Social media giant Meta Platforms (NASDAQ: FB), earlier known as Facebook, will begin trading on the NASDAQ under the ticker symbol META from June 9, replacing the current ticker FB. Shares of the company are down 43% amid a broader tech sell-off, and concerns about slowing advertising revenue due to rising competition from apps like TikTok and Apple’s (AAPL) iOS privacy policy changes.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

That said, Meta continues to focus on its future growth and is investing billions of dollars in rebranding itself as a Metaverse tech company.

Wall’s Street’s Take

In reaction to Meta’s recent announcement of the departure of long-time COO Sheryl Sandberg in fall this year, Mizuho analyst James Lee acknowledged that Sandberg’s “vision” in digital advertising and her experience in guiding the company through transitions, including mobile, video and stories, will be challenging to replace. That said, Lee believes that “the depth of Meta’s bench should provide a smooth transition.”

The analyst opined that Meta’s “established infrastructure and technology” should help in its transition to products such as Instagram Reels and Metaverse-related opportunities. Lee reiterated a Buy rating on Meta Platforms with a $325 price target.

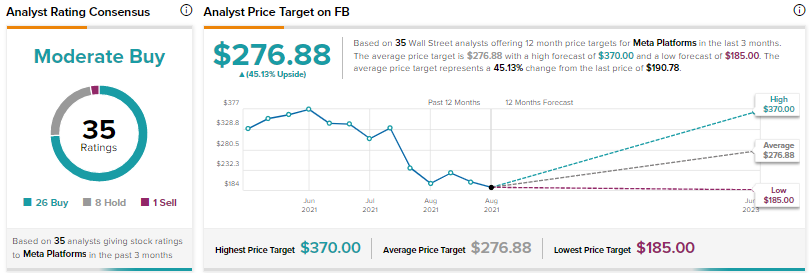

Overall, the Street is cautiously optimistic on the stock with a Moderate Buy consensus rating based on 26 Buys, eight Holds, and one Sell. The average Meta Platforms price target of $276.88 implies 45.13% upside potential from current levels.

Conclusion

Several analysts continue to be optimistic about Meta Platforms’ long-term growth story, despite the impact of near-term headwinds on its stock.

Read full Disclosure