Palantir Technologies (PLTR) has recorded tremendous gains lately, with its Q3 results fueling yet another surge in its share price. Investors have plenty of reason to cheer, as Palantir delivered excellent numbers across the board in Q3. Specifically, Palantir demonstrated notable progress in both its government and commercial segments while achieving an unreal Rule of 40 score. Yet, the stock’s valuation now seems to have reached highs that defy conventional understanding. As I will explain, despite Palantir’s promising potential, today’s valuation has already priced in several years of stellar growth. Hence, I am neutral on the stock.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Government Segment Performance Was Exceptional

To understand just how extraordinary Palantir’s Q3 results were, it’s worth taking a closer look at both of its segments, starting with Government. In particular, Palantir’s Government revenues grew by 33% year-over-year to $408 million. The U.S. government division led the charge, achieving a remarkable 40% year-over-year increase and 15% quarter-over-quarter growth. These rates marked a substantial acceleration from the previous quarter’s 24% year-over-year and quarter-over-quarter growth.

Palantir’s stellar growth in this segment can largely be attributed to the Department of Defense’s growing reliance on Palantir’s AI capabilities, highlighted by a recent five-year contract valued up to $100 million to boost Maven Smart System AI/ML capabilities across all branches of the U.S. military. Notably, the U.S. government segment is benefiting from the growing significance of AI in defense tactics. Take Palantir’s collaboration with the 18th Airborne, for example, which now utilizes AI to perform tasks that previously required thousands of personnel.

Palantir’s Growth Shows No Signs of Slowing

The commercial segment also showed remarkable growth, rising 54% year-over-year and 13% quarter-over-quarter to $179 million. This boosted Palantir’s total commercial revenues to $317 million, up 27% year-over-year. Notably, the growth posted in U.S. Commercial almost mirrors last quarter’s increase of 55%, which shows no signs of a slowdown.

Examining management’s comments, I see that the driving force standing out in this segment is Palantir’s focus on integrating its Artificial Intelligence Platform (AIP) into commercial applications. In the earnings call, Palantir’s Chief Technology Officer Shyam Sankar highlighted a strong example of Palantir’s AIP in action, citing a leading insurance firm. He mentioned that by deploying AIP, this insurance company was able to automate key underwriting workflows, reducing the response time from over two weeks to just three hours. I think this makes for a strong example of how AIP can rapidly generate value for commercial clients, indicating that it will remain a significant driver of Palantir’s growth in the future.

Palantir’s Rule of 40 Score: A Perfect Quarter?

Now that we’ve seen Palantir’s growth across both its Government and Commercial segments, let’s take a look at its Rule of 40, which was probably the most impressive metric in its Q3 results. Notably, Palantir’s performance in Q3 earned it a Rule of 40 score of 68%. In case you are unfamiliar with this concept, the Rule of 40 is a metric that sums a company’s revenue growth rate (in this case, 30%) with its operating margin (in this case, 38% on an adjusted basis). A combined figure above 40% is generally considered excellent. This explains why Q3 looks like the “perfect” quarter in many analysts’ and investors’ eyes.

Palantir’s Valuation Reaches Astronomical Levels

Now, despite its exceptional Q3 results, as evident in Palantir’s Rule of 40 score, the stock’s valuation has climbed to dizzying levels. Palantir stock is now trading at 49 times this year’s expected revenues and 159 times this year’s expected earnings per share (EPS). Such rich multiples demand substantial growth rates to justify the price, which could be challenging to sustain even with Palantir’s unique positioning in the market.

Let’s put this in perspective with a quick bit of math. Well… even if Palantir were to trade at a more reasonable 10 times sales in ten years, and if investors aim for a 10% compound annual growth rate (CAGR) from current price levels, Palantir would need to grow its revenues at a CAGR of 30% over this period. Even if such a staggering growth rate can be sustained, a 10% per annum return is relatively modest given the risk involved—returns that I would argue might be achieved by investing in broader indices with far lower risk. Therefore, while I can’t deny that Palantir’s growth narrative is remarkable, the stock’s valuation presents a challenge for any new investor pondering entering the stock at these levels.

Is PLTR Stock a Buy, According to Analysts?

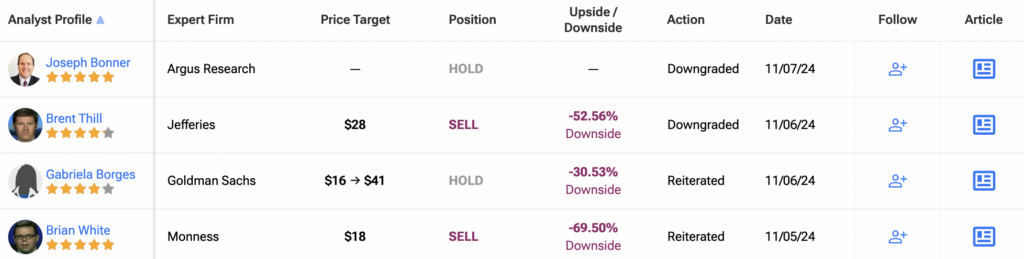

Following Palantir’s significant surge in share price, Wall Street now appears more cautious on the stock’s outlook. Palantir currently holds a consensus rating of “Hold,” with recent analyst ratings consisting of three Buys, seven Holds, and six Sells over the past three months. At $33.73, the average PLTR stock price target implies a 42.82% downside potential, which sends alarming signals about Palantir’s valuation.

For the best guidance on buying and selling PLTR stock, look to Mariana Perez Mora. Over the past year, she’s achieved both the highest accuracy and profitability among analysts, with an outstanding 123.96% average return per rating and a perfect 100% success rate. Click the image below to learn more.

Final Thoughts

To sum up, Palantir’s Q3 performance was undeniably impressive, with stellar growth in both Government and Commercial segments. Nevertheless, the current valuation seems to have already priced in several years of exceptional growth, making further upside challenging. Certainly, Palantir’s overall prospects are highly compelling, especially considering the snowballing adoption of AI among government agencies and enterprises. Still, the stock risk-reward balance appears less favorable at present levels. Consequently, although I still maintain a small position in Palantir, my outlook on the stock has shifted to neutral.