IonQ (IONQ) has established itself as a leading player in the quantum computing space, with its shares surging an impressive 466% since this time last year. The company’s differentiated trapped-ion architecture and strong integration across major cloud platforms have garnered significant investor interest.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, despite its technological strengths, IonQ’s current valuation reflects elevated multiples and persistent profitability challenges. As a result, the risk-reward profile has become more nuanced. While the company’s long-term potential remains compelling, I believe the stock is fairly priced at present, and I therefore maintain a Hold rating.

IonQ Transforms Quantum Computing

Founded in 2015 and headquartered in College Park, Maryland, IonQ has established itself as a quantum computing leader through its distinctive trapped-ion architecture. The firm offers quantum computing as a service (QCaaS) through cloud platforms like Amazon Braket, Microsoft Azure Quantum, and Google Cloud. Users can also run quantum programs remotely on IonQ’s hardware, without having to own the machines.

The business model revolves around becoming a platform provider for next-generation computing, similar to how NVIDIA (NVDA) enables AI with GPUs, IonQ wants to enable quantum breakthroughs with trapped-ion systems. These systems can operate at room temperature while maintaining fidelity rates of 99.9% for two-qubit gates, providing significant advantages over competitors that require extremely cold operating conditions.

Not intent on standing still, the company recently announced its largest acquisition, with the $1 billion purchase of Oxford Ionics, combining the stack with a proprietary ion-trap-on-chip architecture. Additional acquisitions include Lightsynq Technologies and a controlling stake in ID Quantique, representing a further $1 billion.

These massive strategic moves demonstrate a commitment to building a comprehensive quantum ecosystem, though a significant dilution of between 7-11% of shares raises substantial concerns about shareholder value. Technological expansion through acquisitions is promising to a degree, but numerous execution risks remain, given the complexity of integrating multiple quantum technologies.

Explosive Growth Despite Profitability Concerns

IonQ’s revenue trajectory highlights exceptional growth, rising from $1.6 million in 2021 to $43.1 million in 2024. Management forecasts revenue between $75 million and $95 million for 2025, implying a compound annual growth rate of approximately 200% since the company went public.

This rapid acceleration reflects meaningful commercial traction and reinforces the growing demand for quantum computing solutions. IonQ holds a differentiated position as the only quantum hardware provider integrated across all major cloud platforms—Amazon Web Services, Microsoft Azure, and Google Cloud. The company is targeting high-impact markets, particularly in cryptography, cybersecurity, and encryption, which offer substantial long-term potential.

However, the path to profitability remains uncertain. In 2024, IonQ reported a net loss of $331.7 million, while operating expenses rose 38% year-over-year to $83.2 million in Q1 2025. Moreover, free cash flow remained significantly negative at -$123.7 million in 2024, underscoring the capital-intensive nature of quantum technology development. These financial challenges raise important questions about the timeline for achieving sustainable profitability.

IonQ’s Technical Advantages Push Up Expectations

IonQ’s competitive advantage stems from the distinctive strengths of its trapped-ion quantum architecture, which offers several benefits over superconducting approaches used by peers such as IBM (IBM) and Alphabet (GOOGL). Key differentiators include all-to-all qubit connectivity, longer coherence times, and significantly lower error correction overhead, estimated at a 13:1 ratio compared to approximately 100:1 for some competing platforms.

While often complex for investors to understand, these details provide IonQ with a meaningful competitive advantage. The roadmap outlines a clear path to scaling, with plans to reach 100-qubit systems in the coming years and eventually millions of qubits through the integration of multi-core technology and photonic interconnects.

