Nike (NYSE:NKE) shares dipped in the final days of 2023 after the company warned investors it planned to cut $2 billion in costs amid a “softer” revenue outlook in its mid-year Fiscal 2024 earnings report. This presents an opportunity for traders looking to buy the athletic apparel and accessories stock while it’s down in an attempt to capitalize on future gains.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Given Nike’s shift toward a direct-to-consumer model, the company has the opportunity to continue to improve its profit margin. However, it faces headwinds from up-and-comers like On Holdings (NYSE:ONON) and still holds a backlog of inventory built up following the pandemic.

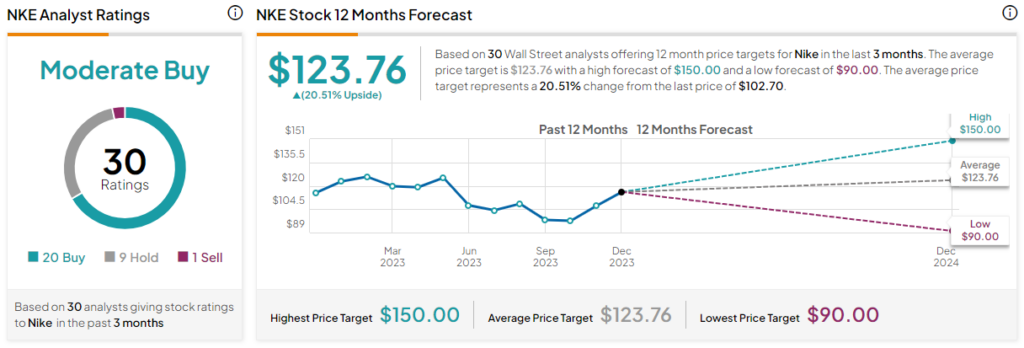

Several analysts across Wall Street reiterated Buy ratings following Nike’s recent second-quarter fiscal report. I join them in being bullish on the stock, as now seems to be a good time to consider buying in if you’ve been meaning to add Nike to your portfolio. Nike has a strong history of long-term growth, so particularly for investors looking to hold NKE shares for a while, there is plenty of upside potential.

Shift to Direct-to-Consumer Continues

Nike’s latest earnings show that its refocus toward a direct-to-consumer model in recent years still has momentum. With NIKE Direct revenues of $5.7 billion for the quarter, a 6% improvement year-over-year, the athletics company seems to be doing a good job of continuing to connect with its customers. Consequently, Nike has been moving away from a wholesale model, and sales in that area fell by 2% year-over-year to $7.1 billion.

Despite the decline in Wholesale revenues, Nike’s gross margin improved by a solid 170 basis points to 44.6% for the quarter, suggesting that as the balance between DTC and Wholesale revenue shifts toward the former, the company ekes out more profit off of the sales of its products.

New Year, New Inventory

Investors prepared to buy and hold Nike shares could also benefit when the company launches new products and updates its inventory. Like many consumer discretionary companies, Nike ended up with a surplus of inventory as the pandemic eased off and customer spending habits normalized. The latest earnings show that it’s still working to unload these older products. Inventories declined by 14% year-over-year to $8.0 billion.

Being saddled with old inventory is a major risk for Nike, particularly among a consumer base eager for the latest offerings. Thus, it’s good news that the company has seen success in reducing its backlog. Still, it may be some time before Nike builds up its inventory with new launches, a move that could trigger an influx of sales. Investors able to hold on to Nike shares for some time could have an opportunity to reap those benefits.

Timing the Technicals and Valuation

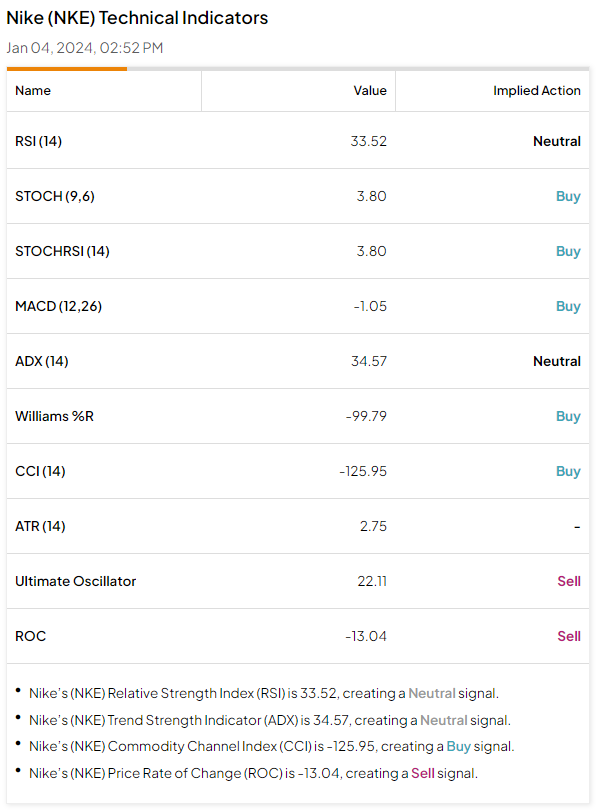

Nike’s forward P/E ratio is currently 30. While this is higher than the average P/E ratio for the consumer discretionary sector, it’s the lowest for Nike in about two months and nearly the lowest level over the last five years. At around 3.0, Nike’s P/S ratio is also lower than it has been for much of the last several years. Additionally, multiple stochastics and other popular technical indicators suggest that Nike is a Buy.

Headwinds Remain: Costs, Consumers, Competition

Despite the reasons above in favor of Nike stock, there are also several important headwinds to keep in mind as well. Take, for example, the fact that Nike said it will aim to cut costs by $2 billion in the next three years. Eliminating excess spending is a worthwhile aim, but one likely reason Nike is doing this is because it expects consumer spending trends to decline.

The company’s business in China has slowed amid a lackluster post-COVID recovery in the region. This, coupled with similar cooling trends in Europe, may have been the impetus for Nike’s decision to call for “softer” revenue in the final two quarters of its fiscal year.

Competition from upstart brands is also a consideration. Nike has long been a dominant player in the athletic apparel and equipment space, but this market is growing denser with the arrival of more recent additions like On Holding, HOKA, and others. Nike now faces increased competition, though it also benefits from its powerful brand legacy and massive resources to research and design new products.

Is NKE Stock a Buy, According to Analysts?

Turning to Wall Street, Nike has a Moderate Buy consensus rating based on 20 Buys, nine Holds, and one Sell assigned in the last three months. At $123.76, the average Nike stock price target implies upside potential of 20.5%.

Conclusion: A Potential Buying Opportunity

Investors looking for a time to enter or add to a Nike position may have found it in the dip following its recent earnings report. The athletic apparel and accessories firm seems to have found continued success in its direct-to-consumer approach, though a backlog of inventory, shifting customer spending trends, and increased competition are important headwinds to keep in mind.