Nvidia (NVDA), the leading AI chipmaker in the world, has seen its market value surge 2,742% in the last five years. On the back of these stellar gains, Wall Street analysts are divided on the prospects for Nvidia stock today. While some analysts argue that Nvidia’s valuation is expensive, others make the case that the company still has a long runway to grow, which justifies its premium valuation. I am neutral on the outlook for Nvidia stock, as I believe the current valuation reflects the economic reality facing the company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analyst Optimism on Innovation and Market Dominance

Nvidia still has the backing of analysts who believe in its innovation and market competitiveness. For example, Morgan Stanley (MS) recently upgraded its rating on Nvidia and set a price target of $144, citing their confidence in the company’s ability to stay at the top of the AI chip industry.

Blackwell chips, which are faster and more versatile compared to existing AI chips, are expected to attract strong demand from big tech companies, such as Amazon (AMZN) and Microsoft (MSFT), as these companies accelerate their AI investments.

Each Blackwell chip is expected to be priced between $35,000 and $50,000, contributing positively to Nvidia’s profit margins, given that H100 and H200 chips – Nvidia’s best-selling products today – are priced between $25,000 to $40,000.

Edward Jones analysts also pointed out recently that Nvidia’s massive share in the AI chip market and its comfortable lead in the GPU market highlight the company’s competitive advantages.

Nvidia has successfully transitioned from a gaming-oriented chip developer to one focused on data centers. This new focus has allowed the company to expand its horizons and cater to the growing demand for data center GPUs. The CUDA platform – an AI development standard across various domains that allows developers to optimize processor performance while easily creating robust AI applications – has also been a growth driver in recent times and is expected to contribute positively to Nvidia’s growth in the future.

According to many Wall Street analysts, Nvidia’s ability to continue to attract and retain engineering talent is also a key differentiator, as it positions the company to be at the forefront of innovation.

Concerns About Growth, Sustainability, and Valuation

Though analysts are generally positive about Nvidia stock, some are questioning the sustainability of earnings growth as well as current valuation levels. For instance, New Street Research recently downgraded Nvidia due to its extended valuation. New Street analyst Pierre Ferragu believes there will be limited upside from here unless Nvidia boosts the outlook beyond 2025 meaningfully, which is not likely to happen anytime soon.

Nvidia is currently valued at a forward P/E of 47x, which does not scream overvaluation, but this may change if growth decelerates in the foreseeable future.

DA Davidson analyst Gil Luria is bearish on Nvidia, as he believes the demand for Nvidia’s GPUs will decline in the next 18 months as tech giants such as Amazon and Meta Platforms (META) are likely to develop their own chips. Barclays (BCS) analyst Blayne Curtis also noted recently that Nvidia’s long-term outlook is not as rosy as it seems, given that some of its biggest customers are already looking for a solution to reduce their dependency on Nvidia chips.

Beyond Analyst Remarks

Nvidia is enjoying competitive advantages, evident from its industry-leading gross margin and leading market share. According to Mizuho Securities, Nvidia controls between 70% and 95% of the market for AI chips, which gives the company pricing power. In the most recent quarter, Nvidia’s gross margins came to 78% compared to just 41% for Intel (INTC) and 51% for Advanced Micro Devices (AMD).

These competitive advantages will help Nvidia report strong earnings growth in the next few quarters, but some risks are looming on the horizon. Last November, at the DealBook Summit, Nvidia CEO Jensen Huang admitted that he wakes up every morning in fear that the company will fail due to increasing competition.

AMD, with its Radeon Instinct GPUs, is trying to capture a share of the growing data center market, and the company’s acquisition of Xilinx in 2022 has helped it gain traction in the AI and machine learning field. Intel is also making inroads into the data center market with its Habana Gaudi AI processors, which are designed to compete with Nvidia’s data center GPUs.

The biggest threat to Nvidia’s AI dominance comes from big tech giants who are focused on reducing their reliance on Nvidia’s products.

Google, wanting to be self-sufficient when it comes to sourcing advanced AI chips, has developed an in-house AI chip series called Tensor Processing Units. These chips are already used in Google’s data centers. Amazon has also developed its own AI chips called Inferentia and Trainium, targeting AWS customers who use Nvidia GPUs for AI applications. In addition to these tech giants, Microsoft and Meta have also announced investments in their own AI chips.

What Is the Price Target for NVDA Stock?

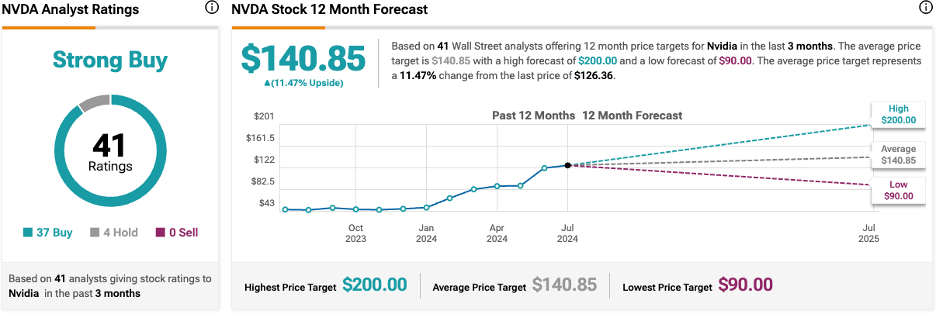

Based on the ratings of 41 Wall Street analysts, NVDA stock comes in as a Strong Buy, with 37 Buy ratings and four Holds. The average Nvidia stock price target is $140.85, which implies upside potential of 11.5% from the current market price.

The Takeaway: Nvidia Seems Reasonably Valued

Nvidia is enjoying competitive advantages, which justifies the premium valuation it trades at. However, competition in the AI chip market is expected to increase dramatically in the coming years, with rival chipmakers and big tech companies aggressively investing in AI chips to grab a share of this booming market. Because of this looming threat, Nvidia seems fairly valued today, with no margin of safety to attract new investors at the current stock price.