Nvidia (NASDAQ:NVDA) stock is a top performer this year, gaining more than 62% year-to-date. Following upbeat Q3 results and a positive outlook reported in February, the stock is likely to remain strong. NVDA has already begun its upward trajectory and has a long growth runway. An overall market pullback due to macroeconomic and recessionary fears could be the only factor pulling the stock down in the near term, if at all. However, given its expensive valuation, I will wait for a better entry point to buy the stock. I am neutral on NVDA.

NVDA’s Q3 Beat & Promising Q1 Outlook

On February 22, NVDA reported upbeat Q4 results topping both earnings and revenue expectations. Higher Data Center revenues (up 11% year-over-year) were able to offset lagging revenues in NVDA’s Gaming segment (down 46% year-over-year).

On top of that, NVDA provided a Q1 outlook way ahead of analysts’ expectations. As a result, the stock soared 14% after its earnings release. Notably, for Fiscal Q1 2023, the company expects revenues to grow sequentially by 7% to $6.5 billion. More positively, adjusted gross margins are expected to range between 66%-67% versus the 63.3% reported in the fourth quarter. This highlights the overall pricing power of NVDA’s offerings across its markets.

Initially, there was fear among the investor community regarding weak Gaming and Data Center revenues. However, those fears were completely put to rest during the Q4 earnings call as management expects both segments to report sequential growth in the upcoming April quarter. In fact, the Q4 quarter could be the bottoming out of the Gaming and Data Center businesses.

AI Adoption is at Its Inflection Point, Says NVDA

Generative AI (artificial intelligence) is the next buzzword in the AI world and is taking the tech world by storm. CFO Colette Kress highlighted during the call that “AI adoption is at an inflection point. Open AI’s ChatGPT has captured interest worldwide, allowing people to experience AI firsthand and showing what’s possible with generative AI.”

Within the AI space, NVDA has a winning edge over its peers as its services are all-comprehensive that include AI supercomputers, algorithms, data processing, and training modules. Further, NVDA has an edge in providing AI services across several industries and continues to innovate further.

Amid growing AI demand, NVDA management expects Data Center sales to register rapid growth throughout 2023, driven by a new AI-as-a-Service business model and innovative product offerings.

For reference, Data Center revenues grew 11% year-over-year but declined 6% sequentially to $3.62 billion during Q4. The sequential decline was attributable to lower sales in China due to COVID-19 and other limitations. Positively, however, annual Fiscal 2022 revenues grew 41% year-over-year to $15 billion.

Importantly, cloud adoption globally continues to grow at a fast pace. Full-year Data Center revenue growth was mainly driven by meaningful partnerships with cloud service providers (CSPs) in the U.S. The CSP partners continue to contribute to the segment’s growth by offering AI-as-a-service and giving access to several offerings.

Notably, the new flagship H100 AI supercomputer is already showing robust demand and is now in full production. It is nine times faster than its predecessor (the A100) and 30x faster than comparative transformer-based, large language models. Therefore, it’s not surprising that Q4 H100 revenues surpassed A100 revenues, which registered a decline during Q4.

Is NVDA Stock a Buy, According to Analysts?

While NVDA shares fell significantly in 2022, 2023 has been rewarding for the shares. However, they are still 31% lower than their all-time high seen in November 2021.

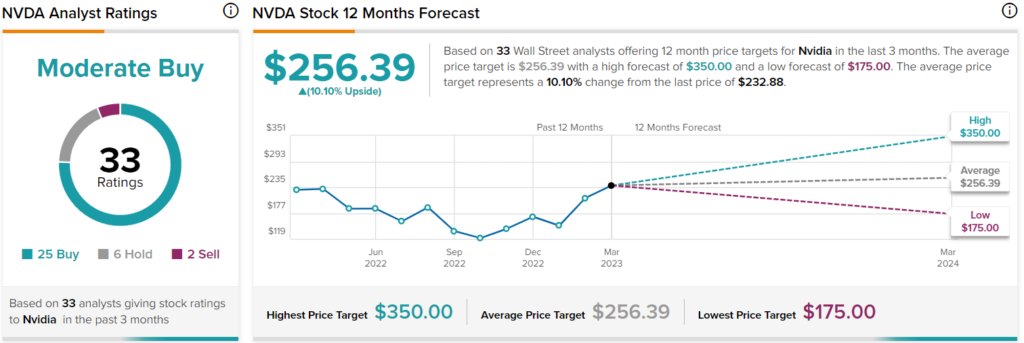

Given its high valuation (more on that below), Wall Street analysts are cautiously optimistic about Nvidia stock, giving it a Moderate Buy consensus rating based on 25 Buys, six Holds, and two Sells. NVDA stock’s average price forecast of $256.39 implies 10.1% upside potential.

Regarding its valuation, NVDA looks expensive, as it is trading at a P/E multiple of 135x, much higher than the peer group median of 23.4x and its own five-year average of about 60x.

However, it’s also important to note that NVDA returned $10.44 billion to shareholders during FY2022 in the form of share repurchases and dividends. This implies a 1.8% return on the company’s current market capitalization of $580 billion.

Conclusion: Wait for a Pullback

Overall, the semiconductor industry is experiencing a slowdown currently but is expected to recover in the second half of the year, which can add to NVDA’s upside potential. Also, the company is well-positioned as one of the pioneering leaders in the AI space as it continues to penetrate across several industries (i.e, its recently-launched AI-on-5G system).

Looking ahead, end-market dynamics for AI cloud adoption remain robust and should present consistent growth for years to come. Still, I believe the excitement regarding AI growth is already priced into the share price. Therefore, it may be prudent to wait for a pullback before buying NVDA stock.