Starbucks (NASDAQ:SBUX) has created massive wealth for long-term shareholders ever since the company went public in 1992. In the last 31 years, SBUX stock has returned a whopping 36,850% to shareholders after adjusting for dividends, easily crushing the S&P 500 (SPX), which has returned around 2,000% in dividend-adjusted gains.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Currently valued at $110 billion by market cap, Starbucks is a slow-moving giant. While it might still deliver outsized gains to shareholders, there are several other growth stocks operating in the coffee space, such as Dutch Bros (NYSE:BROS), which should outpace Starbucks from here.

I am bullish on Dutch Bros stock due to its compelling valuation, ability to enter new markets, and improving bottom line.

An Overview of Dutch Bros

Valued at $5 billion, Dutch Bros owns, operates, and franchises drive-thru shops that focus on serving quality hand-crafted beverages. Founded in 1992 by two brothers, the company first began with a single expresso machine and a pushcart in Oregon. It has since expanded its product portfolio to include other customizable beverages catering to a broad array of customers.

Dutch Bros ended Q3 with 794 locations in 16 U.S. states and recorded sales of $847.6 million in the last 12 months.

How Did Dutch Bros Perform in Q3 2023?

Dutch Bros is among the fastest-growing brands in the quick-service restaurants segment in the U.S. It opened 39 new stores in Q3 across 11 states, of which 37 stores were company-operated. It emphasized that all of the new stores continued to be led by regional operators.

A 23.9% increase in its store count allowed Dutch Bros to increase revenue by 33.2% year-over-year to $264.5 million. Further, same-store sales were up 4%, while company-operated store sales were up 36.3% at $236.5 million.

An expanding revenue base allowed Dutch Bros to increase its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) by 90.5% to $53 million, while adjusted net income rose to $22.4 million, up from $14.3 million in the year-ago period.

Dutch Bros’ growth in 2023 is quite impressive, given a sluggish macroeconomic backdrop and tepid consumer spending patterns. Comparatively, Starbucks increased revenue by 11% year-over-year in its most recent quarter, while earnings were up 31% at $1.06 per share.

Due to the massive brand image of Starbucks, it managed to increase same-store sales by 8% year-over-year on the back of higher footfalls.

The Bull Case for Dutch Bros Stock

Dutch Bros is expanding aggressively and expects to end 2023 with 150 new store locations. It eventually aims to open around 4,000 stores, indicating that the runway for long-term growth is massive, given that Starbucks operates around 18,000 stores in the U.S.

Driven by its expansion efforts, Dutch Bros estimates sales in 2023 to range between $950 million and $1 billion, up from $739 million in 2022. The company will invest between $225 million and $250 million in capital expenditures and has allocated about $20 million to a new roasting facility scheduled to open next year.

It’s evident that Dutch Bros will have to shore up its balance sheet to fund its growth plans, as it has allocated 25% of sales toward capital expenditures in 2023. In the September quarter, it raised equity capital and increased the limit on its credit facility. Additionally, Dutch Bros improved its gross margin by 400 basis points to 24%, showcasing its pricing power while reducing operating expenses.

These stellar metrics have allowed Dutch Bros to more than double its operating cash flow to $94.9 million in the first nine months of 2023 compared to $42.76 million in the year-ago period. Its cash balance also rose to $149.8 million at the end of Q3, from just $34.56 million in the prior-year quarter, providing Dutch Bros with the liquidity to fuel its growth.

Despite single-digit growth at its existing locations, Dutch Bros reaffirmed its guidance for 2023, driving investor optimism higher.

Is BROS Stock a Buy, According to Analysts?

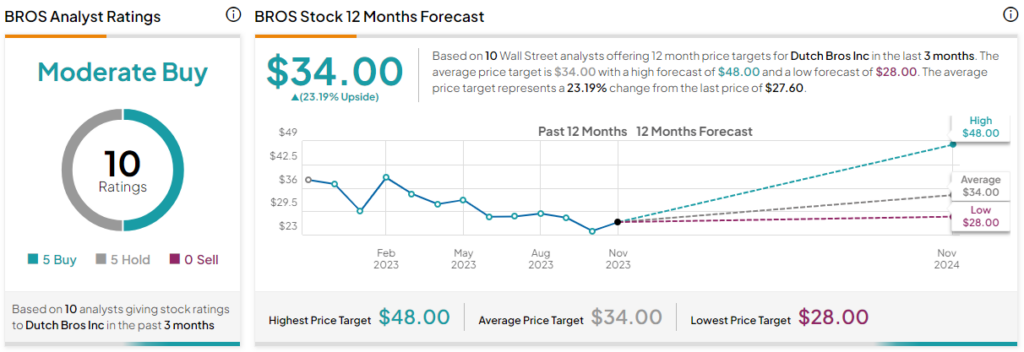

Out of the 10 analysts covering BROS stock, five recommend a Buy, five recommend a Hold, and none recommend a Sell. The average BROS stock price target is $34, which is 23.2% above the current price.

Dutch Bros is forecast to report revenue of $1.63 billion in 2024, while adjusted earnings should grow to $0.36 per share, according to analysts. Therefore, BROS stock is priced at three times forward sales and 76x forward earnings, which is quite steep. However, growth stocks command a premium valuation, and analysts expect Dutch Bros to expand earnings by over 47% annually in the next five years.

Comparatively, Starbucks stock is valued at 23.5x forward earnings, but its earnings are forecast to grow by “just” 17% annually in the next five years.

The Takeaway

Dutch Bros has the ability to deliver game-changing returns to long-term shareholders if it can grow its store count at a sustainable pace. The company will have to generate operating cash flows much higher than its annual capital expenditures to avoid raising equity or debt capital.

Currently, Dutch Bros is ticking most boxes for growth investors in terms of robust sales growth and improving profitability, making it a top investment choice right now.