It’s been just over two years since ChatGPT introduced the world to the capabilities – and the potential – of generative AI. It caught our attention, and our imaginations, and AI has been booming ever since. GenAI has found new uses, and spawned a raft of new applications. The tech brings the promise of lowered costs and higher efficiency for the software industry, reducing input times while increasing capabilities.

The research team at Morgan Stanley has been watching this evolving situation carefully, and in their view, the coming year will see the investment potential inherent in AI come to full bloom – and open up numerous opportunities to buy in.

They describe that set-up as the result of two interacting cycles acting as growth drivers: “Heading into 2025, we see the potential for two emerging cycles to compound, yielding strengthening top and bottom-line fundamentals for software. The first is a software spending cycle, as the industry emerges from a three year period of optimization and digestion, which has firmed the technological foundations for further growth…The second is a secular innovation cycle around Generative AI and the potential for Software to now automate a far broader set of Commercial and Consumer workflows, well expanding the market opportunity going forward…”

The Morgan Stanley analysts take the logical next step, and turn their macro view into concrete recommendations, naming three software stocks that investors can bank on for 2025.

Using the TipRanks platform, we’ve uncovered the broader Wall Street consensus on these stocks, all of which stand out as Strong Buys. Let’s take a closer look.

Semrush Holdings (SEMR)

The first stock on our list of Morgan Stanley picks is Semrush, a company specializing in online visibility. Semrush offers its customers a platform on the SaaS model purpose-designed to give its users a greater understanding of online trends, keyword research, and search engine visibility, all to gain improved insights and more competitive data analysis. The end result: more relevant content; better targeted to customers across a wider range of digital channels. Semrush’s customers use the platform to improve multiple online activities, including SEO, marketing, social media, and pay-per-click campaigns.

Semrush does all of this using a combination of old-school, tried-and-true SEO methodology along with newer AI tech. The company was an early adopter of AI and has been enthusiastic about the tech and its potential to boost productivity, streamline workloads in the software industry, and provide a creative enhancement in many aspects of the business world. The company makes use of AI in its own product suite, making the advantages available to its own customers.

That customer base is extensive. Semrush was founded in 2008, and since then some 10 million users have tried the platform. The company’s SEO database includes 26 billion keywords, 43 trillion backlinks, and covers 808 million domain profiles. Semrush has 13 global offices and serves 156 countries, where marketers can make use of the company’s 16 years’ experience.

On the financial side, Semrush last reported earnings for 3Q24. The company’s bottom line was somewhat underwhelming, coming in at 1 cent per share, down 2 cents from the prior-year value and missing the forecast by 2 cents. At the top line, however, the company showed stronger results – revenue came in at $97.41 million, up 24% year-over-year and beating the forecast by $690,000.

In addition, Semrush raised its outlook for the full-year 2024. The company expects 2024 revenue to hit between $375 million and $376 million, which would represent year-over-year growth of 22%. Backing that, the company expects a full-year non-GAAP operating margin of 12%, and a full-year free cash flow margin of 8%.

Turning to the Morgan Stanley view, we’ll check in with analyst Elizabeth Porter, who after a deep dive into Semrush is impressed by the company’s overall position, its product lines, and its potential for growth. She writes, “We see Semrush as well-positioned to accelerate revenue growth ahead, benefitting from: 1) a large ramping Enterprise SEO product cycle; and 2) alleviating headwinds in the company’s macro-sensitive SMB/Freelance segment. Meanwhile, successful deployment of a Product-Led-Growth motion should enable further margin improvement, driving durable and portable 20%+ growth, dynamics which are not currently priced into shares trading at a ~50% discount to Smid Software on a growth-adjusted EV/S basis.”

