MicroStrategy (MSTR) is a tech company that has spent the last few years accumulating Bitcoin (BTC-USD) on its balance sheet through a well-executed financing strategy. This approach supports my bullish stance on the company, particularly in a rising crypto market. MSTR has outperformed Bitcoin, highlighting the advantages of holding the company’s stock over directly investing in the cryptocurrency. By investing in MSTR, investors can amplify Bitcoin’s potential returns through a regulated stock, making it a more accessible option for institutional investors compared to holding cryptocurrency directly.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

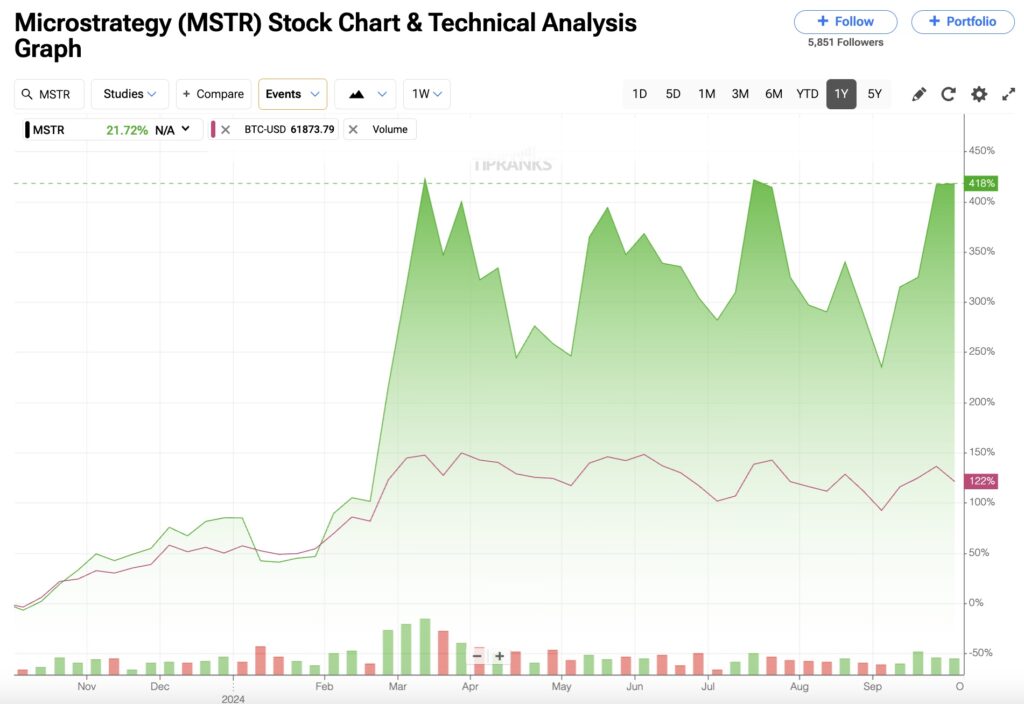

Specifically, this year, MSTR shares have benefited from their high correlation with Bitcoin’s price swings, rallying over 211%. Recently, the shares saw an increase in momentum following the Fed’s interest rate cut. The last time this occurred, Bitcoin’s price more than doubled.

In this article, I will delve into the strategy behind MicroStrategy’s business and explain why buying at current levels may be a wise decision.

Is MicroStrategy Essentially a Bitcoin Company?

Before delving further into the bullish thesis, it’s essential to provide some context. MicroStrategy is (or was) primarily a data software company that helps customers make informed decisions by analyzing large sets of data from multiple sources. However, facing strong competition from powerful players like Microsoft (MSFT) and Salesforce (CRM), its core business has struggled to grow. About four years ago, the company pivoted to make aggressive investments in Bitcoin, led by its CEO, Michael Saylor, a staunch advocate of cryptocurrency.

According to MicroStrategy’s shareholder letter released last year, the company holds an unwavering confidence in Bitcoin for the long term. The management team stated, “Because of its characteristics, we believe Bitcoin is a superior store of value, akin to digital gold or digital property. Just as records and CDs gave way to digital music, we believe gold and other traditional physical stores of value will give way to Bitcoin.”

Currently, about 38% of MicroStrategy’s market cap corresponds to its Bitcoin holdings. By the end of July, MicroStrategy owned 226,500 Bitcoins, purchased at a total cost of $8.3 billion, and now valued at about $14.3 billion.

Breaking Down MSTR’s Bitcoin Strategy

The main bullish argument for MicroStrategy centers on its clever strategy of expanding its balance sheet through Bitcoin acquisitions. Since 2020, CEO Michael Saylor has focused on growing MicroStrategy’s value by buying Bitcoin with debt, particularly through convertible bonds, and capitalizing on the cryptocurrency’s high volatility.

As the price of Bitcoin rises, the company is able to borrow even more money and add to its crypto holdings. At the same time, the company generates revenue from its software business, which amounted to $111 million in Q2, the most recent quarter. However, this represents a slowdown compared to the $120 million generated during the same period last year.

