AI has been a key driver of the bull market in recent years, and its influence continues to spread across the broader economy as more companies integrate it into their operations. GlobalData estimates that about 70% of U.S. businesses are now using AI in some capacity.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The financial incentive is substantial as well. At $41 billion, the U.S. AI market is the largest globally (nearly double that of second-place China) supported by a wide range of technology companies on the front lines of AI development and adoption.

This combination of accelerating AI adoption, healthy market momentum, and abundant investment capital has created a steady pipeline of opportunities for investors.

Analysts at Goldman Sachs are focused on identifying the AI names best positioned for what comes next, with particular attention on Palantir (NASDAQ:PLTR) and Arista Networks (NYSE:ANET). Both are deeply connected to the AI trend but only one earns a Buy rating from Goldman. So, let’s take a look at the pair, and by delving into the TipRanks database, we can see if the rest of the Street agrees with the banking giant’s stance.

Palantir Technologies

First on our list is Palantir Technologies, the mega-cap AI software company co-founded by Peter Thiel in 2003. Palantir has become a leader in AI-powered data analysis and is known for its innovations in matching AI tech with intuitive human flexibility, to bring out the best in both. The company’s core product is its AIP, the AI platform. AIP brings a varied set of tools to the table and can be adapted for use in a wide range of public and private sector fields.

One of Palantir’s key innovations was bringing AI to bear directly on the user interface, allowing users to enter queries and receive responses in real time and in natural language. This was part of Palantir’s other key insight, that AI interfaces should be easy to use. Palantir’s products require no specialized training in computer language or coding on the part of the user at the interface; the AI can even handle multiple languages and real-time translations.

What this does is allow users to concentrate their efforts on data analysis and developing insights, rather than talking to the computer, and Palantir has handled that aspect of its service delivery with extraordinary success. The company has seen a powerful expansion in recent years, and its AI-powered platform has become popular both with the US government and in the commercial sector. Palantir frequently announces new large-scale contracts, domestically and internationally, in both government and business segments.

Just this month Palantir has announced two important new ventures. In the first, announced on November 4, Palantir will conduct a joint venture in the UAE with Dubai Holding to launch Aither. This joint venture will drive AI adoption and transformation in both the public and private sectors in Dubai.

The second announcement, on November 6, concerned a partnership between Palantir and the Spanish environmental services company Valoriza. Under the partnership agreement, the Spanish company will use the AIP to bring AI systems to bear on its waste management and urban services operations.

Turning to the financial side, we’ll look at Palantir’s last quarterly report. This release covered 3Q25 and showed that Palantir saw total quarterly revenues of $1.18 billion. This was up 18% from 2Q25, 63% from 3Q24, and beat the forecast by $89.5 million. At the bottom line, Palantir’s non-GAAP EPS of 21 cents was 4 cents per share better than had been expected. The company has deep pockets and finished the third quarter with $6.4 billion in cash and other liquid assets.

We can note here that Palantir stock has gained an impressive 143% just this year, extending a surge that has seen the stock gain ~2173% over the past 3 years.

Covering this stock for Goldman, analyst Gabriela Borges notes the scale of Palantir’s success, but the gains have resulted in a lofty valuation that shapes the investment case. In her words: “We continue to view Palantir as one of only a handful of software companies that is clearly benefiting from AI deployments today. As enterprises expand from experimentation with use cases to enterprise-wide AIP deployments, Palantir continues to capture a meaningful share of wallet evidenced in increased deal sizes and revenue per customer. While we continue to expect Palantir to capture meaningful share of customer AIP deployments, our positive view is balanced by longer term ecosystem risks (of the industry moving from peak custom deployments to off the shelf adoption) and premium valuation: Palantir trades at ~80x EV/Sales (vs. 20%+ growth/margin peers at ~20x) and >150 EV/FCF (vs. peers at 55x) on 2026.”

This adds up to a Neutral (i.e., Hold) rating for PLTR. Borges’s price target, set at $188, implies that the stock will stay rangebound for the time being. (To watch Borges’s track record, click here)

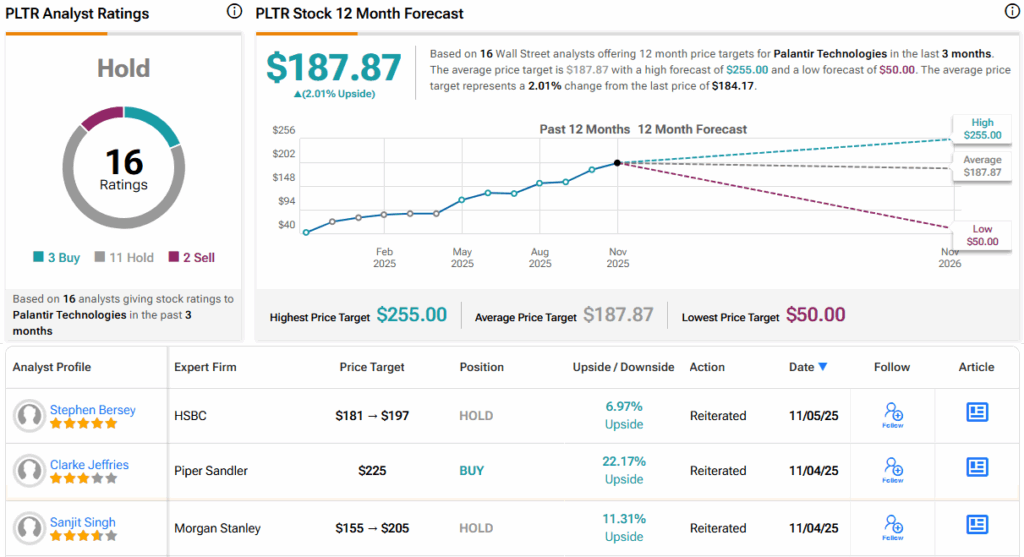

This is consistent with the consensus view; Palantir gets a Hold from the Street, based on 16 recent reviews that include 3 to Buy, 11 to Hold, and 2 to Sell. The stock is currently priced at $184.17, and its $187.87 average target price nearly matches the Goldman outlook. (See PLTR stock forecast)