Porter goes on to put an Overweight (i.e., Buy) rating on SEMR, along with a $20 price target that points toward a one-year upside potential of 21.5%. (To watch Porter’s track record, click here)

While there are only 4 recent reviews on record for SEMR shares, they are all positive – for a unanimous Strong Buy consensus rating. The shares are priced at $16.46, and their $18.25 average price target implies a gain of 11% in the year ahead. (See SEMR stock forecast)

OneStream, Inc. (OS)

The second stock we’re looking at, OneStream, provides a cloud-based, AI-powered platform designed for the needs of online finance. OneStream’s platform gives its users a set of capabilities, including unified financial and operational data functions, and AI decision-making for boosted productivity. The platform is a modernized CFO’s office, in one place, designed for financial planning and forecasting.

It’s a bold play in the world of finance. OneStream uses AI to match the pace of the dynamic financial world, where challenges have million-dollar consequences, or higher. The company’s model has been successful, however – since its founding in 2012, OneStream has built up a customer base of more than 1,500 enterprise clients, including a large portion of the Fortune 500 firms. OneStream’s customers include such major names as UPS, Toyota, Capital One, and KLM.

We should note here that OneStream went public in July of last year, and raised gross proceeds of $490 million in its IPO. The company released its 3Q24 results – its second financial release since going public – this past November. In the release, OneStream showed revenues of $129 million, up 21% year-over-year and beating the forecast by over $5 million. The company’s income was reported as $5.5 million by non-GAAP measures.

This stock is covered by Morgan Stanley’s Chris Quintero, who highlights several reasons why investors should get on board. The analyst writes, “We continue to view OneStream as a high quality asset given its core data platform targets a large market opportunity combined with best-in-class unit economics and revenue growth… we see an attractive buying opportunity for this best-in-class platform, especially given multiple growth tailwinds ahead in 2025, including 1) The ERP Supercycle, 2) Increasing demand for their SensibleML product (allows users to leverage AI for tasks like forecasting, budgeting, and planning), and 3) Potential pricing and packaging refinements. We see both upside to multiple expansion as well as upward estimate revisions throughout 2025.”

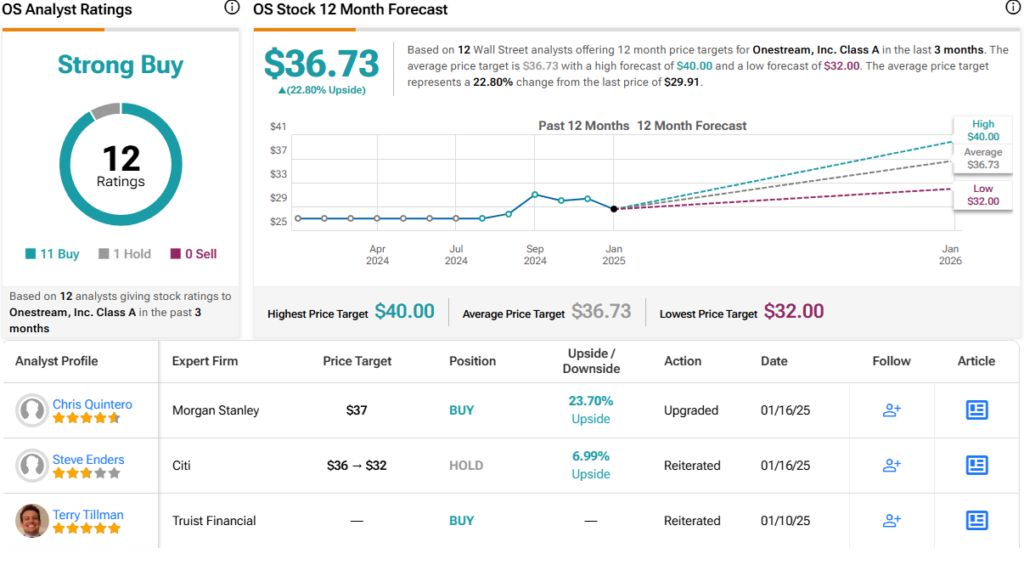

Based on this stance, Quintero gives OS shares a rating of Overweight (i.e., Buy), which he complements with a $37 price target. That points toward a gain of 24% on the one-year horizon. (To view Quintero’s track record, click here)

