The consumer packaged goods (CPG) scene is home to some pretty steady retail cash cows — like POST, BRBR, UTZ — that can hold their own through rocky and inflationary economic environments. Undoubtedly, brand power still means a great deal in the world of CPG products, even as inflation has pushed some to “trade down” to private labels to help reduce the magnitude of sticker shock at checkout.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Though sticky inflation could keep most consumers in that cost-saving mode for a while, the following CPG brands have a value proposition and reputation of quality that will be tough for generics to top, even if consumer pressures worsen.

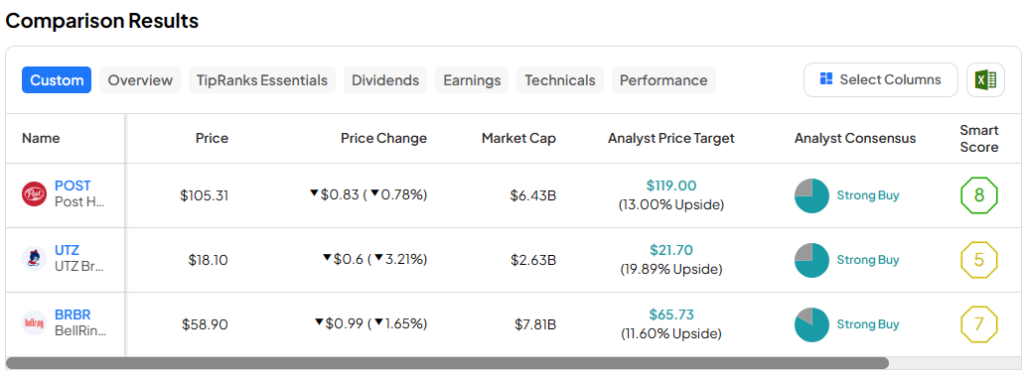

Therefore, let’s check in with TipRanks’ Comparison Tool below to stack up three Strong-Buy-rated CPG companies to see which holds the most year-ahead upside.

Post Holdings (NASDAQ:POST)

Post Holdings is a CPG heavyweight that’s best known for its popular cereal brands, from Pebbles to Honey Comb. Despite its reputation as a play on cereals, the firm has really made massive strides over the years to diversify into other CPG product categories via strategic acquisitions.

Undoubtedly, M&A moves tend to yield mixed-to-somewhat decent results at best. But not for Post. The company is a master of unlocking value through deal-making. The results have already spoken for themselves, with the prior acquisition of pet food deals starting to give results a nice growth jolt.

It’s not just smart deal-making that makes Post worthy of a long-term bet while shares are close to all-time highs. Management has also been incredibly effective at driving operating efficiencies. Undoubtedly, beating inflation is more about just jacking up prices. It’s about finding ways to save money across the supply chain. And though price increases have played a role, it’s clear that Post has many levers it can pull to withstand inflationary hailstorms.

All things considered, I can’t help but stay bullish on the stock because of its caliber of management and still-modest valuation.

With a knack for beating earnings estimates handsomely (earnings topped estimates by fairly wide margins in the last six quarters, as you can see below), Post is clearly one of the best-run CPG plays out there. At 20.3 times trailing price-to-earnings (P/E), the stock trades in line with the packaged-foods industry average of around 20.7 times.

What Is the Price Target for POST Stock?

POST stock is a Strong Buy, according to analysts, with six Buys and two Holds assigned in the past three months. The average POST stock price target of $119.00 implies 13% upside potential.

BellRing Brands (NYSE:BRBR)

Since spinning off from Post, active nutrition CPG firm BellRing Brands has been faring incredibly well. The company is behind such mass-appealing brands as PowerBar and Premier Protein, as well as the protein isolate Dymatize, a brand popular with weightlifters.

Over the past year, the stock surged 62%. Though there have been a handful of corrections endured over the past six months, shares have found a way to drive higher. Today, the stock’s just 6% away from all-time highs after rallying 11% from its year-to-date trough.