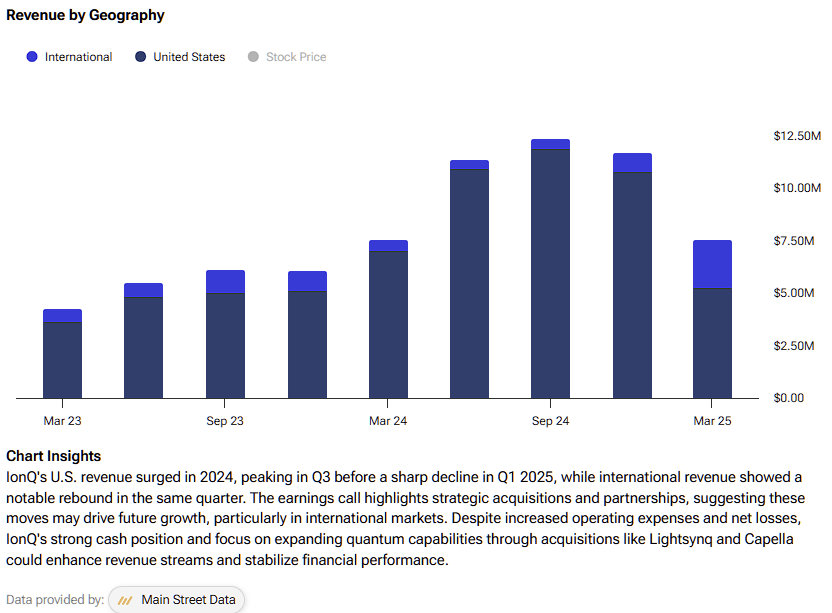

An extensive patent portfolio of over 950 patents, spanning both quantum computing and networking, also provides additional competitive protection. Recent commercial deployments, including a $22 million Forte Enterprise quantum system to EPB in Chattanooga, demonstrate that practical applications are taking shape. While these developments are encouraging, the quantum computing market remains in its early stages, with uncertain commercial timelines and a heavy lean towards revenues generated in the U.S. for now, as reported by Main Street Data.

IonQ Harnesses Technology to Mitigate Financial Risk

While IonQ has established itself as a leader in trapped-ion quantum computing, several key risks warrant investor caution. The company remains significantly unprofitable, with ongoing cash burn primarily driven by substantial investments in research and development. Furthermore, the recent decision to discontinue disclosing forward bookings may raise concerns within the investment community regarding revenue visibility, complicating efforts to assess near-term growth momentum.

Although the company’s balance sheet is currently stable—with low leverage and a strong cash position—the persistently negative cash flow, as previously noted, presents a risk. Without meaningful progress toward improved financial efficiency, there is concern that the current capital position may not be sustainable over the long term.

IonQ’s reliance on government contracts and research partnerships presents another massive vulnerability, especially if public-sector funding priorities shift. And while its trapped-ion architecture has technical advantages for now, the broader field of quantum computing remains fairly experimental, with competitors pursuing alternatives that could scale more quickly or efficiently. Investors are ultimately betting not just on the company’s execution, but on its very specific technological thesis proving correct.

Valuation Concerns Temper Enthusiasm

The quantum computing market presents enormous potential, with McKinsey research projecting that the market could reach $87 billion by 2035. However, this potential comes with significant valuation challenges that warrant caution. IonQ currently trades at approximately 135x projected 2025 sales, with an EV/Sales ratio of 232, dramatically above the sector median of 6.46, according to TipRanks data.

While IonQ is operationally solid, these extreme valuation multiples create substantial downside risk if the company fails to meet lofty expectations. For now, a ~$10 billion market capitalization appears to reflect overly optimistic assumptions.

Are IonQ Shares a Good Buy?

