In February of 2023, I was bearish on Nike stock (NYSE:NKE), citing the company’s move to direct-to-consumer, its high valuation, and its slow growth industry. Since then, the stock has had a total return of negative 23%, while the S&P 500 (SPX) has surged. Now, I’m neutral on Nike because it is turning a corner and beginning to sell more through its wholesale partners. Historically, this has been a very profitable endeavor. Also, the valuation has come down, and the pressure on Nike’s consumers will eventually fade.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Turning a Corner with Wholesale

In the past, I’ve been critical of Nike’s move to DTC (direct-to-consumer). Nike was a fabulously profitable company prior to its adoption of a direct-to-consumer strategy in 2017. In fact, the company’s net profit margin and return on assets grew fairly steadily from 2003 to 2016. But since direct-to-consumer came along in 2017, Nike’s profitability has not only been down, but very volatile. This is probably the result of becoming a retailer that has to hold inventory and take part in DTC shipping and returns.

The good news? Nike is turning the corner. As if Nike saw my article from back in 2023 or just realized the merits of its wholesale partnerships with companies like Foot Locker (NYSE:FL) and Macy’s (NYSE:M), the company is sharpening its focus on retailers.

In the Fiscal Q3-2024 earnings call, CEO John Donahoe said the following, “But a reinvestment with our wholesale partners, so we bring a more holistic offence that grows the market and gets in the path of our consumer. And so, that’s what’s driving our growth. We’ve made the necessary adjustments to bring the best of what’s worked in our proven formula so that we move forward.”

This is the right strategy, in my opinion. To draw an analogy, Coca-Cola (NYSE:KO) isn’t a retailer, and it doesn’t want to be. Get your product in front of the consumer, hold your market share, and be a branded product owner first and foremost. This has been a winning strategy in the past.

When it comes to footwear, I think e-commerce isn’t all that important. Consumers need to try on their shoes for fit and comfort. Also, I don’t think malls are going anywhere; they provide a social, engaging experience that e-commerce cannot. Nike is now meeting consumers where they want to be. All in all, I think Nike will be able to hold its market share with this move and potentially bolster its profitability.

Nike’s Consumers Won’t Struggle Forever

Consumers were cashed up in 2021, but since then, Nike’s consumers have been hit hard by food and energy inflation. U.S. consumer sentiment plummeted in 2022 and stayed low in 2023. But sentiment has since rebounded this year as inflation cools. Now, there’s still a chance this rebound gets interrupted by a U.S. recession, but I see 2025 and 2026 being better for Nike’s low- and middle-income consumers. This should eventually flow through to Nike’s bottom line.

Things also haven’t been so rosy for Nike’s business in China. But in the latest earnings call, Nike’s CFO said, “In Greater China, Q3 revenue grew 6%.” I suspect that Chinese consumers will be just fine because the country’s household savings recently hit a record high. There’s probably a lot of cash on the sidelines here waiting to be spent.

The Valuation Has Come Down

When I first wrote about Nike in 2023, the stock had a P/E ratio of 36x on historically high profit margins. With the footwear industry struggling, Nike’s earnings haven’t been booming, but there may be some room for a return to growth.

Analysts think Nike can grow its EPS at about 9% per annum over the next few years. The company has a history of buying back lots of stock, which should help. The company is by no means cheap at 28x earnings, but there’s enough here for me to upgrade Nike to neutral.

Is NKE Stock a Buy, According to Analysts?

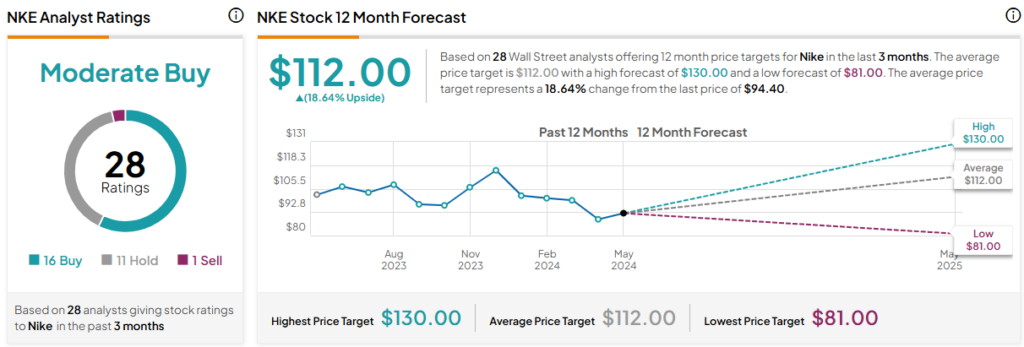

Currently, 16 out of 28 analysts covering NKE give it a Buy rating; 11 rate it a Hold, and one analyst rates it a Sell, resulting in a Moderate Buy consensus rating. The average Nike stock price target is $112, implying upside potential of 18.6%. Analyst price targets range from a low of $81 per share to a high of $130 per share.

The Bottom Line on NKE Stock

Nike seems to be turning a corner. It’s focusing back on its highly profitable direct-to-wholesaler business rather than its less profitable direct-to-consumer business. This should allow the company to maintain its market share and grow its earnings. Moreover, Chinese consumers have a trove of household savings, and U.S. consumers are seeing inflation cool, which may flow through to Nike’s bottom line. I’m now neutral on Nike at a P/E ratio of 28x earnings.