Philip Morris International (NYSE:PM) just posted an exceptional Q2 report this week, beating both Wall Street’s top and bottom line estimates while setting the stage for the company to report record Fiscal 2023 earnings.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The international tobacco behemoth is benefiting from several aspects these days, which are set to persist in the coming quarters. These include resilient combustibles demand, rising non-combustibles momentum, and Swedish Match contributing strongly to sales. Accordingly, I remain bullish on the stock.

Second-Quarter Highlights – Another Strong Trading Period

Philip Morris’ Q2 results highlighted another strong trading period, setting the stage for record Fiscal 2023 profits. Net revenues came in at $9.0 billion, translating to a 14.5% year-over-year boost (or 14.9% on an FX-neutral basis) and marking the best quarter in the company’s history in terms of sales. This figure includes the additional revenues brought in by the acquisition of Swedish Match.

But even if we exclude Swedish Match’s numbers, net revenues grew by 10.5% organically. This was driven by total cigarette and HTU (heated tobacco units) shipment volume growth of 3.3% (reflecting growth of 26.6% for HTUs and a decline of 0.4% for cigarettes), the favorable product mix impact related to the growing ratio of smoke-free products within the company’s product portfolio, and combustible tobacco price growth surpassing 9%.

But let’s take a deeper look at each of Philip Morris’ tobacco segments!

Demand for Combustibles Remains Resilient

Investors have long foretold the demise of combustibles, yet the actual decline has been a very slow and gradual process. Contrary to these predictions, demand for combustibles has proven to be remarkably resilient. Cigarette volumes, for instance, saw only a marginal 0.4% decrease compared to the previous year.

Meanwhile, the exceptional inelasticity of Philip Morris’ business model allowed the company to capitalize on its unmatched pricing power. By doing so, they not only mitigated the small decline in volumes but also achieved an impressive organic growth rate of 7.4% within this division. This growth was primarily driven by implemented price increases, which exceeded 9% and were comfortably absorbed by smokers.

Furthermore, note that favorable foreign exchange rates have started to work in favor of the Combustibles division due to the significant drop in the value of the dollar. This is because the overwhelming majority of the company’s Combustible revenues are sourced outside the USD, owing to its international presence (competitor Altria (NYSE:MO) serves the Unites States instead).

Heated Tobacco Posts Strong Traction

Philip Morris’ Heated Tobacco segment sustained strong traction, evident through its continuous customer base expansion and impressive shipment volume growth of 26.6%. Notably, the quarter-end data reveals a substantial increase in total IQOS (Philip Morris’ flagship electronic cigarette) users, reaching approximately 27.2 million, which is 5.4% more (1.4 million users) compared to last year.

Moreover, Philip Morris’ market share for heated tobacco units in the markets in which IQOS competes also experienced a notable growth of 160 basis points, reaching an impressive 9.2%.

To be fair, it’s essential to acknowledge that the HTU shipment volume during the quarter benefited from the positive net projected effect of distributor and wholesaler inventory movements (against the net negative impact experienced in the previous quarter). However, even after excluding this factor, the company estimates that adjusted in-market sales volume for HTUs still achieved a significant 16% rise, highlighting the continued strong momentum of IQOS.

Swedish Match Acquisition Boosts Oral Nicotine Division

In addition to strong performances in Combustibles and Heated Tobacco, Philip Morris experienced explosive growth in its Oral Nicotine division, mainly attributed to the successful acquisition of Swedish Match.

Remarkably, the company’s oral product shipment volumes surged from 6.0 million in the previous year to an impressive 197.4 million. Separately, nicotine pouches and Snus volumes witnessed a phenomenal increase, rising from 0.9 million and 5.1 million to an astounding 99.5 million and 62.6 million, respectively. Additionally, the introduction of Moist Snuff as a new revenue stream contributed 34.1 million to shipment volumes.

Given Philip Morris’ strong momentum toward its mission for a smoke-free future, its dominant position in oral nicotine delivery is poised to facilitate a smooth transition and drive further sales growth.

Management Projects All-Time High EPS in Fiscal 2023

Philip Morris’ Q2 report was characterized by phenomenal revenue growth, but the fact that the company beat Wall Street’s EPS estimate shouldn’t go unnoticed. Specifically, adjusted EPS landed at $1.60, beating consensus estimates by $0.10 and indicating year-over-year growth of 16.9%.

Following a strong first half of the year, Philip Morris’ management projects adjusted EPS of $6.46 to $6.55 for Fiscal 2023. This implies year-over-year growth of 8.0% to 9.5% and another year of all-time-high profitability.

Is PM Stock a Buy, According to Analysts?

Regarding Wall Street’s sentiment, Philip Morris features a Strong Buy consensus rating based on seven unanimous Buys assigned in the past three months. At $116.17, the average Philip Morris stock price projection implies 19.1% upside potential.

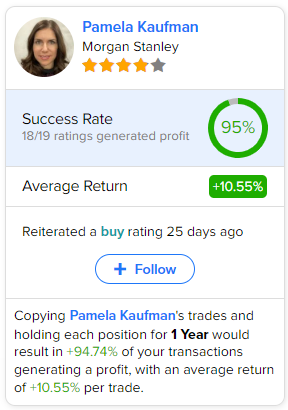

If you’re wondering which analyst you should follow if you want to buy and sell PM stock, the most accurate analyst covering the stock (on a one-year timeframe) is Pamela Kaufman from Morgan Stanley (NYSE:MS), with an average return of 10.55% per rating and a 95% success rate.

The Takeaway

Philip Morris International’s exceptional Q2 performance showcased its resilience and growth potential. With a relatively resilient demand for combustibles and a thriving Heated Tobacco segment, the company is capitalizing on its pricing power and strategy toward a smoke-free future.

The acquisition of Swedish Match is also driving explosive growth in the Oral Nicotine division. Finally, management’s projection of all-time high EPS for Fiscal 2023 cements confidence in the company’s bullish case.