I am neutral on Nano Dimension (NNDM) as it has a strong growth momentum in a promising industry but remains unprofitable and is facing substantial market headwinds at the moment. As a result, it looks like it might be a bit too speculative to take a bullish stance on at the moment.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nano Dimension is headquartered in Florida, United States, and has been operating in the 3D printing industry since 2012. The company’s primary focus remains on the research and development of 3D-printed technologies, including nanotechnology-based inks and a printer for multilayer printed circuit boards.

In addition to research and development, the company also manufactures these printers and their unique conductive inks, which fall under the company’s proprietary products. Nano Dimension was formed by four business tycoons with unmatched experience in the technology and digital print industries. The four entrepreneurs include Sharon Fima, Amit Dror, Simon Fried, and Dagi Ben-Noon.

Strengths

One of the most significant reasons why Nano Dimensions has been able to rapidly scale new products is its market leadership position. This also led to higher profit margins than most of its competitors, even during times when the company was facing downward pressure.

The company also caters to various customer segments with its exhaustive product mix. Additionally, the diverse revenue model backed by its investments outside its industry has also allowed the company to enjoy revenues from various sectors and industries. Nano Dimension’s strong brand recognition makes this company a relatively more popular brand amongst competitors.

Recent Results

According to the company’s unaudited reports, Nano Dimensions’ approximated consolidated revenues reached $7 million in Q4 2021, which ended in December. The full Fiscal Year revenues for 2021 reached $10 million. The unaudited cash and cash equivalents at the end of the year were $1.36 billion.

According to the report, the company’s Q4 2021 revenues increased by 255% compared to Q4 2020 results. Additionally, the increase over Q3 2021 was 420%, and the increase over full-year 2020 reached 194%. In Q3 2021, the company’s total revenues were $1.34 million, and the cash and cash equivalents for the same quarter reached ~$1.39 billion.

Valuation Metrics

NNDM stock is a bit difficult to value given that the company is currently not profitable on a GAAP basis. The company needs to continue growing rapidly in order to generate the economies of scale necessary to turn a profit.

That said, Wall Street analysts expect the company to generate strong growth in the coming years, including 181.8% EBITDA growth in 2022, 254.5% revenue growth in 2022, and turn profitable on a GAAP basis beginning in 2023.

TipRanks’ Smart Score Rating

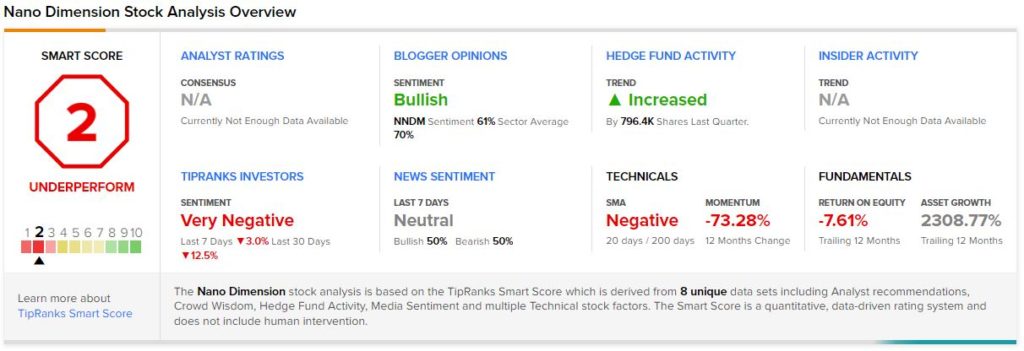

NNDM stock earns a smart score of 2 stemming from bullish blogger opinions, very negative TipRanks investors sentiment, and negative technicals and fundamentals.

Summary and Conclusions

NNDM stock has been getting crushed along with the rest of the high-growth disruptive technology sector over the past year, as its stock has fallen by nearly 75% over that span.

That said, it does enjoy a strong growth outlook for the foreseeable future, and – if it can effectively scale to the point where it can turn profitable – it could end up proving to be a compelling bargain from the current share price.

If investors are prepared to face substantial volatility and maintain a long-term perspective, it could be a good fit for a portfolio. Overall, however, it is a very speculative investment.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure