The great sage of modern baseball, Yogi Berra, said, “It’s tough to make predictions, especially about the future.” His observation holds true in all walks of life, especially in the world of high technology.

In November 2022, OpenAI released ChatGPT, and showed us how generative AI can shatter our notions of what machine learning can do. Last month, the Chinese startup DeepSeek released its latest AI model, R1, and shook up the world of the shakers.

R1 has, reportedly, outperformed the best AI models on the American scene – but what makes this development truly important is how. The R1 model is open source, and DeepSeek has claimed that the AI’s training cost – the combined cost of the background tech and hardware that makes it possible – came in at just $6 million. That’s a tiny fraction of the costs associated with some of the headline-grabbing US-based AI systems, such as ChatGPT, Gemini, or Grok.

But is this a sign of a seismic shift in AI development, or just a one-off anomaly? Baird analyst Tristan Gerra leans toward the latter, suggesting this could be more of an exception than the start of a trend.

“DeepSeek is high in novelty claims but time will tell whether it creates a disruption in current AI models and AI architectures – we strongly suspect it does not. The claimed cost seems unrealistic, built on existing AI research and GPU architectures thus are not remotely comparable with the amount of AI costs already deployed without which DeepSeek would not exist. Additionally, we see lower-end/lower cost implementations as fueling further demand for AI systems, with price elasticity driving a commensurate surge in GPU volumes,” Gerra opined.

With that in mind, Gerra is doubling down on Nvidia (NASDAQ:NVDA) and Micron (NASDAQ:MU) as top AI plays. Both companies are industry leaders, both enjoy ‘Strong Buy’ analyst consensus ratings, and both stand to benefit from AI’s relentless growth. Let’s take a closer look.

Nvidia

First up on our list, Nvidia, isn’t just the world’s largest semiconductor company – it is one of the largest publicly traded firms on Wall Street. The chip maker’s stock lost a historic $590 billion in the aftermath of the DeepSeek headlines, the biggest single-day decline ever recorded.

However, Nvidia’s meteoric rise has been well-documented and even accounting for the recent DeepSeek-related loss, the stock has gained 441% over the past three years. The gains have come hand-in-hand with very strong sales, as Nvidia’s GPU chips have proven the most popular with data center operators and AI application developers.

R1’s release was a direct challenge to that dominance. According to DeepSeek, their latest AI model doesn’t use the latest versions of the top-end processor chips or rely as much on high-speed computing. As a result, it makes only a fraction of the power demands we see in established AIs. If R1 lives up to this hype, it would become the first of a new model of AI, and Nvidia, which has based its success on dominating the market for expensive, high-end, AI-capable processor chips, will be forced to adapt quickly. That evidently spooked investors.

Nvidia, for its part, seems to be taking this development in stride. The company released a statement praising DeepSeek for its impressive advancement in AI technology, especially in demonstrating the model’s test-time scaling capabilities. The company also noted that DeepSeek’s R1 is still based on previous AI models – and those used more traditional AI training methods.

Assuming Nvidia is correct, the market for high-end AI-capable chips is not going away – and Nvidia holds the leading position in that market, despite delays in the new Blackwell series. And last summer, Nvidia unveiled the successor to the Blackwell series, Rubin, a new GPU architecture scheduled for release in 2026.

In its last set of financial results, covering fiscal 3Q25, Nvidia reported $35.08 billion in revenues, up 93% year-over-year and beating the forecast by $1.95 billion. At the bottom line, Nvidia’s non-GAAP EPS of 81 cents was 6 cents per share better than expected. The company finished the fiscal third quarter with $38.5 billion in cash and other liquid assets, providing the company with deep pockets to weather a storm.

For Tristan Gerra, the key here is that Nvidia remains a solid player with a strong product line. The 5-star analyst says in his write-up on Nvidia, “We are slightly lowering our 2H gross margin estimate for Nvidia given our expectation of a lower mix of GB200 versus B200/B300 this year based on system-level issues. Reducing our Grace unit estimate this year by 1M to 1.5M units to account for implementation challenges; this mix shift could reduce upside to our AI revenue estimate for the year. No changes to our EPS estimates: Beyond an expected B200 channel push, we expect strong B300 demand, while the Rubin platform should catalyze further performance/revenue growth. NVDA remains a Best Idea.”

