I stand out from the crowd with a bearish assessment of software provider Okta, Inc. (OKTA) at this time. In my opinion, retail value investors should ignore the Moderate Buy consensus rating of Wall Street analysts.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

On Its Way

Okta, Inc. is a rising star in IAM, the identity and access management platform business. The company targets small and medium-sized businesses, NGOs, and governments worldwide.

OKTA software manages and secures identities, enables users to access their applications in the cloud or on-premise with a single entry of their user credentials. It also provides support and training. It mostly sells directly to customers. Okta, Inc., formerly Saasure, Inc., was incorporated in 2009.

In the early years, the stock lingered in the high $20s. It moved up into the $60s in 2019 and has skyrocketed 872% over the past five years. Shares were $294 at their 52-week high. OKTA was attracting investor and hedge fund attention in the IAM space. Following six M&As, the stock meandered. Shares are down this past year by about 17%.

Downsides for Retail Investors

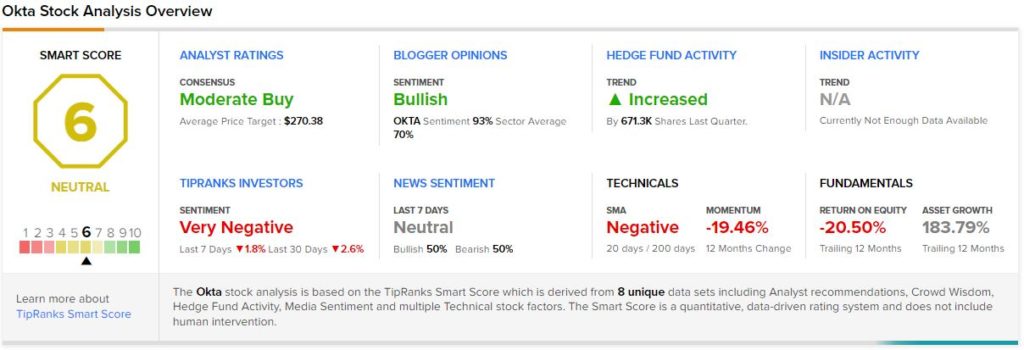

The company does not pay a dividend. Technicals and fundamentals are both in negative territory, and its return on equity is -20.5%. TipRanks’ investors are very negative on the company. News coverage, sentiment, and the buzz are slipping. Bearish-toned articles are appearing more often.

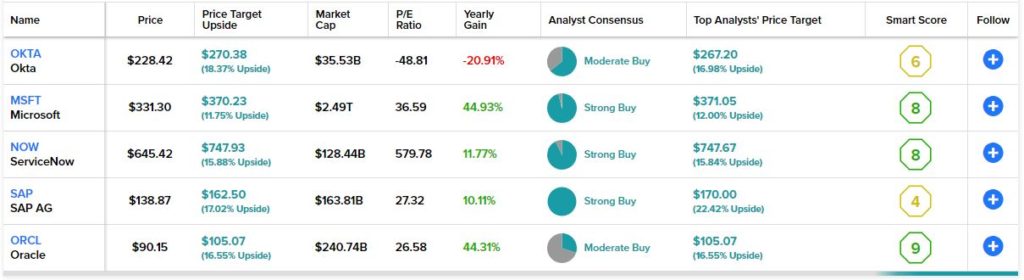

Investors can find competitors paying dividends with less risky short interest numbers. For instance, Microsoft (MSFT), SAP AG (SAP), and fledgling PubMatic (PUBM) are IAMs worth considering. (See similar IAM stocks)

OKTA shares are volatile. The stock’s beta is 1.62, higher than the market volatility. Around December 1, 2021, shares tumbled 8% to $181.95 after Q3 earnings missed estimates.

By December 8, shares were over $240. On December 20, the market dropped 673 points, and OKTA fell below $211, climbed to $222, and closed down at $218.91. Investors need a high-risk tolerance passion for this rollercoaster ride.

OKTA repeatedly loses money, except for some recent quarters. Near future earnings do not look more hopeful. The OKTA stock earnings chart tells the story. The consensus EPS forecast is -$0.24 in Q4 ’22 compared to last year’s EPS of $0.06.

There is also substantial insider selling year after year that raises my hackles. Insiders are selling much more than they are buying.

Luscious Liquidity

OKTA has a debt of about $2.02 billion and has no earnings. Its short-term liabilities stand at $988 million, cash and short-term investments are $2.48 billion, and equity is about $6 billion.

OKTA made six acquisitions in the past few years. The investment industry welcomed the recent additions. In part, they contributed to the 61.2% year-over-year revenue growth.

They bought cloud identity startup Auth0 for $6.5 billion. OKTA will help Auht0 build its identity management operations and sales. Buying Auth0 solidifies relations with some of the same customers and generates another $200 million in revenue for OKTA. The premium price OKTA paid did not thrill investors and OKTA shares fell almost 7% on the buyout announcement.

While free cash flow has been growing quickly, Okta’s FCF margin is still a relatively fragile 10% for the cybersecurity market.

There are two other positives for Okta. First, hedge funds are more bullish again. Managers began increasing their holdings in September 2021. A record 62 funds invested in OKTA going into the fourth quarter. The two largest fund holdings invested $424 million and $221 million.

Second, the identity and access management market was forecast to grow at a CAGR of 13.2% from 2018-2026. That implies the industry will be larger than $24 billion in the next four-to-five years. The work-from-home phenomenon is going to continue growing.

Fortune predicts businesses and governments will turn more to IAM providers, like OKTA, to enhance employee productivity, build better security and access, and ferret out policy violations.

OKTA is a low-risk company in a thriving industry. It stands far from any vortex of failure with its ~$35.5 billion market cap. The neutral Smart Score rating and downsides spark a sense of discontent and unease I have for retail value investors buying OKTA.

On the positive side, OKTA appears to be a viable growth company in a burgeoning industry. The company has solid managers and the resources to make more acquisitions. Okta underpins the opportunities to build a major presence in its marketplace and become consistently profitable. Perhaps it may even become a takeover target in an industry fraught with M&A activity.

Wall Street’s Take

Turning to Wall Street, OKTA earns a Moderate Buy consensus rating based on nine buys and five holds assigned in the past three months.

The average Okta price target is $270.38, an implied upside of 18.3% over the next 12 months. Analyst targets range from a high of $320 to a low of $230 per share.

Disclosure: At the time of publication, Harold Goldmeier did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >