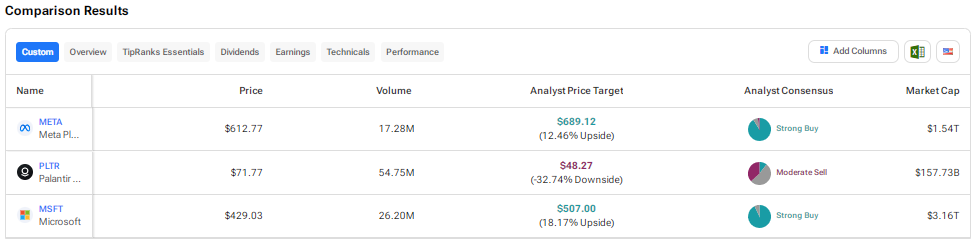

Despite elevated interest rates and macro pressures, technology stocks gained immense attention last year due to the generative artificial intelligence (AI) wave. Tech stocks are expected to benefit from a lower interest rate environment and an improved spending in 2025. However, lofty valuations of some tech stocks following a strong rally in 2024 could impact their movement this year. Bearing this backdrop in mind, we used TipRanks’ Stock Comparison Tool to place Meta Platforms (META), Palantir Technologies (PLTR), and Microsoft (MSFT) against each other to pick the best tech stock, according to Wall Street analysts.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Meta Platforms (NASDAQ:META)

Shares of social media giant Meta Platforms have rallied more than 66% over the past year, driven by the company’s solid results and optimism about the prospects in AI. The company is investing billions of dollars to capitalize on AI growth opportunities and improve its ad tools. While announcing the Q3 results in October 2024, CEO Mark Zuckerberg stated that one million advertisers have already used Meta’s generative AI advertising tools.

The company raised its capital expenditures guidance for 2024 to the range of $38 billion to $40 billion and expects its capex to continue to grow significantly this year due to the acceleration in AI infrastructure expenses.

Is Meta Stock a Good Buy?

Recently, Goldman Sachs analyst Eric Sheridan increased the price target for Meta Platforms stock to $668 from $630 and reiterated a Buy rating. Ahead of the Q4 2024 results on January 29, Sheridan continues to believe that the company is well-positioned to gain from many long-term secular growth themes, including Reels, click-to-messaging Ads, and AI (including the adoption of the Advantage+ offering).

Outside of Meta’s core advertising business, Sheridan also sees other possible longer-term revenue growth opportunities like Meta AI, AI Agents, Reality Labs and Llama AI models.

With 40 Buys, three Holds, and one Sell recommendation, Meta Platforms stock scores a Strong Buy consensus rating. The average META stock price target of $689.12 implies 12.5% upside potential from current levels

Palantir Technologies (NASDAQ:PLTR)

Data analytics software provider Palantir Technologies was the best-performing stock on the S&P 500 Index (SPX) in 2024, with a jump of 340%. The company’s strong fundamentals, inclusion in the Nasdaq 100 (NDX), and the traction for its AIP (Artificial Intelligence Platform) offering boosted investor sentiment.

Palantir is heading in the right direction and delivering strong growth rates in both its Commercial as well as Government businesses. The company’s offerings are witnessing rapid adoption, with customer count increasing by 39% year-over-year to 629 in Q3 2024. Moreover, the company closed 104 deals having a value of over $1 million in the quarter.

While the company’s long-term AI prospects look attractive, there are major concerns about PLTR stock’s elevated valuation following last year’s stellar rally.

What Is the Prediction for PLTR Stock?

In a research note to investors, Jefferies analyst Brent Thill said that he sees further downside in Palantir stock following the recent selloff. Thill highlighted that PLTR stock still trades at 46x enterprise value to the next 12-months revenue, or greater than two times the next highest software player.

He also noted the rise in insider selling through Rule 10b5-1 trading plans, with the CEO Alex KARP selling over $2 billion in stock and other executives offloading more than $600 million in the past five months. The analyst thinks that continued insider selling might weigh on PLTR stock. Thill reiterated a Sell rating on the stock with a price target of $28, which indicates a major downside risk of over 60% from current levels.

