Norwegian Cruise Line (NCLH) stockholders might ask when their ship will sail, as the price action has been frustrating lately. On the other hand, this isn’t a time to just give up on Norwegian Cruise Line. After crunching the numbers, I am bullish on NCLH stock and hope to see a swift rebound in the near future.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Norwegian Cruise Line is a well-known cruise line operator. One might assume that people aren’t booking cruise vacations during a time of persistent inflation. However, Norwegian Cruise Line’s quarterly data suggests that there’s still fairly strong demand for cruises. Norwegian Cruise Line CEO Harry Sommer even went so far as to say, “We are witnessing robust demand with strong pricing and booking volumes leading to record-breaking advanced ticket sales.”

That’s a highly encouraging statement, so NCLH stock ought to be flying right now – right? Unfortunately, stock prices don’t always move in the direction that one would expect. Yet, if there’s a disconnect between the data and the Norwegian Cruise Line share price, then perhaps there’s a good opportunity for enterprising investors.

Norwegian Cruise Line Reports Record Quarterly Revenue

Here’s what you need to know about Norwegian Cruise Line’s second-quarter 2024 results. First of all, the company generated record second-quarter total revenue of $2.37 billion. That’s up 8% year-over-year, so it’s a respectable result.

Of course, everything should be taken into context. When you hear about “record” quarterly revenue, bear in mind that practically everything is more expensive nowadays. Thus, it’s easier to achieve revenue “records.”

Nevertheless, Norwegian Cruise Line’s Q2-2024 revenue result shows that people haven’t abandoned cruises. Besides the record revenue, Norwegian Cruise Line reported a 105.9% occupancy rate, which was “slightly above guidance.” Thus, the cruise ships are full of passengers, and that’s a good sign.

What about the current quarter? Norwegian Cruise Line didn’t provide third-quarter 2024 revenue guidance in its earnings report, but the company did forecast an occupancy rate of around 108.2%. This implies quarter-over-quarter growth, so maybe Norwegian Cruise Line will also report sales growth for Q3.

So far, everything looks pretty good for Norwegian Cruise Line. However, NCLH stock traded lower by around 0.7% today after the release of Norwegian Cruise Line’s quarterly data and forward guidance. This is difficult to explain, so let’s delve deeper into the numbers.

Norwegian Cruise Line’s Impressive Bottom-Line Results

Should investors worry about Norwegian Cruise Line’s bottom-line results? Not really, as 2024’s second quarter and the forward guidance indicate growth, not contraction.

For one thing, NCLH’s adjusted EBITDA increased by 14% year-over-year to $587.668 million, which exceeded the company’s guidance of $555 million. Additionally, Norwegian Cruise Line reported adjusted earnings of $0.40 per share in Q2 of 2024. This represents an impressive 33% improvement on a year-over-year basis.

Moreover, this EPS result surpassed the company’s own quarterly earnings guidance of $0.32 per share as well as Wall Street’s consensus estimate of $0.32 per share. What more could investors possibly ask for?

In case that wasn’t enough, Norwegian Cruise Line also raised its full-year 2024 adjusted EPS guidance by $0.11 or more than 8%, from $1.42 previously to $1.53 currently. Granted, the actual numbers won’t necessarily match up to Norwegian Cruise Line’s guidance estimate. Still, it’s a positive sign that the company anticipates decent full-year top-line and bottom-line results.

Finally, we should observe that Norwegian Cruise Line has now beaten consensus EPS estimates in five out of the past six reported quarters. Plus, the company just delivered two consecutive profitable quarters.

I’m not concluding that it will be easy sailing for Norwegian Cruise Line, but it’s baffling that the market didn’t push NCLH stock higher after the quarterly data release. Most likely, investors wanted to see blockbuster results instead of just good results. In time, I expect the market to appreciate Norwegian Cruise Line’s impressive progress, especially in light of the challenging macroeconomic context.

Is NCLH Stock a Buy, According to Analysts?

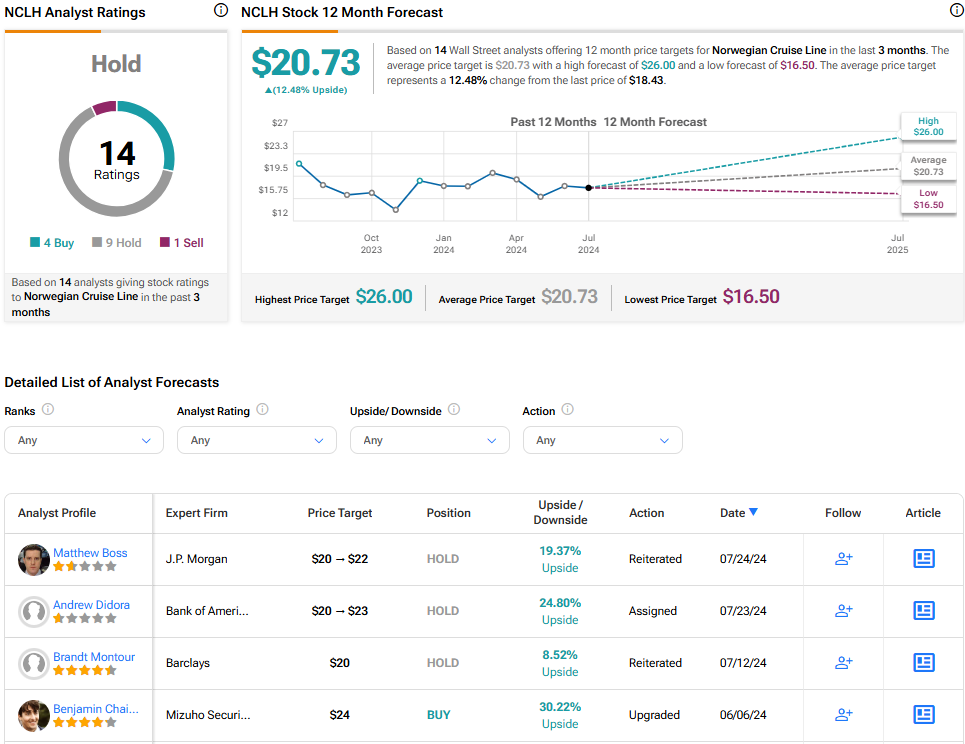

On TipRanks, NCLH comes in as a Hold based on four Buys, nine Holds, and one Sell rating assigned by analysts in the past three months. The average Norwegian Cruise Line stock price target is $20.73, implying 12.5% upside potential.

Conclusion: Should You Consider NCLH Stock?

Buying cruise stocks isn’t for the faint of heart. Nowadays, it takes a lot to impress the market, and even Norwegian Cruise Line’s reasonably impressive top-line and bottom-line quarterly results weren’t enough to move the needle today.

That’s why patience is required, and I hope to see Norwegian Cruise Line’s loyal investors get rewarded in the long run. Therefore, while it’s likely only appropriate for a small-sized share position, I would consider purchasing NCLH stock.