With growth stocks back in vogue, the Nuveen ESG Large-Cap Growth ETF (BATS:NULG) has raced to a total return of 31.6% year-to-date. The ETF has put up a strong performance over the years that put it right in the mix with some of the market’s largest and most popular growth ETFs, making it worth a closer look from investors.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What is NULG ETF’s Strategy?

NULG is a $1.12 billion passively-managed ETF from Nuveen, which is owned by fund giant TIAA. Its underlying index is the TIAA ESG USA Large-Cap Growth Index and it invests in large-cap U.S. growth stocks that meet its ESG (environmental, social, and governance) criteria.

For readers not familiar with ESG, it is essentially a framework that some funds use to take a sustainable approach to investing. They do this by taking a company’s environmental impact, social impact, and governance into account, in addition to traditional financial metrics. ESG investing has its share of proponents and detractors, which is beyond the scope of this article, but you’ll see why it’s not of paramount importance when evaluating NULG either way.

NULG’s Holdings

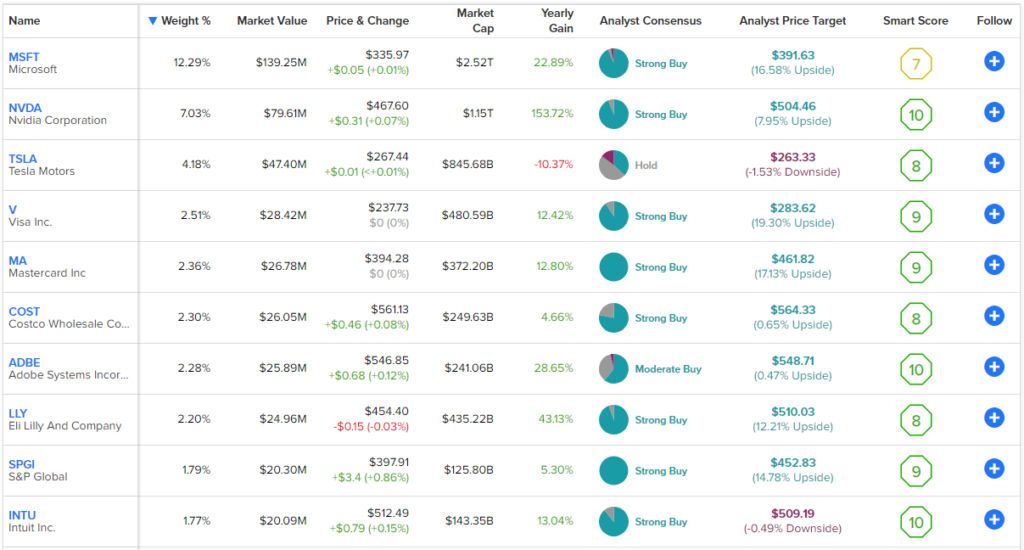

NULG is fairly well-diversified with 113 holdings, and its top 10 holdings account for under 40% of its assets. While the fund is an ESG fund, I don’t read into that too much in terms of its holdings, as they are largely similar to what you would find in other large-cap U.S. growth funds that don’t screen for ESG metrics. See below for an overview of NULG’s top 10 holdings using TipRanks’ holdings tool.

Top holding Microsoft (NASDAQ:MSFT) has a large weighting here at 12.3%, but after that, the fund becomes considerably more diversified. Beyond Microsoft, NULG owns other mega-cap tech and growth stocks like Nvidia (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA) that have played a big part in driving the overall market higher this year.

It also owns software heavyweights like Adobe (NASDAQ:ADBE) and Salesforce (NYSE:CRM). However, there’s more to NULG than just big tech — it also owns Visa (NYSE:V) and Mastercard (NASDAQ:MA), pharmaceutical giant Eli Lilly (NYSE:LLY), and membership warehouse juggernaut Costco (NASDAQ:COST).

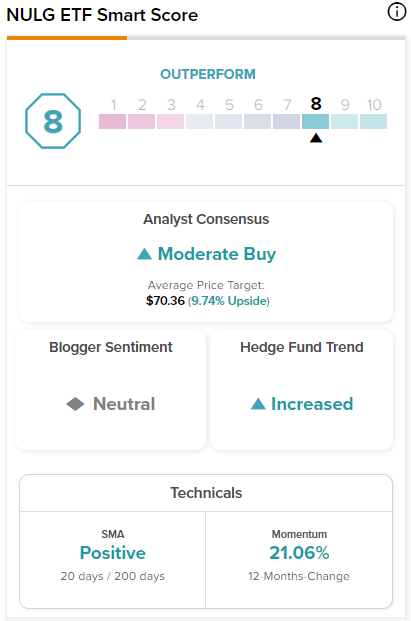

You’ll notice a lot of green in the table above, as this is a strong group of blue chip holdings with some very strong Smart Scores across the board. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A Smart Score of 8 or better is equivalent to an Outperform rating.