This stock has picked up 12 recent analyst reviews, and the lopsided 11 to 1 split, favoring Buy over Hold, supports the Strong Buy consensus view. The shares are currently trading for $29.91, and their $36.73 average target price suggests that the stock has an upside potential of 23% in the next 12 months. (See OS stock forecast)

MongoDB, Inc. (MDB)

Last on our list is MongoDB, a well-known player in the world of data platform software – and a Morgan Stanley ‘top pick’ in the software sector. MongoDB has created a database platform designed to empower its users – to promote innovation, creation, and transformation, through the combination of top-end software and useful data. The company boasts that its platform was built by developers, for developers, making it uniquely suited to address the needs of today’s cutting-edge data applications.

This includes AI. MongoDB’s platform is particularly suited to supporting AI apps and systems, giving a flexible data model that promotes AI training, a distributable architecture for efficiently scaling AI workloads, and the robust security approach needed in today’s digital world. The company’s AI is capable of bringing semantics into search functions, taking them beyond simple keywords, and of integrating large language models with operational data.

What it all comes down to, MongoDB offers its customers a solid set of capabilities to put their data to work, effectively, to generate usable results in any sector. The company’s product lines, especially Atlas, its flagship database platform, have proven popular – as of October 31 last year, the company boasted a customer count of 52,600, representing year-over-year growth of 13%.

That number comes from the company’s last financial report, for fiscal 3Q25. In that quarter, MongoDB generated revenues of $529.4 million, up 22% year-over-year and $33.66 million better than had been anticipated. The company’s bottom line, the non-GAAP EPS of $1.16, was 47 cents per share ahead of the forecast. Atlas was the key driver of these results, and its revenue was up 26% year-over-year; it made up 68% of MongoDB’s total revenue stream.

In another metric that shows the company’s underlying strength, MongoDB reported a strong reserve of liquid assets – totaling $2.3 billion in ‘cash, cash equivalents, short-term investments and restricted cash.’

Analyst Sanjit Singh covers this software stock for Morgan Stanley, and he believes that the company has strong prospects going forward. Laying out the background, Singh writes, “While concern about initial 2025 guidance achievability persists, we see this as a clearing event for the stock as we believe 1) growth is fundamentally still stronger than perceived limiting the magnitude of the guidance risk, 2) investor expectations have already re-anchored lower to mid-teens CY25 growth, and 3) even a guide down has the potentially to be interpreted as incremental conservatism in light of the CFO transition (Michael Gordon, the CFO and COO, will leave his role at the end of the company’s fiscal year on January 31, 2025), which could make this a look through.”

While the analyst sees risks here, he goes on to explain why MongoDB should continue growing going forward: “Against this more attractive setup, we see our re-acceleration thesis firmly in play. First, model dynamics surrounding the fading headwinds from multiyear licensing deals and Atlas expiry revenue help paint a clearer picture of Atlas growth which we still believe will accelerate in C1Q25. Second, into the C2H we see key product cycles – primarily, Atlas Vector Search and Relational Migrator – start to contribute more meaningfully, as they have already scaled to a base of ‘thousands’ of AI applications, some of which should find more meaningful product market fit and therefore usage in C2H25. Third, we see a potential for MongoDB to deliver better-than-expected growth while expanding margins coming out of an investment cycle, which is underappreciated today.”

Altogether, these comments support Singh’s Overweight (i.e., Buy) rating for MDB, and his $350 price target suggests a one-year gain of 36% for the stock. (To watch Singh’s track record, click here)

Leading tech stocks frequently generate a lot of Wall Street interest, and MDB has 28 recent reviews, with a breakdown of 24 Buys, 3 Holds, and 1 Sell to support the Strong Buy consensus rating. The shares are selling for $257.86, and the $376.85 average target price implies an upside of 46% over the next year. (See MDB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.