The new year is off to another interesting start. The technology sell-off has continued as investors look to more stable plays in the current environment. COVID-19 variants are once again dominating the news, and several countries have entered new lockdown phases.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This makes for a very difficult investing environment. It is, however, also why investors should have a strong foundation of blue-chip stocks. While exposure to growth helps portfolios outperform in a bull run, when things turn sour, investors will be happy they have their foundational stocks to hold them up.

One such stock is Pepsi (PEP) which has been a strong performer in recent years. It is a company I am bullish on, given the current market sentiment.

A Diversified Consumer Staple Stock

What makes Pepsi so attractive? For starters, it is one of the world’s largest food and beverage companies. It controls the supply chain for a slew of brands across the beverage and snack categories, including Pepsi, Mountain Dew, Gatorade, Doritos, Lays, and Ruffles.

One of the main reasons to go with Pepsi over a company like Coke (KO) is because it is more diversified. While Pepsi and Coke go head-to-head in the beverage category, the snack segment sets it apart. The company has three main product segments – Frito-Lay, Quaker, and beverages.

Pepsi also manufactures and distributes other brands through partnerships and joint ventures with companies such as Starbucks. Partnering with Starbucks (SBUX) is likely to lead to higher growth versus Coke’s partnership with McDonald’s (MCD). Why? Starbucks is growing at a much faster pace than McDonald’s.

Speaking of growth, Pepsi is expected to grow revenue in the mid-single digits, while earnings should read high single-digit growth in Fiscal 2022. Looking further out, Pepsi is expected to maintain high, single-digit growth over the next three to five years.

While this may not seem like much, it is quite respectable for a blue-chip stock. Remember, investors aren’t buying Pepsi for exponential growth. They are buying it because, as a consumer defensive stock, it has proven to deliver stable returns even during the most volatile of times.

Dividend King

Another reason why investors should consider Pepsi to anchor their portfolio is because of its dividend. The majority of foundational stocks are likely to pay a dividend because most are mature companies that have been in operation for decades.

Pepsi has ample cash flow to both re-invest in the business and return cash to shareholders. It also happens to be one of the top dividend stocks in the world.

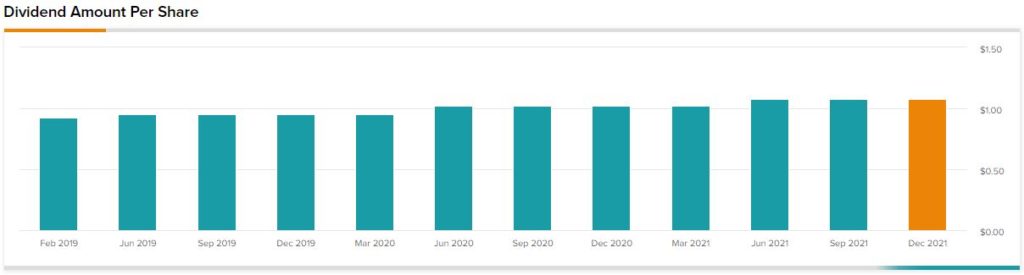

The company is only a year away from achieving Dividend King status. This year, with another raise, it will have achieved 50 consecutive years of dividend growth. Over the past five years, the company has raised dividends by an average of 7.5% annually, and Pepsi’s dividend yield is healthy 2.5%.

The company’s current payout ratio is ~68% which is consistent with the company’s five-year average of 65.6%. In comparison, Coke’s has ballooned to 101% because of slowing growth in recent years. It is also seeing much smaller dividend raises as a result. This is yet another reason why Pepsi stands out today.

Wall Street’s Take

Turning to Wall Street, Pepsi earns a Moderate Buy consensus rating based on just one Buy and one Hold rating.

The average Pepsi price target of $180.00 puts the downside potential at 3.5%.

Conclusion

Pepsi is likely a good bet if you are looking for stability. While the company is trading near 52-week highs, it is still very much worth considering. Adding Pepsi to one’s portfolio should decrease volatility until the next big growth bull run.

Download the TipRanks mobile app now

Disclosure: At the time of publication, Mat Litalien has positions in Coke, McDonald’s and Starbucks.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >