The past few weeks haven’t been kind to high-growth companies. This includes fintech, in which many of the industry leaders are suffering from some pretty significant declines.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Case in point, Lightspeed (LSPD) and Nuvei (NVEI) have both been targeted by short sellers and their stocks are down by over 50% from 52-week highs. The impacts are having ripple effects across the industry and even the blue chips are seeing notable declines as retail investors get spooked.

A good example of this is Paypal (NASDAQ: PYPL) which has lost 3.8% over the past month and is now trading at a 41% discount to 52-week highs. Where others panic, I see opportunity and am bullish on Paypal’s stock.

Leading Fintech Company

Paypal is arguably the most well-known fintech company. It was spun out of eBay (EBAY) back in 2015 and has grown into one of the largest payment solutions companies in the world. The company has more than 400 million active accounts and operates in more than 200 markets.

Over the years, Paypal has expanded its reach through strategic acquisitions and has amassed an impressive portfolio of brands. These include Venmo, Xoom, Simility, Honey, Paidy, Hyperwallet, and Braintree, among others.

For the past 20 years, the company has been at the forefront of digital payments innovation and the company is well positioned to be a leader over the next 20.

Mixed Q3 Results

In early November, Paypal announced mixed Q3 2021 results. While earnings of $1.11 per share beat estimates by $0.03, revenue of $6.1 billion came in $50 million lighter than expected. In the quarter, it added 13.3 million net active accounts and exited Q3 with 416 million.

Year-over-year, the company experienced healthy growth, as evidenced by the numbers below.

- Revenue +13.2%,

- EPS: +4%

- Free Cash Flow: +20%

- Total Payment Volume (TPV): 24%

The company also announced that Venmo users in the U.S. would be able to use the platform on Amazon (AMZN) starting in 2022.

“We’re thrilled that we are teaming up with Amazon to enable customers in the U.S. to pay with Venmo at checkout,” said a release.

The news could prove to be material as Venmo has over 80 million users in the U.S., and it processed close to $60 billion in TPV, up 36% year-over-year.

Unfortunately, what was an otherwise solid quarter was overshadowed by weak guidance. Paypal expects revenue of $6.85 billion to $6.95 billion, and upcoming earnings of $1.12 per share in Q4 2021. This compares to analysts’ average estimates of $7.24 billion and $1.28, respectively.

When a company misses guidance, the company’s stock usually reacts to the downside. Not surprisingly, Paypal closed the day down 10.4% from its pre-earnings day close. Couple the disappointed quarter with the subsequent short attacks on LSPD and NVEI, and Paypal’s stock price has struggled to gain any momentum since.

The good news is that now might be the perfect entry point for those looking to add Paypal to their portfolio. The company is trading at a discount to historical averages.

Wall Street’s Take

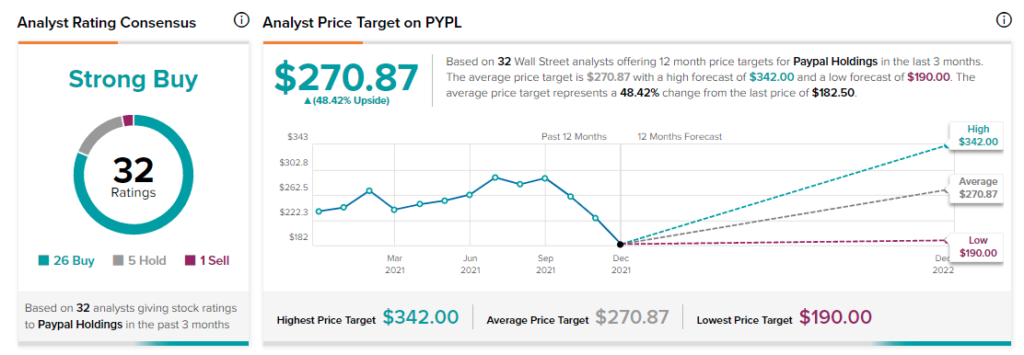

From Wall Street analysts, Paypal earns a Strong Buy analyst consensus based on 25 Buy ratings, five Hold ratings, and only one Sell rating.

The average Paypal price target of $270.87 puts the upside potential at 48.4%.

Disclosure: At the time of publication, Mat Litalien did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >