The economy appears to be chugging along, making slow and steady gains. Unemployment remains low, at 3.9%; the rate of inflation, at 3.2% for last month, continues its deceleration. The key drag now is interest rates, which the Federal Reserve has indicated it will hold ‘higher for longer.’ This overall picture is cautiously positive, for investors seeking forward gains, and the markets have responded. The S&P 500 is up 9.5% from the bottom it hit on October 27.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

So the main question for investors right now seems to be, ‘Where to invest?’ A recent note from Oppenheimer would suggest the insurance industry.

“Insurance will always be essential for both businesses and individuals,” according to market legend Warren Buffett, and he makes a good point. Insurance policies protect our money, and insurance companies, offering essential products and able to generate their own investment profits from the industry’s float, have plenty of benefits to attract customers and investors.

Oppenheimer’s Michael Phillips sums up the benefits of this segment, saying, “While often viewed as a sleepy, conservative industry, the P&C insurance sector has seen performance on-par with the S&P 500 over the last 20 years. When coupled with a low beta, the return profile of the sector makes a compelling risk/reward proposition for investors looking for financial sector stocks. P&C historical returns benefited from strong relative performance in 2022, but we believe the right P&C insurers can be long-term value compounders and a piece of a diversified portfolio.”

So let’s follow this lead, and look at two of Phillips’ insurance picks using data drawn from the TipRanks platform.

Don’t miss

- There’s an Opportunity Brewing in Auto-Tech Enablers, Says Goldman Sachs – Here Are Two Stocks the Banking Giant Likes

- ‘Time to Hit Buy,’ Says Bank of America About These 2 Stocks

- Oppenheimer Expects the S&P 500’s Advance to Continue Into 2024 — Here’s Why These 2 Stocks Might Be Worth Buying

HCI Group (HCI)

We’ll start with a small-cap holding company, HCI Group. This Florida-based company offers a wide range of insurance products through its subsidiaries, mainly directed at individual clients. The company’s policy offerings include various home policies, such as fire and condo owners insurance; flood insurance and wind-only insurance, and basic homeowners policies. Included as well are claims settlement services, insurance advisories, and real estate services. HCI Group does not offer life insurance policies, and serves a clientele located in Florida. The company’s largest subsidiary, the Homeowners Choice Property & Casualty Insurance Company, is a leader in Florida’s P&C insurance sector.

HCI Group brought in nearly $500 million in revenue last year, and the company’s stock price has gained more than 100% so far this year. The most recent bump to the stock came on Nov 7-8, right after the 3Q23 results were released; the company beat the forecasts across the board, and the shares jumped over 20%.

So let’s look at the company’s 3Q23 report. HCI had a top line of $131.6 million, up 4% year-over-year and some $7.4 million better than had been anticipated. The company’s bottom line, the non-GAAP earnings per share, was listed as $1.41 and was a full $1.10 over the forecast. These results were derived from the $188.3 million in gross premiums received in the quarter, compared to the $181.7 million from the year-ago period.

Covering this stock for Oppenheimer, analyst Phillips sees the combination of established core business and newer expanded operations as a key support, and writes, “Our Outperform rating is supported by our view that the company’s various operations, particularly the Citizens depopulation impact, TypTap, and Greenleaf, are all not properly valued in the current stock price. Additionally, we found numerous favorable trends in the core Homeowner’s Choice business that support our view of an underappreciated operational outlook for the company.”

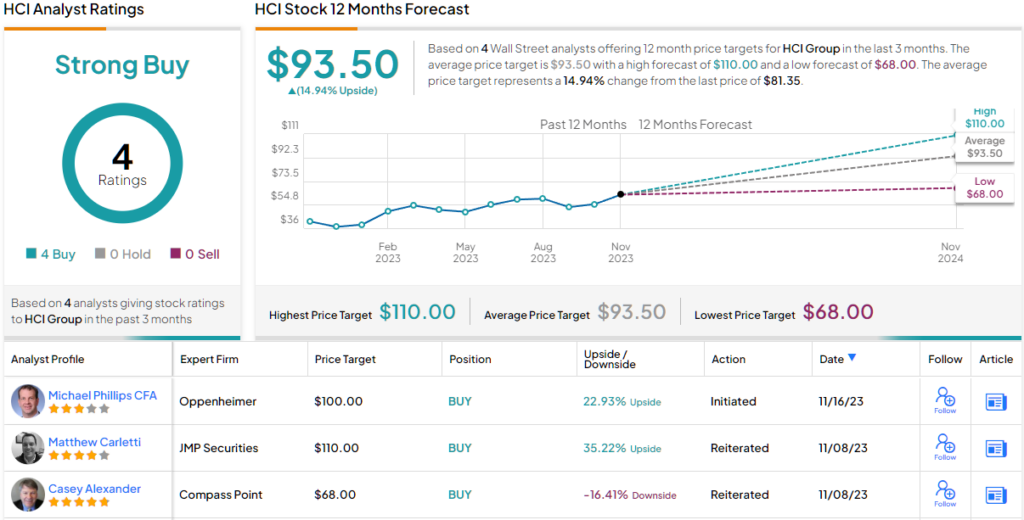

Phillips’ Outperform (i.e. Buy) rating comes with a $100 price target, which points toward a 23% one-year upside potential. (To watch Phillips’ track record, click here)

