Paychex, Inc. (NASDAQ: PAYX) offers integrated human capital management (HCM) solutions to organizations of any size, from startup to enterprise.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company reported impressive results for the fourth quarter of Fiscal 2022. Revenues of $1.14 billion climbed 11% year-over-year, while earnings increased 13% from the year-ago quarter to $0.81 per share. However, the company provided weak projections for Fiscal 2023.

Remarkably, the new TipRanks’ monthly website visitor tool already reflected strong results for the fourth quarter. The wide acceptance of the company’s innovative technology solutions and the rising client base were the primary drivers.

Website Traffic Indicated an Uptrend

The earnings results were evident on TipRanks’ new tool that measures visits to the Paychex website. Pre-earnings, we were able to see insights into Paychex’s performance in the fiscal fourth quarter.

According to the tool, the Paychex website recorded a whopping 73.3% year-over-year surge and an 8.43% sequential rise in global visits in Fiscal Q4 2022. Also, year-to-date website growth, compared to year-to-date website growth in the previous year, came in at 66.84%. This, in turn, indicated that the company might report strong results in the fourth quarter.

The predictions that were based on TipRanks’ website visits data turned out to be correct, with Paychex reporting better-than-expected results in Fiscal Q4 2022.

Wall Street’s Take

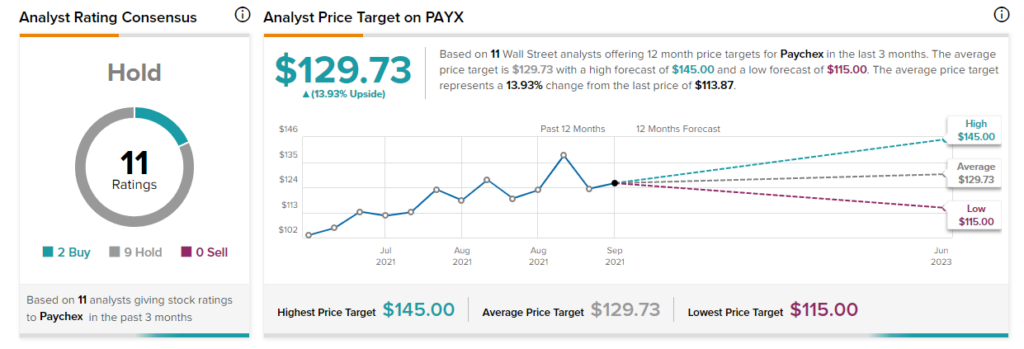

Following the Paychex earnings report, Barclays analyst Ramsey El Assal maintained a Hold rating on the stock and reduced the price target to $127 (11.53% upside potential) from $140.

Though the company reported upbeat results, the three-star analyst remained on the sidelines. Assal believes that the company’s sales outlook reflects the concern about an impending recession, “which is likely giving investors pause in today’s tape.”

Overall, the stock has a Hold consensus rating based on nine Holds and two Buys. The average Paychex price target of $129.73 implies 13.93% upside potential to current levels. Shares have increased 7.5% over the past year.

Bottom-Line

Paychex provided decent gains over the past year and posted strong results in the last few quarters. Website trends on TipRanks’ Website Traffic Tool also reflected an uptrend. Nevertheless, following the slowdown in the economy and fears of an impending recession, along with the company’s slower growth expectations in the upcoming period, analysts prefer to remain on the sidelines.

Read full Disclosure