Mark your calendars: Nvidia’s (NVDA) third quarter earnings report is set to be released on November 20, and this could be the quarter with the highest expectations the company has ever faced. While I’m a long-term Nvidia bull, I believe that simply exceeding estimates won’t be enough to generate a more bullish market reaction. For that to happen, I think investors need to see an upward revision of the annual guidance, along with positive commentary on Blackwell technology, as potential catalysts for Nvidia in Q3.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

In this article, I’ll detail what investors can expect from Nvidia’s Q3 earnings and explain why I still consider Nvidia a Buy ahead of the earnings announcement.

Key Numbers to Watch for in Nvidia’s Q3

Much of my optimism about Nvidia’s upcoming quarter will hinge on whether the company delivers results in line with its guidance. For Q3 of fiscal year 2025, Nvidia has already forecast revenue of approximately $32.5 billion, with gross profit margins expected to be around 75%. These are impressive figures, especially given the size of Nvidia and the nature of its products. Gross margins of 75% are exceptional for a tech company of Nvidia’s scale, reflecting the high efficiency and premium positioning of its offerings.

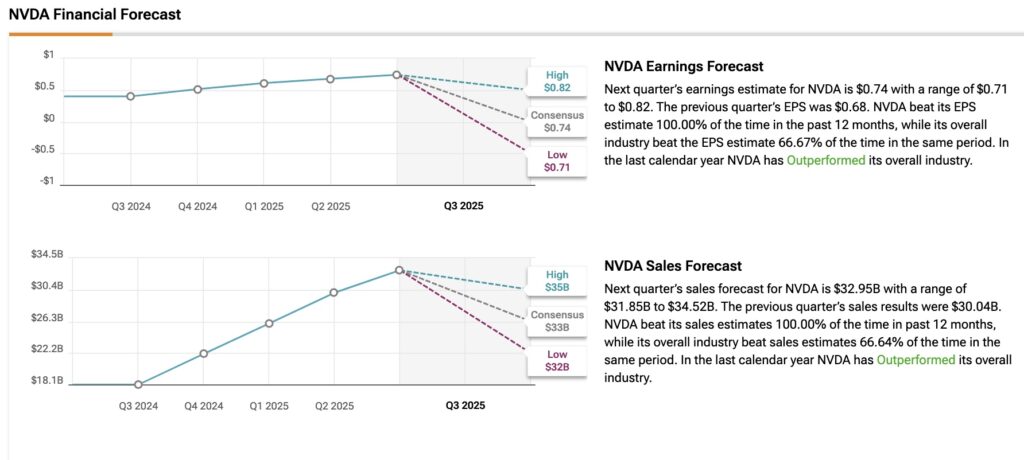

Overall, analysts have set an increasingly high bar for Nvidia, with the consensus expectations for Q3 calling for EPS of $0.74 and revenue of $32.94 billion. Over the past three months, 31 out of 37 analysts have revised their EPS estimates upward, while 34 out of 41 analysts have increased their revenue forecasts.

If Nvidia meets or exceeds these expectations, it would represent substantial year-over-year growth. Last year, the company reported in Q3 $18.1 billion in revenue and 74% gross margins. A doubling of revenue and a slight increase in margins of about 80 basis points would be would be a huge win, proving the company’s undisputed position in the market.

Blackwell Technology Could Drive Nvidia’s Next Big Leap

One major factor that could significantly boost Nvidia’s outlook following its Q3 results is Blackwell technology, which is central to the company’s future growth. Investors are closely monitoring the progress of Blackwell’s manufacturing ramp-up, particularly given the exceptionally strong demand for its chips. This raises an important question: Is Nvidia on track with production, or has the demand been so overwhelming that the company has had to increase output to meet orders?

If Nvidia’s management were to announce that they successfully ramped up production in response to heightened demand, it would likely be seen as a positive surprise for investors. For instance, if Nvidia revealed that, despite initial projections for 2025 being sold out, it managed to negotiate with suppliers to secure increased supply, it would demonstrate the company’s ability to effectively manage its supply chain while responding to rising demand.

Such an announcement would likely be viewed as a bullish signal for Nvidia’s stock, particularly if the company could meet or exceed Blackwell’s demand without sacrificing product quality or delivery timelines.

Palantir’s Earnings as a Proxy for Nvidia’s Earnings Reaction

While I’m bullish on Nvidia heading into its earnings report, it’s important to acknowledge that the bar is exceptionally high this time around—probably higher than ever before. Because of this, I believe Nvidia can easily deliver a strong beat across the board, but for the market to react positively, the company may also need to provide an upward guidance update to maintain momentum.

A similar scenario played out recently with Palantir (PLTR), one of the standout AI companies. Despite having a very high bar set for its Q3 earnings—along with a stretched valuation due to a massive triple-digit increase in its stock price over the year—Palantir saw significant gains post-earnings. The company’s narrative—that it is uniquely positioned to capitalize on the booming demand for AI software (just as Nvidia is with hardware)—led to an upward revision of its guidance, which in turn sparked a positive market reaction. This is the type of outcome I anticipate for Nvidia this quarter as well.