As a result, over the past five years, MicroStrategy’s shares have appreciated by nearly 1,200%, closely mirroring fluctuations in Bitcoin prices. However, the journey has not always been smooth. A few years ago, high inflation and rising interest rates made it more expensive for the company to issue new debt or rollover existing obligations. During the crypto winter, from early 2021 to early 2023, MSTR shares plummeted by as much as 86%, falling to less than $15 per share. Today, however, shares have rebounded and exceed $185.

Why Buy MSTR Rather than BTC Itself?

My Buy stance on MicroStrategy extends to the belief that purchasing MicroStrategy stock may be more advantageous than buying the cryptocurrency or investing in a BTC fund. At first glance, it may seem illogical to pay a premium on MicroStrategy’s net asset value (NAV) in Bitcoin, which currently exceeds 2.3x. This premium reflects how much more or less the market values the company’s stock compared to its Bitcoin holdings alone, especially when you could simply buy the cryptocurrency directly.

However, MicroStrategy’s primary advantage lies in its ability to capitalize on and acquire more Bitcoin. So far this year, the company issued two convertible debt offerings at less than 1% in March, scaled up its convertible note offering in June, and conducted another offering more recently in September, using the proceeds to buy additional Bitcoin.

This ability to raise capital is one of the main justifications cited by Benchmark analyst Mark Palmer, who notes that the company has timed the market extraordinarily well. In fact, MicroStrategy’s stock has significantly outperformed Bitcoin since it began its Bitcoin acquisition strategy in August 2020. It has also outperformed the S&P 500 (SPY), NASDAQ (QQQ), gold (GLD), silver (SLV), and major tech stocks. Palmer concludes that, particularly in a bull market, the premium on MicroStrategy shares is justified, and I tend to agree.

Is MSTR a Buy, According to Wall Street Analysts?

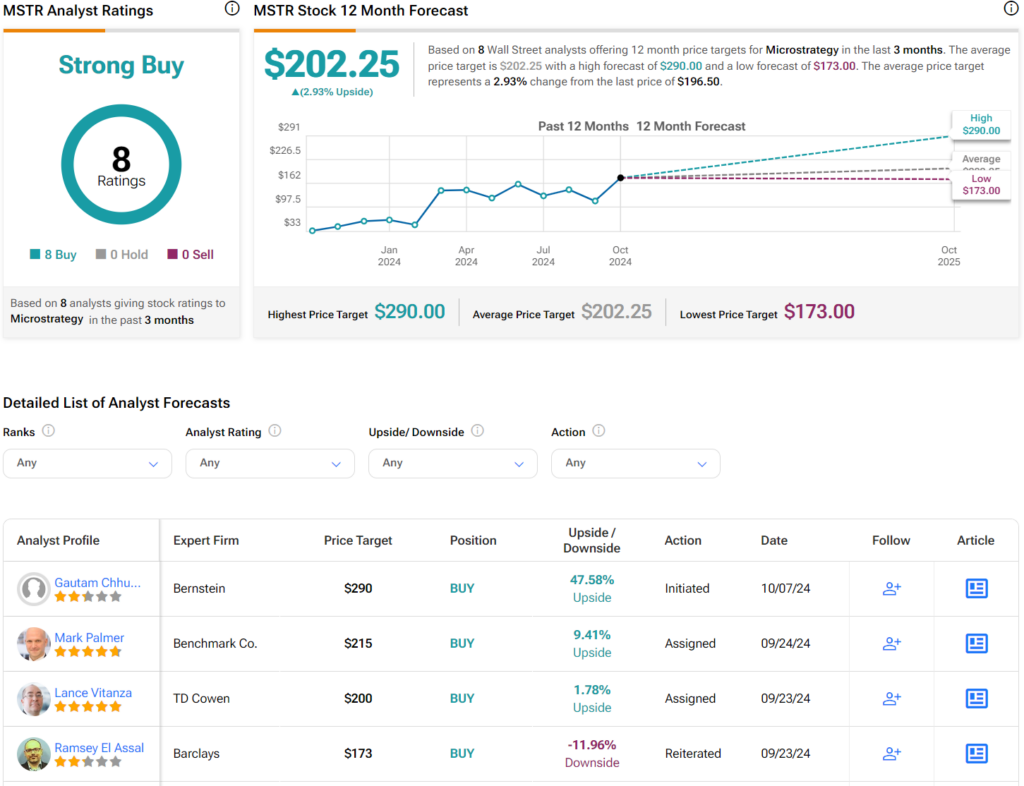

The Wall Street consensus on MSTR stock is exceptionally optimistic. All eight analysts covering the stock recommend buying it, resulting in a Strong Buy consensus. The average price target is $202.25, indicating a potential upside of 2.93% based on the latest share price.

Conclusion

In summary, I believe that during crypto bull markets, investors who are bullish on Bitcoin should consider a position in MicroStrategy. This approach makes sense because MicroStrategy’s use of debt to increase its Bitcoin holdings has been effectively executed, potentially leading to outperformance relative to both the market and the currency itself. Therefore, I view MicroStrategy as a Buy. However, investors should be aware of the risks associated with strong volatility, as fluctuating Bitcoin prices can quickly alter the short- to medium-term outlook.