For a CPG firm, BRBR stock seems expensive again at 41.9 times trailing P/E, well above the packaged food industry average. That said, I am bullish and believe BRBR deserves to trade at a premium given “health and wellness” tailwinds.

Recently, analysts over at TD Cowen praised BellRing Brands as a potential takeover target. Indeed, with some of the most well-known protein products in the CPG industry, I bet any firm would love to scoop up the firm to jolt its growth profile. With a $7.8 billion market cap, BellRing Brands certainly seems like a bite-sized deal. In any case, it’s clear the company is faring well as an agile and lean standalone entity.

More than a month ago, Hedgeye (an investment research company) suggested that the company “may have a new market opportunity with GLP-1 patients,” many of whom would shed a great deal of muscle mass in addition to fat. That’s a massive market that aims not only to lose weight but also to stay fit and strong. I think Hedgeye is spot-on to have BRBR stock as a long idea.

What Is the Price Target for BRBR Stock?

BellBring stock is a Strong Buy, according to analysts, with 10 Buys and two Holds assigned in the past three months. The average BRBR stock price target of $65.73 implies 11.6% upside potential.

UTZ Brands (NYSE:UTZ)

From nutrition to snacking, we have UTZ Brands, a company behind a line of savory but rather fatty goods, from cheese puffs to chips. Undoubtedly, the rise of GLP-1 drugs could certainly put a dent in the demand for such goods in the long haul. That said, I believe that the mid-cap ($1.5 billion market cap) firm is small enough and high-growth enough to take market share away from its much larger rivals to more than offset any such GLP-1 headwinds.

With an emerging brand name and hot new product innovations, I’m inclined to stay bullish on the snacking lightweight.

For the latest (first) quarter, UTZ beat on earnings by a penny per share (earnings per share of $0.14 ahead of the $0.13 consensus) as revenue pretty much came in line with expectations. With intriguing new products, like Mike’s Hot Honey potato chips, I wouldn’t dare stand in Utz’s way. The only thing better than savory chips are unique, sweet, and spicy chips that simply must be tried.

The stock is down 10% from its 52-week highs. Nonetheless, it seems likely to trend higher into year’s end as the firm looks to build on recent strength while seeking to take share with (literally) hot new snacks.

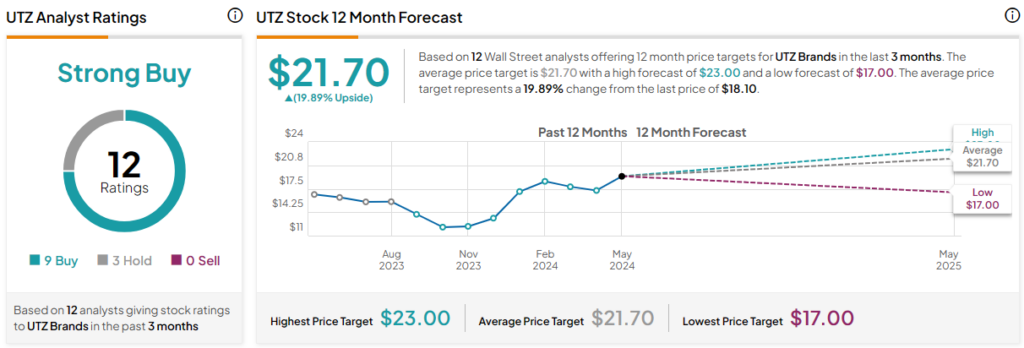

What Is the Price Target for UTZ Stock?

UTZ stock is a Strong Buy, according to analysts, with nine Buys and three Holds assigned in the past three months. The average UTZ stock price target of $21.70 implies 19.9% upside potential.

The Takeaway

Analysts remain optimistic about the following CPG stocks, and it’s easy to see why. They’ve been operating quite well, even in the face of inflation. And with solid brands, they stand to not only keep powering higher amid what remains of inflation, but they also have the growth edge to take share from their market rivals. Of the trio, analysts seem to see UTZ stock as having the most to gain from here.