PubMatic (PUBM) seems to do everything right. I am bullish but have reservations.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

PubMatic is a decade-old, $1.7-billion market cap company. PubMatic provides a cloud infrastructure platform. It enables real-time programmatic advertising transactions for Internet content creators and advertisers. (See Analysts’ Top Stocks on TipRanks)

Money for Clients and Investors

The company’s mission gauges success by driving ROI for app developers, publishers, and media buyers.

PUBM went public in Q3 2020 amid the pandemic. Within five months, the stock shot to a high over $75. Shares plummeted 20% a month later. They continued dropping over the rest of the year but are up 45.4% for the year. In October, shares began climbing to almost $40 in anticipation of strong Q3 reports.

PUBM did not disappoint. Q3 GAAP EPS beat estimates by $0.17. Organic revenue was reportedly up 58% year-over-year. The EBITDA margin topped 30%.

The big push driving the recent 22% price increase was the predictions accompanying the November report. FY 2021 revenue will be closer to $226 million than the $206 million as earlier thought. EBITDA for the year will probably be $20 million more. For 2022, the company expects revenue to be at least $281 million.

An Industry Standout

Concomitantly, Bloomberg’s digital media guru Justin Smith described 2021 as an unprecedented year for social media advertising and disruptive platforms.

Digital advertising companies are on a spending tear following record Q3 earnings results. Companies spent $378 billion the year PUBM went public. This year will close with them spending upwards of $455 billion, and an estimated $525 billion next year.

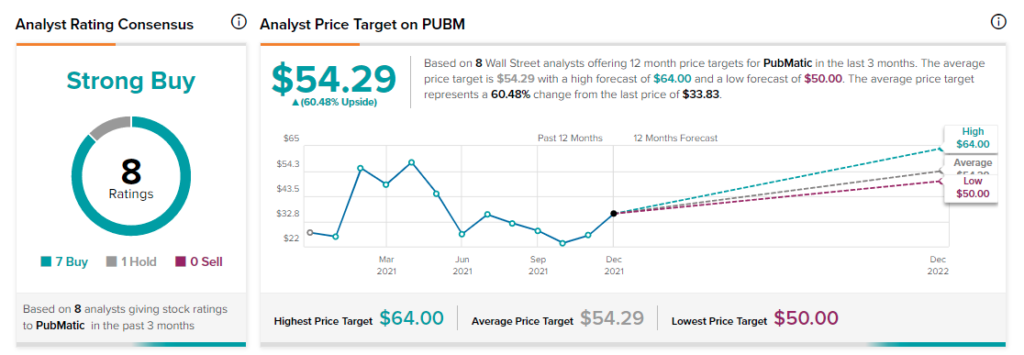

The average PUBM price target is $54.29. That is an impressive implied upside of 60.5%.

PUBM has shown remarkable resilience. It beat profit forecasts every quarter since Q4 2020. PUBM outshines competitors, like Taboola (TBLA), that have a similar market cap but report slim profits.

Caveats

PubMatic is a shrewd and effective beneficiary of the industry growth. The company has momentum and is profitable, but there are caveats.

Insiders have been on a selling spree throughout 2021 since the stock went public. Hedge funds decreased their holdings by 825,000 thousand shares over the last quarter.

Analysts’ consensus EPS forecast for Q4 2021 is $0.28, whereas last year’s EPS for the same quarter was $0.66. The stock has a higher Beta factor than I desire. This suggests the stock is more volatile than the market.

The romance of newness may wear thin; short interest is almost 9%, and PUBM does not pay a dividend. The forward P/E ratio of 55.6 suggests analysts have overvalued the stock compared to the 26 median P/E among its peers.

As well, TipRanks gives PUBM a Smart Score of 5 out of 10, and their investors’ sentiment stands at Very Negative.

Takeaway

The media and analysts are touting PUBM. I expect its revenue growth, phenomenal margins, and building on years of profits will underpin the favorable stock assessment.

The stock price enjoyed a recent push from its stellar Q3 financial report, outlook, and the strong tech sector finish in the first week of December.

Despite reports of inflation, consumer sentiment is rebounding, and that ultimately means more spending on advertising. We need to hear more about how the demise of third-party cookies will affect PUBM.

PUBM’s management knows how to make money and grow revenue. Investors may already have factored in the good news, causing the shares to move up in price and insiders and hedge funds to sell, however.

Disclosure: At the time of publication, Harold Goldmeier did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >