscal 2023 turned out to be not so positive for the chipmaker, led by a slowdown in smartphone sales. Rising inflation has put a damper on consumer spending on discretionary products such as electronics and smartphones. Its latest fourth-quarter Fiscal 2023 results were also gloomy, disappointing investors. The stock has gained a mere 18.2% YTD, which is not great compared to the massive gains its peers in the semiconductor industry have achieved so far in 2023.

In Q4, its revenue declined by 24% year-over-year to $8.7 billion, beating consensus estimates by $146 million. Meanwhile, earnings per share (EPS) for the quarter fell by 35% to $2.02, surpassing estimates by $0.11. For the full Fiscal year, revenue and earnings declined by 19% and 33%, respectively.

Notably, Qualcomm’s operations are distinguished by two segments: QCT (Qualcomm CDMA Technologies), which represents its chip business, and QTL (Qualcomm Technology Licensing), which covers its licensing business. In Fiscal 2023, QCT accounted for about 85% of its total revenue.

Let’s break down its revenue for the QCT segment (chip sales). The market’s lukewarm demand for new smartphones led to a 22% decline in Handset chip sales in Fiscal 2023, while its IoT (Internet of Things) chip sales dropped 19.2% year-over-year. Qualcomm’s Automotive chip sales, on the other hand, stood out with a 24% increase from Fiscal 2022.

As the automotive industry continues to evolve, Qualcomm’s Snapdragon Digital Chassis remains an essential part of this digital transformation. In the Q4 earnings call, CEO Cristiano Renno Amon highlighted the company’s new long-term strategic deal with Amazon’s (NASDAQ:AMZN) AWS (Amazon Web Services) “to enable automakers to integrate cloud technologies into their vehicle development life cycle.”

What’s more, Qualcomm is also a dividend stock that has a dividend yield of 2.6%, significantly higher than the S&P 500’s (SPX) average yield of 1.6%. The company generated $9.8 billion in free cash flow in Fiscal 2023, out of which it used $3.5 billion to pay dividends and $3 billion to repurchase shares. It also ended Fiscal 2023 with a strong balance sheet with $11.3 billion in cash, cash equivalents, and marketable securities.

Fiscal 2024 Could Turn Around QCOM’s Fortunes

Going into 2024, according to International Data Corporation, the global smartphone market is expected to recover by 4.5% year-over-year. This recovery could help boost demand for Qualcomm’s products.

While other chip makers like Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD) are ramping up their AI efforts, Qualcomm is raising the stakes in the game as well.

In its annual Snapdragon Summit event in October, the company unveiled two new generative AI-integrated chips, the Snapdragon 8 Gen 3 for smartphones and the Snapdragon X Elite for the personal computer (PC) market. For improved audio experiences, it also unveiled the AI-powered S7 and S7 Pro Gen 1 sound platforms.

Qualcomm’s efforts to stay current with the evolving tech industry by incorporating AI into all its products and services are positioning it for more growth. Furthermore, in the fourth quarter, Qualcomm also announced a deal with Apple (NASDAQ:AAPL) to supply Snapdragon 5G Modem-RF Systems for smartphone launches from 2024-26.

Looking ahead, management sees signs of stabilization in the demand for 3G, 4G, and 5G handsets worldwide. Hence, the company now forecasts Q1 Fiscal 2024 revenue in the range of $9.1 billion to $9.9 billion and EPS between $2.25 and $2.45.

If Qualcomm meets the upper end of the guidance, that would mean 5% revenue and 3.4% earnings growth over the year-ago period. Along with an amazing sequential growth of 14% in revenue and 21.3% in earnings, it would also signal the global smartphone market’s recovery. Meanwhile, analysts forecast revenue of $9.5 billion and EPS of $2.36 for Fiscal Q1 2024.

Although Qualcomm did not provide full-year guidance for Fiscal 2024, the outlook for the start of the fiscal year appears encouraging. Analysts foresee its revenue and earnings to show year-over-year growth of 5.5% and 9.3%, respectively. Currently, Qualcomm trades at 13.4 times its projected 2024 earnings. For a growth stock with AI capabilities, its valuation seems fair.

Is Qualcomm a Buy, According to Analysts?

Following Qualcomm’s fourth-quarter results, TD Cowen analyst Matt Ramsay reaffirmed his Buy rating on the stock with a target price of $145.00. The analyst finds Qualcomm’s successful foray into the PC space and its commanding presence in the Android handset market to be impressive. Additionally, DZ Bank also upgraded QCOM stock to Buy from Hold, assigning a price target of $140.

Meanwhile, after QCOM’s Q4 earnings, JPMorgan (NYSE:JPM) analyst Samik Chatterjee now believes Qualcomm “finally reported an end to the downward spiral” with its rosy outlook for Q1 Fiscal 2024. The analyst has a Buy rating on the stock and raised its price target from $135 to $140.

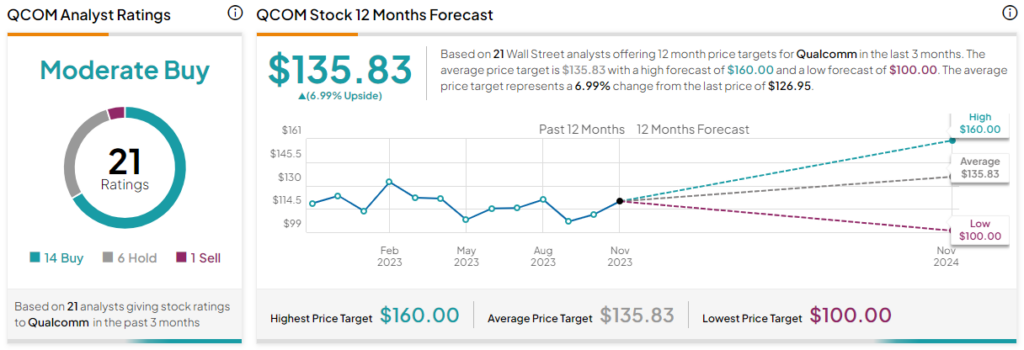

Out of the 21 analysts covering Qualcomm stock, 14 recommend a Buy, six recommend a Hold, and one recommends a Sell, giving the stock a Moderate Buy rating. The average QCOM stock price target is $135.83, implying 7% upside potential over the next 12 months.

The Takeaway

Qualcomm still plays a pivotal role in shaping the future of technology as we delve deeper into the 5G, IoT, and AI era. Its relentless pursuit of innovation, coupled with its diverse product portfolio and improving market dynamics, may all contribute to stronger revenue and profit growth in the years to come. For this reason, I remain cautiously optimistic that good days are ahead for Qualcomm.