Peloton (NASDAQ:PTON) has seen its ups and downs throughout the past few years. It saw an exponential rise in sales during COVID-19 as people were forced to stay home but still wanted a way to exercise. Post COVID, PTON experienced large losses as gyms reopened and people wanted to get out of the house. Now Peloton is on a mission to rebrand the company with less focus on its luxury exercise equipment and a stronger emphasis on the more accessible Peloton App.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

When most people think of Peloton, they think of the indoor stationary bike with motivational instructors who teach a variety of live and on-demand classes that can be completed from the comfort of one’s home. However, Peloton is so much more than that, offering a variety of products besides the bike including Peloton Tread, Peloton Guide, Peloton Row, Peloton App, apparel, and accessories.

The Peloton Rebrand

As Peloton is much more than just an in-home stationary bike, the company now aims to make people aware of all the products and services it offers. The rebrand wants to shift consumers’ viewpoints to seeing it as an accessible fitness app that makes working out achievable to anyone, anywhere. Therefore, Peloton wants to focus on app subscriptions rather than selling its expensive equipment, making access to the content more affordable and expanding the brand’s customer base.

Furthermore, with the focus on app subscriptions and usage, Peloton has created a tiered system providing different levels of content based on various price points. The goal is to drive in new customers who previously did not want to pay the hefty prices for the equipment and give them access to the classes. The app allows users to follow along with classes at the gym, using the equipment there, or in the comfort of their homes, with classes that do not require any equipment.

The impact of this rebranding is currently unknown. People who currently have Peloton equipment bought into the idea of exclusivity and club-like community, which the lower price point eliminates. Therefore, the ease of joining the Peloton community may not sit well with current owners. They have supported the company for so long and paid high prices to be a part of the elite Peloton community.

Additionally, owners of the Peloton equipment will still have to pay $44/month for the Peloton All Access Membership to access classes that are displayed on the equipment screen, while new app subscribers only have to pay $24/month for the Peloton App+ membership on their personal devices. This price difference is something that may drive away existing customers and create a further shift in the way people use their Peloton equipment.

Is Peloton a Buy or a Sell?

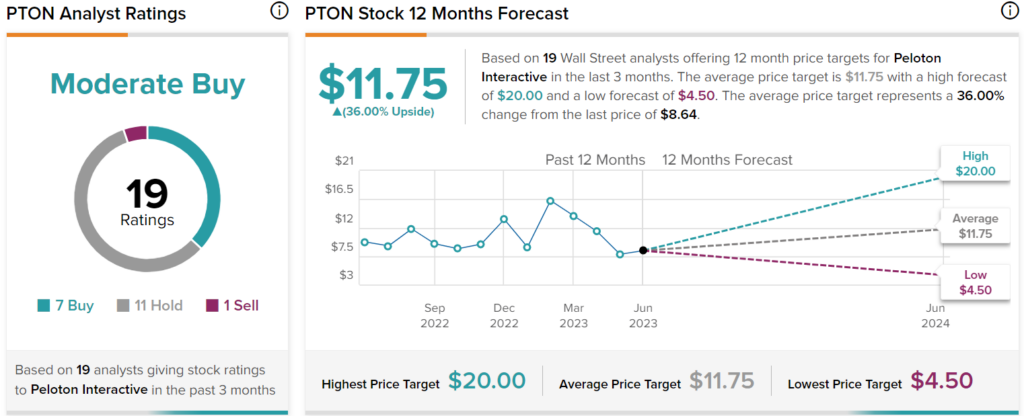

Throughout the past three months 19 analysts have rated Peloton and it has a Moderate Buy consensus rating. Peloton received 7 Buy, 11 Hold, and 1 Sell ratings from these analysts. From the perspective of these 19 analysts, the price target of the average future stock price is $11.75, resulting in a 36% upside from the current stock price. Year-to-date, Peloton stock is up 6.4%.

Takeaway

Overall, Peloton has seen better days as the stock soared from 2020 to 2021. In the past three year the stock has declined in value by 83.02%. However, there is hope for positive returns in the future with the company rebrand hoping to attract a larger audience and drive traffic to the app.