In this piece, I evaluated two Magnificent Seven stocks: Meta Platforms (META) and Alphabet (GOOGL). A closer look suggests bullish views for both. However, a clear winner does still emerge.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Of course, Meta and Alphabet don’t really operate in the same sectors. However, the fact that both have appeared in multiple stock acronyms over the years (remember FANG and FAAMG?) and are part of the so-called Magnificent Seven makes this comparison worthwhile.

Meta Platforms owns several social media properties, including Facebook, Instagram, and WhatsApp. However, the company has been attempting to reinvent itself into a metaverse company in recent years, touting the metaverse as “the future of digital connection.”

Meanwhile, Alphabet owns the Google search engine and many other properties. Thus, the company rakes in revenue from app sales via Google Play, purchases on YouTube, cloud services fees, online advertising, licensing, and even hardware like its Chromebooks and the Nest thermostat.

In terms of share price, Meta Platforms stock has surged 48% year-to-date and is up 72% over the last 12 months, although it is up only 4% for the last three months. In contrast, Alphabet stock is up a mere 8% year-to-date, accounting for nearly all of its 11% one-year return. Alphabet’s lackluster year-to-date and one-year gains can be attributed to the shares’ 14% tumble over the last three months.

Despite such a dramatic difference in their recent share-price performances, the gap between Meta’s and Alphabet’s valuations is not significant. However, the two companies don’t address exactly the same industries. Thus, we compare each company’s price-to-earnings (P/E) ratios to their own histories to gauge their valuations over time and determine which is the better Big Tech play.

Meta Platforms

At a P/E of 25.9x, Meta Platforms is trading at a small premium to Alphabet. However, the stock is on a steady downtrend on a P/E basis, although it’s trading much closer to its 52-week high than its 52-week low. Nonetheless, the multiple compression grants Meta Platforms a long-term bullish view.

Meta Platforms has certainly had its share of trouble since transitioning into a metaverse company. However, it’s still raking in the revenue on its social media properties, notching $39.1 billion in revenue for the June quarter, up 22% year-over-year.

At the same time, Meta Platforms is developing artificial intelligence technology, aiming to build a nice in generative AI and develop the AI applications that will be used by the masses for years to come. Most importantly, Meta is using AI to guide targeting for its digital advertising and recommendations on its social networks.

Despite these efforts, estimates suggest that Meta’s AI initiatives may contribute only minimally to its revenue.

However, analyst Deepak Mathivanan of Cantor highlighted Meta Platforms as a “top pick” among internet stocks. While he acknowledged the limited revenue impact of AI efforts, he also pointed to the company’s forward valuation. In fact, his estimates suggest a forward P/E of 20x FY25E earnings per share, which he said already embeds AI skepticism and provides room for potential upside for the shares.

Thus, I fully agree with this analyst’s assessment, especially due to the current multiple compression we’ve been seeing in Meta’s P/E ratio. The recent peak of about 39x came in July 2023, and the company’s P/E has been on a broader downtrend since then — despite its rising share price.

What Is the Price Target for META Stock?

Meta Platforms has a Strong Buy consensus rating based on 41 Buys, three Holds, and one Sell rating assigned over the last three months. At $584.82, the average Meta Platforms stock price target implies an upside potential of 11.27%.

Alphabet

At a P/E of 21.5x, Alphabet has a slight advantage over Meta in terms of valuation. In fact, Alphabet hasn’t been this cheap on a P/E basis since March 2023. Thus, a bullish view seems appropriate.

Put simply, Alphabet just looks too cheap to ignore at current levels. In fact, even excluding the cheapness of Alphabet’s P/E, the stock hasn’t been this cheap on a per-share level since March, indicating a buy-the-dip opportunity.

Additionally, Alphabet stock is slipping dangerously close to oversold territory with its Relative Strength Index of 32.5. As such, anything below 30 puts the stock in oversold territory and suggests an upside correction could be around the corner.

Finally, Alphabet’s 52-week range of about $120 to $192 is far less dramatic than Meta’s range of $279 to $544, indicating greater stability in Alphabet shares. In a market with significant volatility, investors could certainly do with holding some stable and steadily growing shares in their portfolios.

What Is the Price Target for GOOGL Stock?

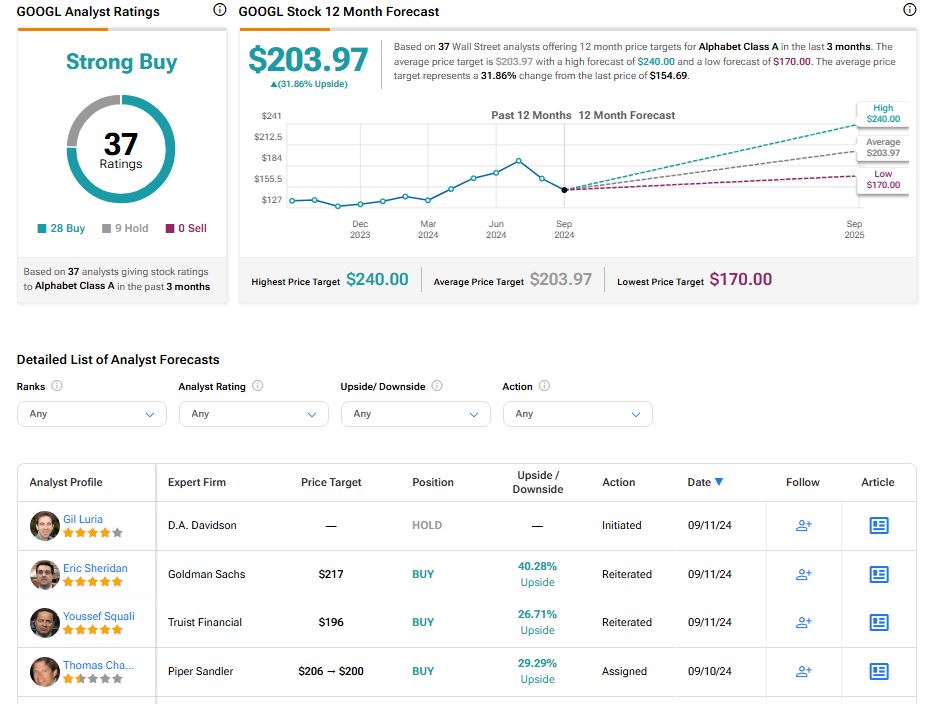

Alphabet has a Strong Buy consensus rating based on 28 Buys, nine Holds, and zero Sell ratings assigned over the last three months. At $203, the average Alphabet stock price target implies an upside potential of 35.27%.

See more GOOGL analyst ratings

Conclusion: Bullish on Meta Platforms and Alphabet

Ultimately, neither Meta Platforms nor Alphabet will be going anywhere anytime soon. Thus, both look like long-term buy-and-hold positions with a permanent place in a long-term portfolio. However, Alphabet is offering a distinct buy-the-dip opportunity right now because it’s too cheap to ignore. There hasn’t been a better time to buy this stock in months, if not more than a year based on P/E.

In contrast, Meta’s year-to-date gain makes its shares less attractive in the near term. Nonetheless, even at the current per-share price, investors are unlikely to lose money if they buy and hold for the long term.

Hence, both stocks receive bullish ratings, although Alphabet emerges as the clear winner.