As a ‘Best Idea,’ Nvidia shares get an Outperform (i.e., Buy) rating from Gerra, whose $195 price target on the stock implies a 49% increase from current levels over the next year. (To watch Gerra’s track record, click here)

Overall, Nvidia shares hold a Strong Buy rating from the Street’s analyst consensus, based on 39 recent reviews that include 37 to Buy and 3 to Hold. The shares are currently trading for $131.14 and have an average target price of $178.86, suggesting a one-year upside potential of 50%. (See NVDA stock forecast)

Micron Technology

Next on our list is Micron, a semiconductor chip firm based out of Boise, Idaho. The company is particularly well-known for its memory chips, essential components of the AI boom. Micron’s high-bandwidth memory (HBM) chips are especially suited to AI uses.

In February of last year, Micron announced that it was partnering with Nvidia, providing its HBM3e chips for the larger firm to use in its AI-capable semiconductors. More recently, Micron’s HBM4 was chosen for use in Nvidia’s upcoming Rubin platform. Micron boasts that its HBM chips can match or exceed the performance of its rivals while consuming 30% less power, giving them a competitive advantage in a tough field.

Like Nvidia above, Micron took a hard hit with the release of DeepSeek’s R1. Micron, like most of its peers, has benefited greatly from the rise in AI over the past few years. But, by stepping up and providing the powerful memory chips required by AI data centers and high-speed computing, the company is vulnerable to DeepSeek’s release of a lower-cost, less energy-hungry AI competitor. The chips consume less power but keep their performance: the chief qualities that will be needed to compete with DeepSeek’s model.

Like Nvidia above, Micron comes to this fight with a record of successes. The company’s earnings and revenues have both been trending upwards in recent quarters. In the last reported period, fiscal 1Q25, Micron’s $8.71 billion in revenue was up 84% year-over-year and met Street expectations, while the non-GAAP EPS of $1.79 beat the forecast by 2 cents. Micron had $6.7 billion in cash and cash equivalents at the end of the fiscal first quarter.

Checking in again with Baird analyst Gerra, we find him upbeat on Micron – citing the company’s exposure to Nvidia’s Rubin as a key point. Gerra says of Micron, “We are bullish on the ramp of Rubin, which by extension will be very positive for HBM content. The larger die size and I/O count of Rubin means a 30%+ increase in HBM capacity required to support flat volume. This dynamic is in support of continued tight HBM supply in 2026 and will benefit pricing/margin, in our view. Micron is well entrenched as a key HBM supplier starting in 2H25 while Samsung continues to struggle. Lower Grace volumes is a positive for DDR5. Micron remains a Best Idea.”

Looking ahead, the analyst gives MU shares an Outperform (i.e., Buy) rating, with a price target of $130 that points toward an upside of 42% for the next 12 months.

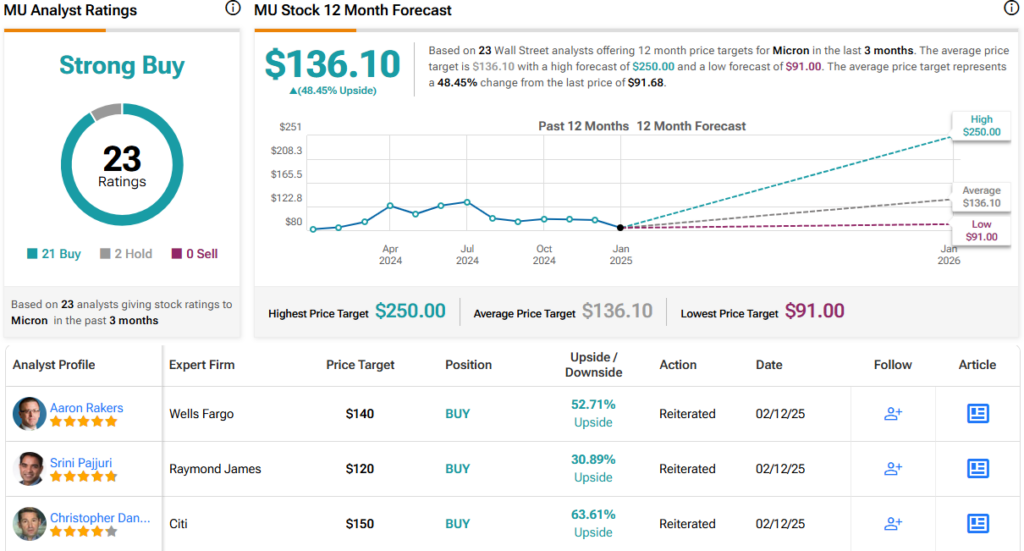

The Strong Buy consensus rating on Micron is based on 23 recent reviews that break down to 21 Buys and 2 Holds. The shares are priced at $91.68, and their $136.1 average price target is a bit more bullish than the Baird view, suggesting a one-year upside of 48%. (See MU stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Questions or Comments about the article? Write to editor@tipranks.com