However, unlike Palantir’s growth story, Nvidia’s valuations are way more reasonable when adjusted for growth. The stock is currently trading at a forward price-to-earnings (P/E) ratio of 52x, which is relatively low compared to its expected 35.4% EPS growth over the next three to five years. This gives Nvidia a PEG ratio of 1.47x, which is far more attractive than Palantir’s 6.5x PEG ratio. Additionally, Nvidia’s PEG is lower than most of its Magnificent 7 peers, with the exception of Alphabet’s (GOOGL) 1.35x and Meta Platforms’s (META) 1.23x, suggesting Nvidia is more reasonably priced relative to its growth prospects.

How to Time Nvidia’s Growth Wave

As a long-time Nvidia bull who has consistently supported the company’s growth story, I recognize that a smart investment strategy should take into account the potential for both gains and losses.

Right now, I see Nvidia’s growth story split into two camps. Some investors view it as being in the early-to-mid stages of hypergrowth, justifying its high valuation and potential for further upside. Others, however, see it as a potential bubble, given its 2,800% rise and all-time highs, waiting for the first earnings miss to trigger a major sell-off. Even if the bears are right, there’s still money to be made as long as Nvidia continues to deliver. The challenge is knowing when to lock in profits if the growth story falters.

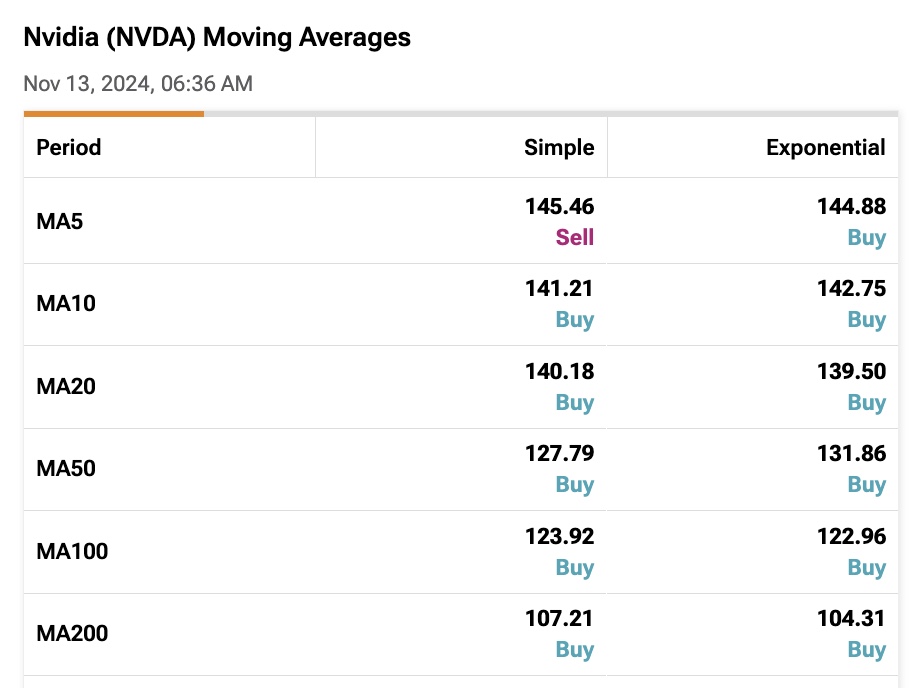

Given that Nvidia has an annualized volatility of 51%, I believe it’s more useful to track the 200-day moving average. Relying on shorter-term moving averages could result in too much noise and frequent buy and sell signals, leading to unnecessary trades. Therefore, a simpler, more effective strategy could be: buy when Nvidia is above its 200-day moving average and sell when it’s below.

In addition, Nvidia’s 200-day moving average is $107.21, and with the stock trading around $148.29 (at last check), this provides a bullish signal.This reinforces my belief that now is not the time to sell ahead of earnings. On the contrary, in my view, Nvidia remains a solid buy before its earnings report.

Is NVDA A Buy, According to Wall Street Analysts?

Wall Street’s sentiment on Nvidia is becoming increasingly positive, with several analysts raising their price targets for the stock since the last quarter. The consensus remains a Strong Buy, with 39 out of 42 analysts recommending the stock as a Buy, while only three have a Hold rating. The average NVDA price target is $157.82, suggesting a 6.43% upside potential.

Conclusion

I’m still bullish on Nvidia heading into Q3. The company’s dominance in AI, the potential of Blackwell technology, and its ability to meet strong demand position it well for continued growth. While expectations are sky-high, I don’t believe now is the time to “lock in profits” or sell. The stock is trading above its long-term moving averages, and its valuation remains reasonable when adjusted for growth, further reinforcing my Buy stance ahead of earnings.