Arista Networks

Arista Networks, the next stock on our list, is both a hardware and software company, focused on delivering the top-end services for client-to-cloud networking in the expanding realm of AI data centers and campuses. The company is known for its physical networking devices as well as the software platforms needed to run them, and has a reputation for delivering quality. Arista Networks is a large-cap firm, with a $170 billion market cap and over 20 years of experience in systems networking.

The company’s core business is in the development and deployment of high-end, AI-capable, cloud-based networks. Arista produces everything from routers and switches to the stacks and racks needed to run a cloud network, and its technology is designed to be expandable and scalable. The company’s modular cloud network hardware is adaptable to any industry and is configurable for most any purpose – better, it can be installed to support as few as 100 servers to as many as 100,000 or more. Once up and running, Arista’s hardware can be expanded, allowing it to grow as the users grow.

Arista itself operates at a large scale. We have already noted the company’s significant market cap; we should note also that Arista boasts more than 10,000 cloud customers worldwide, and has deployed over 100 million ports. Despite a dip in the share price since the end of October, Arista’s stock is up 21.8% this year, outpacing the NASDAQ’s 19% gain over the same period.

Also of interest to potential investors, Arista announced on October 29 the release of its latest generation of platforms, the R4, for AI, data center (DC), and routed backbone deployment. The new R4 series is designed to bring down the total cost of ownership without compromises in high-performance capacity, AI job completion time, or low power consumption. The new routers mark an important addition to Arista’s product portfolio.

On the financial side, Arista’s 3Q25 report was released on November 4 and marked the company’s 19th consecutive quarter of record revenue growth. The top line came to $2.31 billion, up 27% from the prior-year period and beating the forecast by $41.76 million. At the bottom line, Arista’s 75-cent non-GAAP EPS figure was 4 cents per share better than had been anticipated.

In his Goldman write-up on Arista, analyst Mike Ng expects that this networking firm will continue to see strong growth in the coming years. Summarizing his outlook for the company, he writes, “ANET continues to see strong demand across its suite of networking solutions for AI and Campus. Specifically, within AI/Data Center, ANET should benefit from its position as a best-of-breed provider of networking hardware supported by its performance-enhancing EOS management software suite against the backdrop of broader networking themes including growing complexity of cluster builds, broadening XPU diversity (where ANET expects 4-5 accelerators to emerge over the next couple of years), and broadening customer bases across neoclouds and large tier-2 service providers.”

These comments back up Ng’s Buy rating, while his $170 price target suggests that ANET shares will appreciate by 26% over the next year. (To watch Ng’s track record, click here)

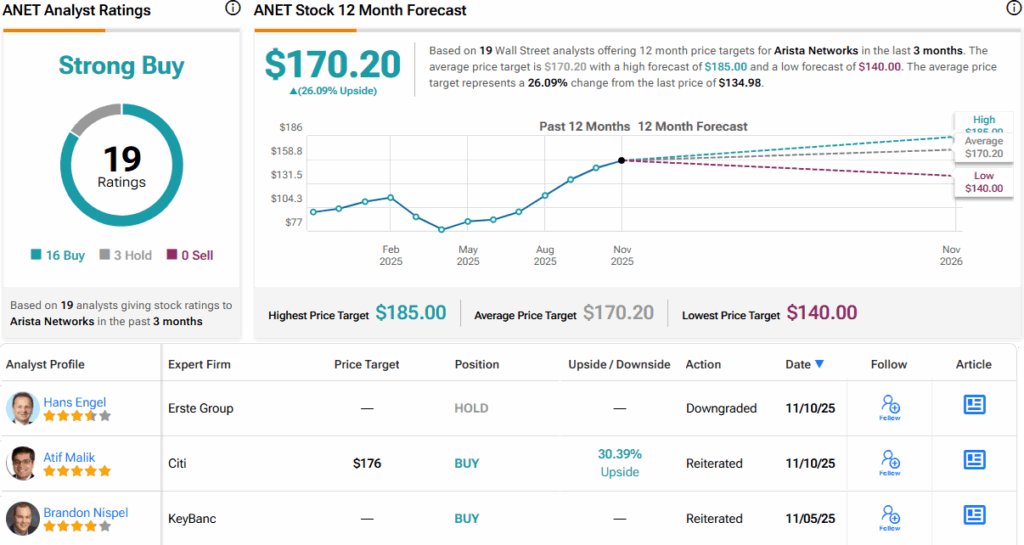

The Street’s analyst consensus agrees with Ng. Wall Street puts a Strong Buy rating on Arista’s shares, based on 16 Buys and 3 Holds. The stock is selling for $134.98, and its average price target, $170.2, is practically the same as Goldman’s objective. (See ANET stock forecast)

With facts laid out on Palantir and Arista Networks, the Goldman call is clear: Arista is the superior AI stock to buy right now, with stronger upside and less risk of overvaluation.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.