An impressive nine out of NULG’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above.

NULG itself features an Outperform-equivalent ETF Smart Score of 8.

Is NULG Stock a Buy, According to Analysts?

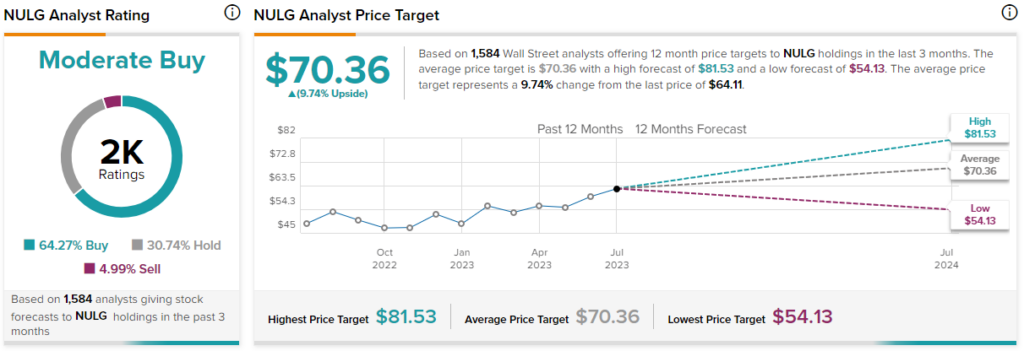

Turning to Wall Street, NULG has a Moderate Buy consensus rating, as 64.27% of analyst ratings are Buys, 30.74% are Holds, and 4.99% are Sells. At $70.36, the average NULG stock price target implies 9.7% upside potential.

Track Record

In addition to this desirable Smart Score and favorable rating from analysts, NULG has compiled a pretty solid track record in the years since its inception. As of the close of the most recent quarter that ended in June, NULG had a stellar one-year total return of 29.6%.

Over the past three years, NULG’s annualized total return was 13.8%, and its five-year total annualized return was 15.6%. While NULG hasn’t been around long enough to post a 10-year return, since its inception in 2016, its annualized return has been an impressive 17.2%.

How do these results stack up to the broader market? NULG trails the Vanguard S&P 500’s (NYSEARCA:VOO) three-year annualized return of 14.6% but beats its five-year annualized return of 12.3% by a decent margin.

Compared to other top growth ETFs, NULG slightly lags the Schwab U.S. Large Cap Growth ETF’s (NYSEARCA:SCHG) three-year total annualized return of 14.4% but comes in ahead of its five-year annualized return of 15.4% by the narrowest of margins. Additionally, NULG beats the Vanguard Growth ETF’s (NYSEARCA:VUG) total three-year annualized return of 12.6% and its five-year return of 14.5%.

Based on these comparisons, NULG is right in the mix with these top growth ETFs as well as the broader market over the past three and five years, which is a great sign, as these are all great ETFs.

Fees and Expenses

NULG’s expense ratio of 0.26% is reasonable enough, and there’s certainly nothing exorbitant about it. An investor putting $10,000 into NULG would pay $26 in fees in year one. While this isn’t bad, it should be noted that the much larger aforementioned growth funds, like VUG and SCHG, each have an expense ratio of just 0.04%, which is much lower than NULG’s, meaning that they would pay just $4 in fees in year one if they invested $10,000.

However, over time, the gap between the NULG investor’s expenses and those of the SCHG or VUG investor would widen. Assuming the fees remain where they are now and that each fund returns 5% per annum, the NULG investor would pay $331 over the course of 10 years, while the VUG or SCHG investor would pay just $51 over the same time span.

So, while NULG’s expense ratio isn’t egregious, more cost-effective options abound, and the differences in expenses add up over time.

Investor Takeaway

Overall, NULG looks like a pretty good ETF. It has a very strong portfolio, it’s rated highly by TipRanks’ Smart Score and by analysts, and it has put up a performance in line with some of the market’s top growth ETFs over the past three and five years.

I don’t put that much weight into the ESG aspect of NULG, as despite running these ESG screens and picking stocks that meet the criteria, its portfolio isn’t all that different from that of a typical large-cap growth ETF.

The only issue with NULG is that while its fees are reasonable enough, they are higher than those of the bigger, more popular growth ETFs that it ostensibly competes with. So, while this ETF will likely continue to be a good investment over time, investors have to decide if there is a compelling reason to choose it over one of these similar ETFs with lower fees like VUG or SCHG.

If NULG can continue to keep the slight edge that it has maintained over VUG and SCHG on a five-year basis, it could be worth it, although past performance is never a guarantee of future results.