The current earnings season continues to roll on, with Microsoft Corp. (MSFT) recently posting encouraging results across the board, boosted by widespread cloud adoption. The digital transformation that swept across global companies during the COVID-19 pandemic has provided a strong tailwind for MSFT’s Azure and Office 365 adoption rates, and the firm is now fully invested in video gaming and metaverse-related industries after its Activision Blizzard (ATVI) acquisition.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Elaborating his bullish position on the stock is Ivan Feinseth of Tigress Financial Partners, who was enthusiastic about Microsoft’s capacities for ramping its most prominent products. Moreover, the firm has seen productive ramping of its Surface PC line and Windows 11 operating system.

He went on to write that Microsoft’s “ongoing enterprise digitization continues to drive increasing cloud migration and great productivity technology adoption.”

Feinseth rated the stock a Buy, and raised his price target to $411 from $366. This new target now represents a possible 12-month upside of 34.34%.

The $2.29 trillion market cap technology conglomerate reported revenues up 20% year-over-year, an impressive feat given the tough comparisons from last year’s strong performance. Over the same time period, Microsoft repurchased nearly $11 billion in shares and continued to raise its dividend, making it far more attractive to long-term investors.

The five-starred analyst noted enhancements made to Microsoft’s Teams platform, with its Essentials platform targeted at smaller sized businesses.

Of course, Feinseth had to touch on the monumental acquisition of Activision Blizzard, which has catapulted MSFT’s already prominent position in gaming and its profit reaping subscription business. Moreover, he is upbeat about how this could materialize into possible metaverse-related opportunities for monetization in the future.

Beyond these developments, Microsoft has recently partnered with retail chain CVS Health Corp. (CVS) to improve its digital capacities, and will be absorbing AT&T’s analytics and advertising company, Xandr.

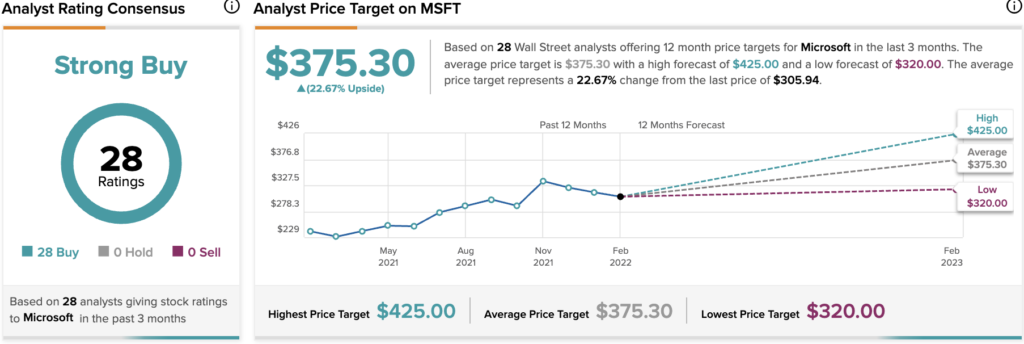

On TipRanks, MSFT has an analyst rating consensus of Strong Buy, based on 28 Buy ratings. The overwhelmingly positive sentiment has translated into an average Microsoft price target of $375.30, which indicates a potential 12-month upside of 22.67%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure