As the tech landscape constantly evolves, Palantir (NYSE:PLTR) has been a stock to watch, especially following its recent Q3-2023 earnings report, which sparked a 20%+ jump in its stock price. The big data analytics firm has shown plenty of strength this year (up 181% YTD), and its recent results were good, too, with its financials trending in the right direction. However, its high valuation is concerning and makes buying the stock risky. Therefore, we’re neutral on PLTR stock and are proceeding with caution.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Q3 Earnings: A Brief Overlook

Palantir’s Q3 earnings outperformed analyst expectations with a narrow beat on both the top and bottom lines. The company’s revenue exceeded forecasts by approximately $2.5 million, while non-GAAP EPS beat estimates by $0.01, coming in at $0.07. Its Commercial segment grew its revenue by 23%, and its Government segment revenue grew by 12%.

Meanwhile, the firm now expects 2023 revenue to fall between $2.216 billion and $2.22 billion, ahead of the $2.21 billion consensus. Also, PLTR expects adjusted operating income of $607 million to $611 million (the previous estimate was $576 million+) and a full year of GAAP profitability. It’s no wonder that investors were happy with the report.

The Good

Palantir’s consistent GAAP profitability in 2023 is impressive. The company has lived up to its promise of being GAAP profitable each quarter this year, projecting the same in Q4. As stated above, the firm revised its full-year guidance upwards, signaling confidence in the remainder of the fiscal year.

Moreover, Palantir’s eligibility to join the S&P 500 (SPX), according to CEO Alex Karp, is a significant milestone and can support the stock price. Plus, it’s a positive indicator of the company’s growth and stability, although it doesn’t necessarily trigger runaway enthusiasm for us.

Furthermore, Palantir’s operational discipline is reflected in its low-debt balance sheet and substantial cash and short-term investment reserves, which account for about 8.5% of the company’s market cap.

The Bad

Palantir’s valuation presents a concern. Post-earnings, the stock trades at a hefty multiple of 14.5 times its estimated 2023 revenue and 61 times its estimated 2023 non-GAAP EPS. These figures highlight the market’s high expectations, banking on continued aggressive growth. For reference, the sector median forward P/S and P/E ratios stand at 2.3x and 20.3x, respectively.

While the company is expected to grow its revenue by 18.7% and 20.7% in 2024 and 2025, respectively, its valuation just seems to present too much risk, especially since there are plenty of other established tech stocks trading at lower valuations that are also growing nicely.

Is PLTR Stock a Buy, According to Analysts?

Analysts agree that Palantir stock may be overpriced. PLTR comes in as a Hold based on three Buys, six Holds, and six Sell ratings assigned in the past three months. The average PLTR stock price target of $14.46 implies 19.5% downside potential.

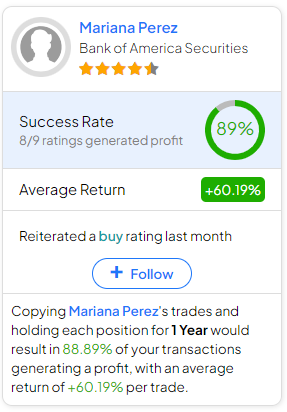

If you’re wondering which analyst you should follow if you want to buy and sell PLTR stock, the most accurate analyst covering the stock (on a one-year timeframe) is Mariana Perez of Bank of America (NYSE:BAC) Securities, with an average return of 60.19% per rating and an 89% success rate. Click on the image below to learn more.

The Takeaway

Palantir Technologies remains an intriguing stock with plenty of long-term potential. The company’s double-digit-percentage growth in both its Government and Commercial sectors underscores its potential. However, investing in Palantir requires a delicate balance between recognizing its growth trajectory and being mindful of the overenthusiasm reflected in its current valuation.

For us, the stock is likely overvalued and overbought after its sharp post-earnings rally, so we aren’t looking to buy it. Analysts agree, too, expecting the stock to fall from here. The takeaway? Proceed with caution.