Overall, Wall Street has a Hold consensus rating on PLTR stock based on two Buys, 10 Holds, and seven Sell ratings. The average PLTR stock price target of $48.27 implies a downside risk of about 33%.

Microsoft Corporation (NASDAQ:MSFT)

Microsoft is viewed as one of the major beneficiaries of the ongoing AI wave. The company’s investment in ChatGPT-maker OpenAI and significant capital spending on AI infrastructure are expected to boost its future prospects. MSFT is on track to invest about $80 billion to build AI-enabled data centers to train AI models and deploy AI and cloud-based applications.

Also, the company’s AI investments are expected to drive continued growth in its Azure cloud service. Notably, revenue from Azure and other cloud services increased by 33% in Q1 FY25, with management highlighting that about 12 percentage points of Azure growth was attributable to AI.

Despite concerns about the near-term impact of significant AI spending on the bottom line, Microsoft’s long-term growth story looks attractive.

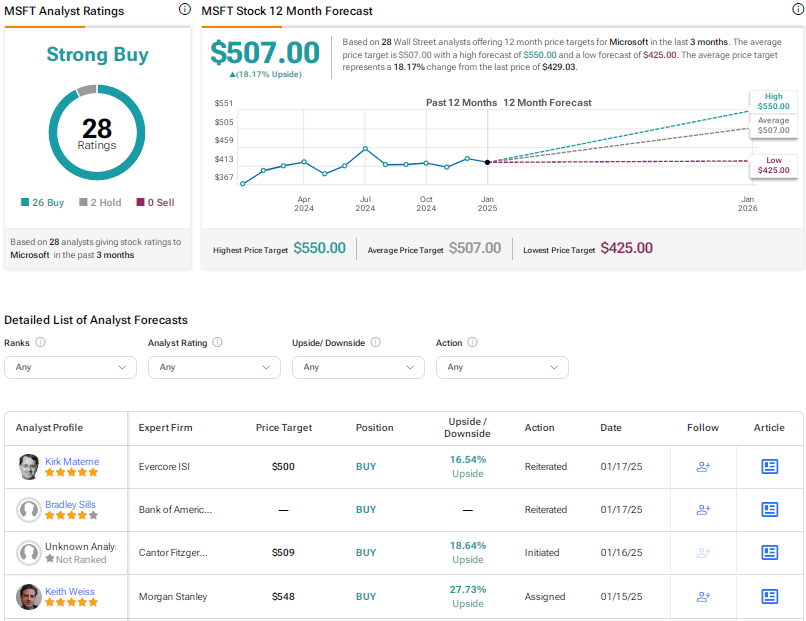

Is Microsoft a Buy, Sell, or Hold?

Ahead of MSFT’s upcoming Q2 Fiscal 2025 earnings, Evercore analyst Kirk Materne reaffirmed a Buy rating on Microsoft stock with a price target of $500. The analyst feels that Azure’s reacceleration and some normalization in the company’s capex growth in the second half of Fiscal 2025 could help investors refocus on the long-term durability of MSFT’s revenue and EPS growth.

Specifically, Materne expects a stabilizing spending backdrop for cloud services, accelerating adoption of AI services by enterprise clients, and expanded AI-related capacity to drive Azure growth into the 33% to 34% range over the next few quarters. He expects Q2 Fiscal 2025 Azure growth at or above the high end of the 31% to 32% guidance range. However, he cautioned investors about forex headwinds.

Overall, Materne expects Microsoft to gain from several favorable factors in the calendar year 2025, including the “ability to monetize Gen AI at both the app and infra layer, its durable growth algorithm, and fortress like balance sheet.”

With 26 Buys and two Holds, Wall Street has a Strong Buy consensus rating on Microsoft. The average MSFT stock price target of $507 implies 18.2% upside potential.

Conclusion

Wall Street is bullish on Meta Platforms and Microsoft stock but bearish on Palantir stock due to valuation concerns. Currently, analysts sees higher upside potential in Microsoft stock than the other two tech players. Specifically, Microsoft is expected to gain from several growth catalysts, including AI opportunities and strength in its cloud business.