With earnings season in full swing, there will be a slew of interesting quarterly releases to look forward to. Amid a market embroiled in uncertainty, Meta Platforms (FB) is set to release its Q122 financial results on Wednesday, April 27.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Many people were taken aback by the social media giant’s dismal Q4 financial results. While revenues increased by 20% year-over-year, earnings numbers were disappointing, falling by 5%.

In addition, Daily Active User (DAU) numbers showed signs of deterioration due to an increasingly competitive environment. In Q4, Facebook’s DAUs fell sequentially to 1.929 billion, marking the company’s first-ever monthly active user decline in its history.

Furthermore, rising interest rates combined with growing inflation have wreaked havoc on the markets. Concerns about legal challenges, as well as other macro headwinds, are also weighing on FB shares. As a result, the stock has lost 13% of its value year-to-date and 29% in the last year.

Now, let’s look at how the company is expected to perform in the first quarter.

Website Visit Stats Reflects an Upward Trend

To obtain a better understanding of Meta’s current status, we used TipRanks’ Website Traffic Tool, to dig into the company’s monthly user numbers ahead of the fiscal Q1 print.

We discovered through the tool that overall projected visits to Meta website increased in fiscal Q1. In particular, the total projected worldwide visits to facebook.com increased by 11% sequentially from the fourth quarter.

Given the positive trends in visits to Meta’s platforms, particularly Facebook, we can anticipate a strong quarter in terms of top-line growth.

Q1 Expectations

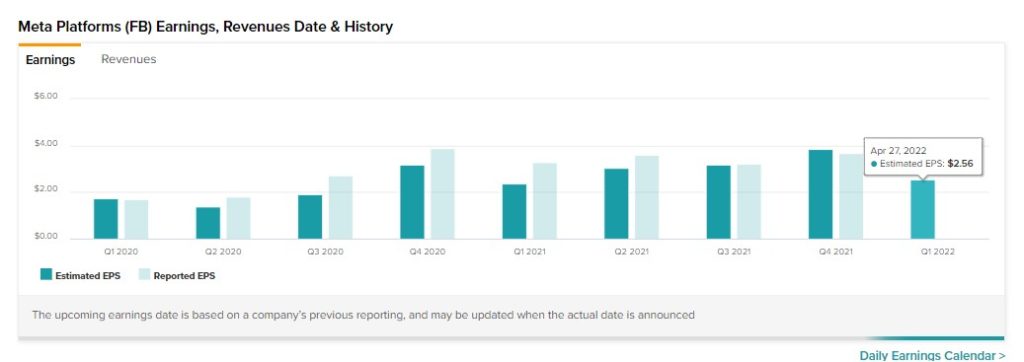

According to analysts, Meta is expected to report adjusted earnings of $2.56 per share, reflecting a decrease of 22.4% from the year-ago quarter.

Given the ongoing difficulties, Meta provided weak Q1 guidance. The business forecasts total sales to be in the region of $27-29 billion, which is lower than the average expectation of $30.1 billion.

In response to the guidance figures, Meta’s CFO Dave Wehner commented, “We expect our year-over-year growth in the first quarter to be impacted by headwinds to both impression and price growth.”

Wall Street’s Take

Ahead of the Q1 earnings results, BMO Capital analyst Daniel Salmon remains concerned about near-term visibility and the declining DAU growth.

He writes, “The potential for continued sequential daily active-user declines brings the possibility of further multiple contraction into play.”

As a result, Salmon maintained a Hold rating on the stock but lowered the price target to $225 from $290. This implies 22.2% upside potential from current levels.

The Street is cautiously optimistic about Meta, with a Moderate Buy consensus rating based on 33 Buys, 13 Holds, and one Sell. At $312.88, the average FB price target suggests 70% upside potential from current levels.

Bottom Line

FB stock may suffer in the upcoming quarter due to macroeconomic headwinds and litigation entanglements. Furthermore, TikTok is becoming a bigger competitor, which could hurt the company’s DAU figures.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.