Palantir (NYSE:PLTR) has emerged as a prominent force in the data analytics and software space. The company is changing the way complex, large-scale data is used to make informed decisions in a variety of industries. Investors flocked to this AI (artificial intelligence) stock this year, as it has gained a massive 185.9% YTD. Meanwhile, analysts have mixed opinions about Palantir because of its lofty valuation. I agree that the stock is overpriced, but its outstanding scope in data analytics and AI still makes me bullish.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Impressive Growth Trajectory

Palantir’s growth story has been nothing short of remarkable. Its commitment to AI-driven data analysis continues to expand into various industries and sectors. Its AI platforms use machine learning and data analysis to process massive amounts of data and assist in decision-making.

Through its Gotham and Foundry platforms, the company serves both government and commercial enterprises. This factor has contributed to the company’s revenue increasing from $595.4 million in 2018 to $2.13 billion for the trailing 12 months.

In its third quarter, total revenue increased 17% year-over-year to $558 million, driven by the firm’s strategic investments and adoption of AI platforms across various industries.

Q3 also marked Palantir’s fourth quarter of profitability, which has made the company eligible for inclusion in the S&P 500 (SPX). Palantir reported a net income of $72 million under GAAP (generally accepted accounting principles), or $0.03 per share, compared to a net loss of $123.9 million, or $0.06 per share, in the year-ago quarter. Both revenue and earnings surpassed consensus estimates.

Notably, Palantir generated around 55% of its total revenue from government clients in Q3. Having government customers protects the firm’s revenue during uncertain times, and this revenue increased by 12% year-over-year to $308 million. Meanwhile, the company’s Commercial revenue jumped by 23% to $251 million in Q3.

Untapped AI Potential

Palantir’s Artificial Intelligence Platform (AIP), launched in April, remains a major catalyst for the company’s long-term growth. During the Q3 earnings call, chief business affairs and legal officer Ryan Taylor stated that AIP is receiving positive traction from both its existing and new customers.

AIP has boosted productivity for many of its partners in various industries, such as Tampa General, HCA Healthcare (NYSE:HCA), and Aramark Holdings (NYSE:ARMK). According to the company, around 300 organizations used AIP in the last five months.

Moreover, in October, the U.S. Department of Defense awarded a three-year contract worth $250 million to Palantir to continue testing, deploying, and scaling its AI and machine learning capabilities for the U.S. Army.

Furthermore, Palantir has also formed strategic alliances with CAZ Investments and PwC to provide enhanced data analytics and AI-powered solutions. Besides that, the firm collaborated with other government agencies for new contracts in the second quarter. All of these strategic deals may contribute to its revenue and profits, going forward.

PLTR’s Valuation is High, but the Future is Bright

Following another successful quarter, management increased revenue guidance for the full year, expecting revenue to be between $2.21 billion and $2.22 billion range. On top of that, the company looks forward to another quarter of GAAP profitability.

Palantir stressed that it would report GAAP net income in each quarter of 2023, which is likely what has caused its stock to soar this year. Meanwhile, for the full year 2023, analysts predict revenue of $2.22 billion, in line with the company’s forecast, and EPS of $0.25.

For 2024, Palantir is expected to report revenue growth of 19.6% to $2.65 billion and earnings growth of 19% to $0.29 per share. The stock trades at 63 times forward earnings and 15 times forward sales based on these estimates, and many analysts find this valuation to be quite steep.

However, I believe the company has yet to fully realize the potential of its AIP platform, which could boost revenue in the near future. Management also emphasized in the Q3 earnings call that the “potential market for AIP and the trajectory of possible AIP growth for [its] business is massive.”

Is Palantir a Buy, According to Analysts?

Following Palantir’s Q3 results, on November 3, Goldman Sachs analyst Gabriela Borges increased her price target for the stock to $12 from $11 with a Hold rating. Despite being impressed with its expanding U.S. commercial business and focus on AIP bootcamps, the analyst believes there are stocks with a more favorable risk-to-reward profile.

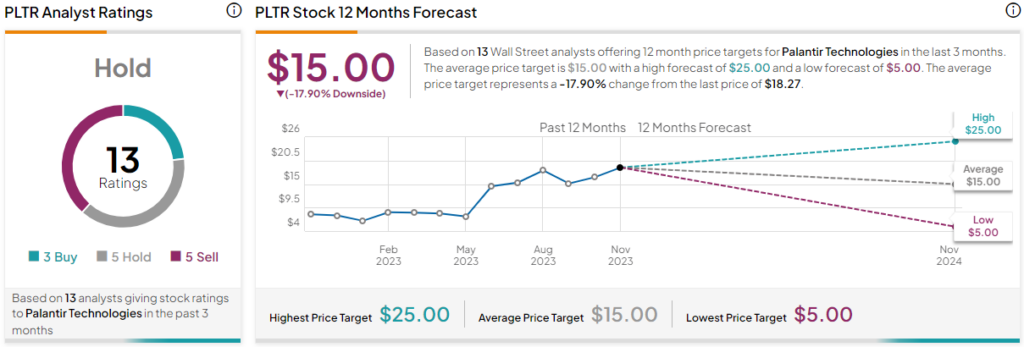

Overall, Wall Street has a Hold rating on Palantir based on three Buys, five Holds, and one Sell rating assigned in the past three months. The average PLTR stock price target of $15.00 implies 19% downside potential over the next 12 months.

The Bottom Line on Palantir

Palantir stands out in the rapidly evolving AI sector, which is a constantly developing niche with enormous potential, and the stock remains an intriguing AI pick for investors with a high risk tolerance. If the company can secure more strategic partnerships to justify its high valuation in the near term, then the stock might be able to achieve Wedbush analyst Daniel Ives’ high target price of $25 (which implies 36.8% upside potential from current levels).

Therefore, I maintain my bullish stance on this tech stock, owing to the outstanding scope of its AI platforms in the long term.