The first month of 2022 has not been so kind to tech investors, as the sell-off has continued to punish growth stocks into serious correction territory in an increasingly bear market environment. While markets have largely been red, one stock in the FAANG group has shown considerable weakness over the last few trading sessions, and TipRanks’ monthly website visitor data showed the writing on the wall.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Upon releasing earnings after hours on Thursday January 20, Netflix, Inc. (NFLX) proceeded to precipitously plummet until Friday’s closing bell, by more than 21%. Unfortunately for those buying the dip, the stock has since languished and has yet to recover.

The dramatic move down in share price comes after about two months of sliding valuation, as heightened competition, fears of an inadequately de-risked business model, and concerns of decelerating subscriber growth pushed investors out of NFLX. By Thursday evening, these worries proved legitimate, and the stock fell more than it had after earnings in a decade.

The main catalyst for the sell-off was the company’s slowdown in subscriber adds, which came in at 8.3 million, under a prior guidance of 8.5 million. Even worse, the streaming giant forecast 2.5 million additional subscribers for Q1, far below Wall Street consensus estimates of around 6.9 million.

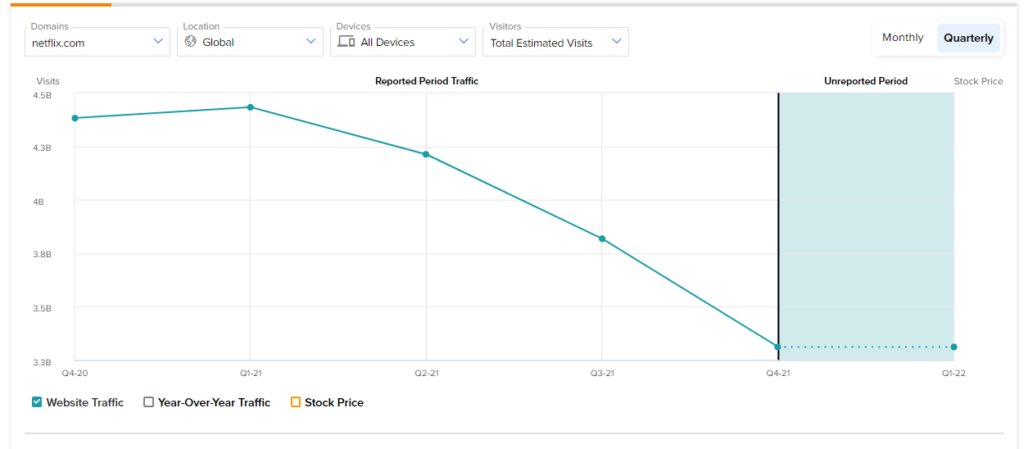

While the ongoing price action is tragic for Netflix investors, it does not come completely out of the blue. Among the new tool’s most useful utilities is its ability to showcase a site’s total estimated visits even before an earnings release. For Netflix.com, the stats clearly pointed to a downward trajectory.

As mentioned before, Netflix now guides sub adds to 2.5 million for Q1, which is significantly less than last year’s 4 million adds over the same time frame. Year-over-year, it can be identified that Netflix’s total quarterly visits are down 24.45% in Q4 2021 compared to Q4 2020.

For a company like NFLX, total quarterly visits are a strong indicator of user activity and future subscriber growth. The company runs off its main website, unlike other tech firms which are more B2B-oriented. Tellingly, quarter-over-quarter, monthly visits fell by 13.27%.

These disappointing numbers come even as the firm has invested about $14 billion into producing and developing its own content in 2021, and despite releasing the highly popular Squid Game series last year. Netflix has recently moved into the online gaming space in an attempt to diversify its product offerings.

As far as Wall Street is concerned, the jury appears to be hung. Upon hearing the news of sliding shares, analysts ratings were immediately split in their sentiments. Some were still bullish on the discounted share price, and others took the subscriber metrics more severely and downgraded to neutral.

After a slew of new ratings, TipRanks’ analyst rating consensus now stands at Moderate Buy, based on 16 Buy, 15 Hold, and three Sell ratings. The average Netflix price target is $521.04, suggesting a possible 12-month upside of 34.58%. Before market open on Tuesday, NFLX shares were priced at $387.15 a piece, not so far off from its 52-week low.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure