Occidental Petroleum (NYSE:OXY) is an energy stock in Warren Buffett’s Berkshire Hathaway (NYSE:BRK.B) portfolio. Berkshire owns 248 million shares of OXY, indicating a 28% stake in the company, which is quite sizeable. I believe this Warren Buffett stock is a good buy in May 2024. I am bullish on OXY stock due to its acquisition of CrownRock, expanding chemicals business, and massive potential for low-carbon products.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Berkshire has increased its stake in Occidental Petroleum since 2020, and it is now worth roughly $16 billion. The company accounts for 4.4% of Berkshire’s equity portfolio and is one of its largest portfolio companies in 2024.

Warren Buffett is arguably the greatest stock market investor the world has ever seen. Also called the Oracle of Omaha, Buffett has a proven history of identifying quality undervalued stocks, allowing him to comfortably beat the broader markets over time. Due to his excellent track record, Wall Street closely follows Buffett’s investments.

An Overview of Occidental Petroleum

Occidental Petroleum is engaged in the exploration and production of oil and natural gas. It has three primary business segments that include the following:

- Oil and Gas: It explores, develops, and produces oil and condensate, natural gas liquids, and natural gas.

- Chemical: The segment manufactures and markets basic chemicals and vinyls.

- Midstream and Marketing: It gathers, processes, transports, and stores oil, condensate, natural gas liquids, natural gas, and power.

How Did Occidental Petroleum Stock Perform in Q1 of 2024?

In Q1, Occidental Petroleum generated adjusted earnings of $0.63 per share, higher than estimates of $0.58 per share. It reported revenue of $6.2 billion, a decline of 12.7% year-over-year. Occidental Petroleum ended Q1 with $1.3 billion of unrestricted cash and delivered a free cash flow of $700 million.

It expects total production to increase between 1.23 million to 1.27 million BoE (barrels of oil equivalent) per day in Q2, above the 1.17 million BoE per day in the March quarter. The midpoint of its production guidance for Q2 will be its highest quarterly production since 2021.

Investors should note that oil and gas stocks are cyclical, and their earnings are tied to energy prices, which can be very volatile. It suggests that earnings for energy stocks will move significantly higher when oil prices are elevated. Several energy companies, including Occidental Petroleum, reported record earnings in 2022 due to higher prices.

Alternatively, Occidental Petroleum (and its peers) should be positioned to generate enough cash flow to sustain its operations, reinvest in capital projects, and maintain its dividend yield, even when commodity prices move lower.

While Occidental Petroleum saw an erosion in its bottom line, it surpassed earnings estimates in Q1 and reported positive free cash flow amid an uncertain macro environment.

OXY’s Big-Ticket Acquisition

In December 2023, Occidental Petroleum disclosed plans to acquire CrownRock for $12 billion via a combination of cash and stock. This purchase should further bolster Occidental’s presence in the Permian Basin.

Occidental Petroleum expects the acquisition to add $1 billion to its free cash flow, assuming oil prices average $70 per barrel. Today, crude oil prices are hovering around $80, indicating that free cash flow should be over $1.1 billion, significantly moving the needle for Occidental Petroleum.

The expansion in free cash flow would help OXY repay its debt and enhance shareholder returns in 2024 and beyond. Investors should note that Occidental Petroleum is issuing over $9 billion in debt to fund the acquisition while taking over CrownRock’s existing debt of $1.2 billion.

OxyChem Is a Key Driver

As noted above, Occidental Petroleum has a chemical business, which allows it to offset a portion of earnings volatility associated with daily swings in oil prices. The OxyChem business has started to generate stable cash flows for the company, as Occidental Petroleum continues to expand the capacity for this segment.

In its investor presentation, Occidental Petroleum stated that it is modernizing and expanding its facility in Texas and allocated capital to enhance multiple plants on the Gulf Coast. These enhancements should be completed in the next 24 months and should increase earnings between $300 million and $400 million each year.

A Low-Carbon Platform

Additionally, Occidental Petroleum is building a low-carbon energy solutions platform. It has allocated $600 million in 2024 to build a direct air capture (DAC) plant in Texas, which is on track to begin operations in mid-2025. The DAC plant will capture 500,000 tons of carbon emissions each year, which can be commercialized.

Occidental Petroleum plowed in more than $1 billion to acquire Carbon Engineering in 2023, the company behind the DAC technology. The carbon capture business may help bring in significant revenue and earnings in the coming decades. In fact, Occidental expects earnings from the carbon capture business to be similar to its oil and gas business over time.

Is Debt a Concern?

Occidental Petroleum ended Q1 with long-term debt of $19 billion. This number might rise to $29 billion once the CrownRock acquisition is closed. However, the company announced a divesture program, aiming to sell assets worth between $4.5 billion and $6 billion. The proceeds of the divesture will be used to deleverage its balance sheet, as Occidental Petroleum aims to maintain principal debt levels of $15 billion.

In Q1 of 2024, Occidental Petroleum’s interest expense totaled $284 million, which suggests its debt is easily serviceable given the company’s free cash flow of $700 million. Moreover, OXY’s long-term debt-to-EBITDA ratio is 1.4x, which is not too high.

What Is the Target Price for OXY Stock?

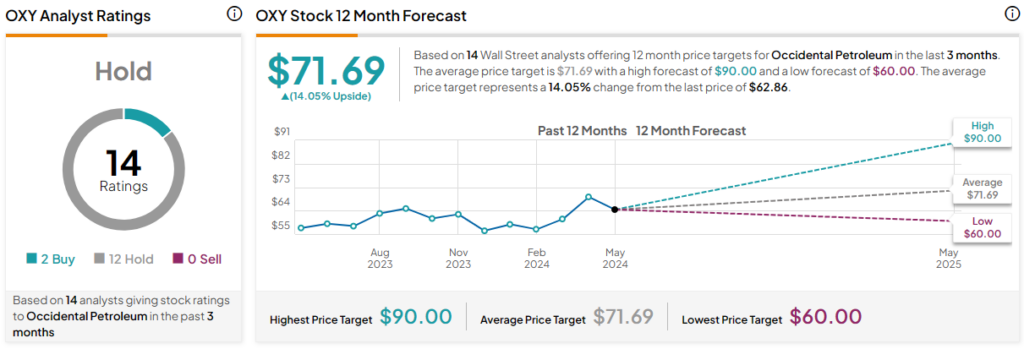

Out of the 18 analyst ratings given to OXY stock, two are Buys, 12 are Holds, and none are Sells, indicating a Moderate Buy consensus rating. The average OXY stock price target is $71.69, indicating upside potential of 14.1% from current levels.

The Takeaway

Occidental Petroleum’s earnings and cash flow took a hit in Q1 due to lower oil and gas prices. Alternatively, there are multiple catalysts for Occidental Petroleum that should help it deliver outsized gains to shareholders. I believe the potential upside from non-oil businesses makes OXY stock a top investment choice for those looking to gain exposure to the energy sector.