Posting a year-to-date gain of 8.8%, visual discovery engine, Pinterest (NYSE:PINS) is currently trading near its 52-week high level. While a top management shuffle is likely to drive growth opportunities, its recent advertising partnership with Amazon seeks to make the platform more shoppable. Also, it intends to add AI capabilities to its platform.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

New CFO, Amazon Partnership

In May, Pinterest, the social curating website for sharing images, appointed its new CFO, Julia Brau Donnelly, replacing Todd Morgenfeld, who left the company to pursue new career opportunities. Julia earlier served at online furniture retailer Wayfair (NYSE:W).

Analysts cheered the appointment, as clearly reflected by their reaffirmed stock ratings, citing her eCommerce expertise driving retail sales for advertisers on the Pinterest platform. D.A. Davidson and Citi had reaffirmed their Hold ratings on the stock back then.

In April, Pinterest collaborated with Amazon (NASDAQ:AMZN) for a new advertising partnership wherein advertisers are given the opportunity to post their products on Pinterest. Through this, users will navigate to the Amazon shop through a Pinterest link. This marks the company’s first step towards opening third-party ad demand on Pinterest, as indicated by CEO Bill Ready in its Q1 earnings call.

Pinterest’s AI Angle

“We’re making sure that it’s additive to people’s lives, not addictive, which I think has been one of the criticisms of some of what has happened with AI and social media over the last many years is that in a lot of ways it was becoming more and more addictive,” CEO Bill Ready said at a March Shoptalk retail conference in Las Vegas.

Moreover, he believes that the company’s efforts and further processing around AI, combined with recent cost cuts, should drive margin expansions in 2023 amid a rough ad sales market.

As a social media platform, PINS operates in an industry with peers like Facebook (NASDAQ:META), Snapchat (NYSE:SNAP), and Alphabet’s (NASDAQ:GOOG) Google.

Positive Q1, Soft Outlook

Pinterest Q1, which was reported in April, saw a growth in revenue to $603 million from $575 million in the year-ago quarter as the global monthly active user base expanded to 463 million from 433 million prior. EPS came in at $0.08 ahead of analyst expectations. In May 2023, total website traffic at Pinterest grew 1.8% month-over-month to 403.85 million while on quarter-to-date basis, Q2 of 2023 (Apr-May), total unique visitors on all devices are up 24.67% year-over-year.

For Q2, the company sees revenue to be in line with the growth it saw in the most recent two quarters, which is 4.6% in Q1 and 3.5% in Q4 of 2022. Operating income is estimated to grow at a low-teens percentage basis sequentially.

Is Pinterest a Buy or Hold?

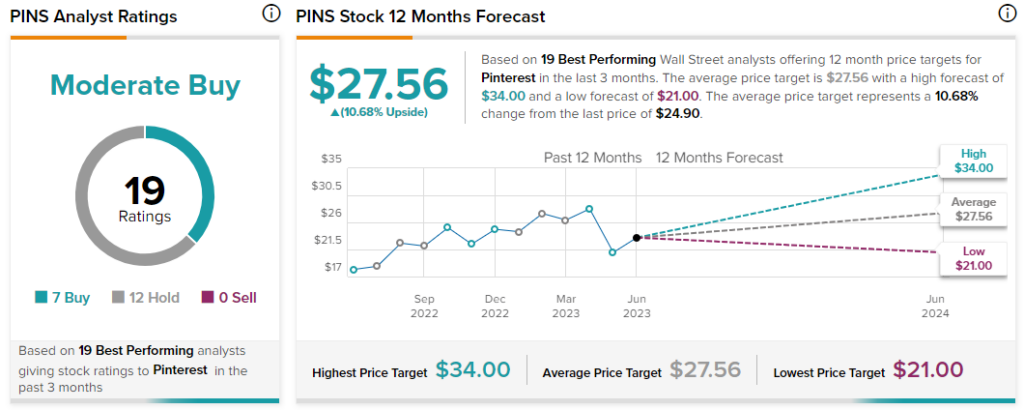

Of the 19 top Wall Street Analysts covering PINS stock, 12 have a Hold rating while seven assign a Buy, taking the average analyst consensus rating to Moderate Buy. The average analyst price target stands at $27.56, implying a 10.7% upside potential from current levels.

In early June, Wells Fargo initiated coverage of PINS with a Hold rating, assigning a price target of $23, which implies 7.6% downside potential from current levels. The analyst believes that the company must push aggressively for higher user engagement through a direct purchase or third-party retail media partnership.

Last month, Piper Sandler Analyst Thomas Champion reaffirmed his Buy rating on the stock with a $31 price target implying a 24.5% upside potential from current levels.