Overall, HCI’s 4 recent positive analyst reviews give it a unanimous Strong Buy consensus rating. The shares are priced at $81.35 and the $93.50 average price target suggests ~15% gain lying in wait for the coming year. (See HCI stock forecast)

Selective Insurance Group (SIGI)

Next up on our list is Selective Insurance Group, a super-regional P&C insurance company. The ‘super regionals’ are larger firms that write multiple lines of insurance policies across multiple state jurisdictions. Selective Insurance Group, with its $6-plus market cap and its operations in 30 states, fits that bill. The company operates through its subsidiaries, which are focused on providing customer-first P&C policies through independent agents to businesses, individuals, and public entities.

Selective’s size and scale allow the company to offer a wide range of policies, tailored to the customer’s needs. Policy offerings for businesses cater to manufacturers, small- and medium-sized businesses, private schools, and auto repair shops, among many others. Individual purchasers can choose from auto insurance, home/condo insurance, renters’ policies, and ‘umbrella’ policies to provide additional coverage. The company also offers comprehensive flood insurance policies.

The headline figure for Selective in its last earnings report, from 3Q23, was the ‘net premiums written,’ a measure of the overall business. This was up 17% year-over-year, to $1.06 billion. The company’s ROE, or return on common equity, came in at 14.1%. Total revenue for the quarter was $1.08 billion, up 21% y/y and in-line with the forecast. The bottom line EPS number, $1.51 per diluted share, was up 53% year-over-year – but it missed the forecast by 9 cents per share.

The Oppenheimer view here is somewhat contrarian – and decidedly bullish, taking a long-term view of the company and its prospects. Phillips writes of SIGI: “Our Outperform rating is based on Selective’s management team’s putting the company on a strong path toward durable margins and ROEs and an extensive runway for organic growth with a balance sheet that has a low cost of capital secured decades out… Selective stands out as a non-consensus call, as we are the only non-hold/Perform-rated team on the Street, as far as we know.”

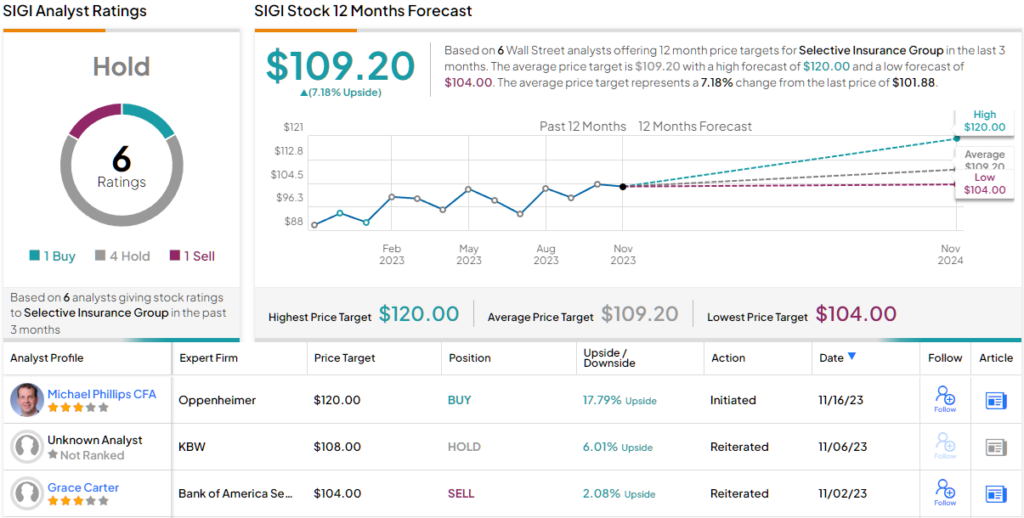

That Outperform (i.e. Buy) rating is accompanied by a $120 price target, suggesting a potential gain of approximately 18% within the one-year timeframe.

As the Oppenheimer note pointed out, the consensus here is not as bullish; SIGI gets a Hold rating from the analyst consensus, based on 6 recent reviews that break to 1 Buy, 4 Holds, and 1 Sell. The shares have a trading price of $101.88 and an average target price of $109.20, suggesting a 7% upside potential for the next 12 months. (See SIGI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.