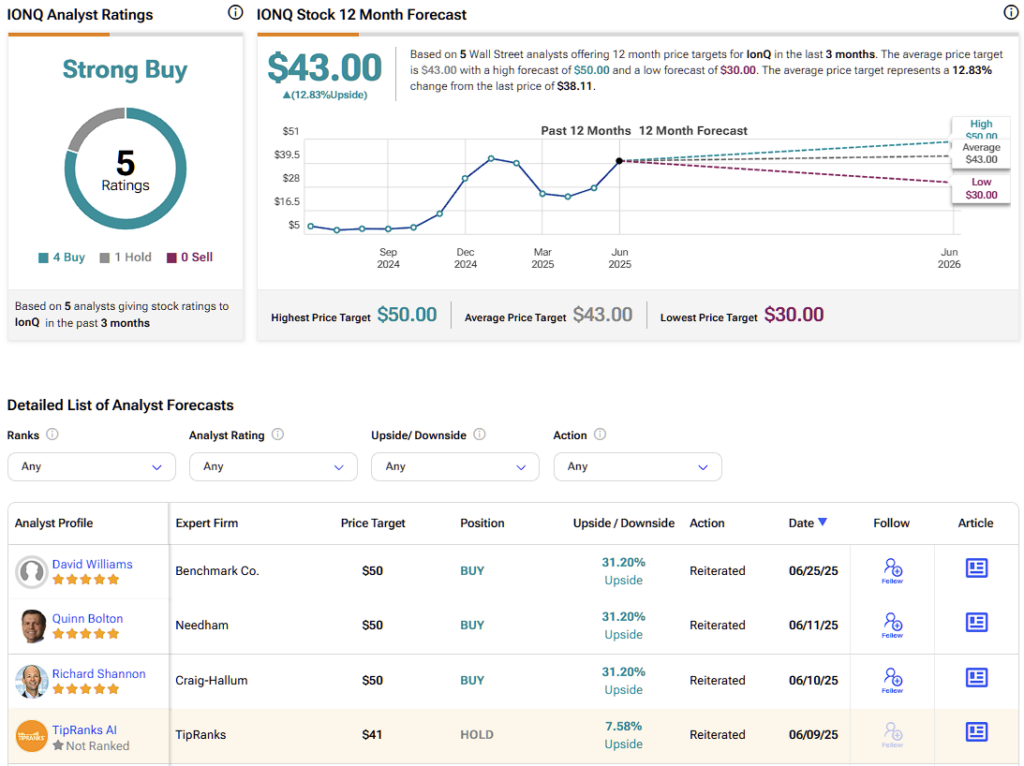

Turning to Wall Street, IonQ carries a Strong Buy consensus rating based on four Buys, one Hold, and zero recent Sell ratings. At $43, IonQ’s average stock price target implies about 13% upside potential.

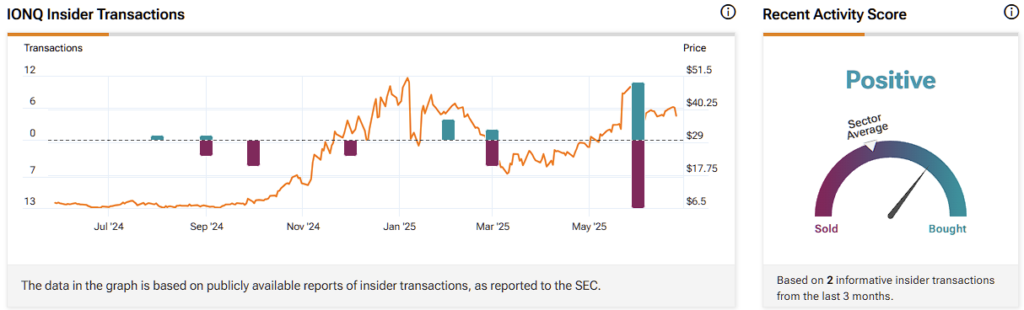

Moreover, according to TipRanks data, the mixed trend in insider transactions reflects the complex variables at play. A spike in recent activity shows both heavy buying and selling. While these transactions are often unrelated to future performance, large transaction volumes of this nature are unlikely to send encouraging signals to the market about leadership confidence.

IonQ Possesses Strong Potential as Valuation Calls for Patience

In my view, IonQ presents a nuanced investment case within the emerging quantum computing sector. The company benefits from a strong technical foundation, an expanding patent portfolio, a healthy balance sheet, and a growing network of commercial and research partnerships—all of which support its long-term potential.

However, the current valuation appears to be ahead of near-term fundamentals. Continued operating losses and execution risks—especially in such an early-stage and capital-intensive industry—highlight the disconnect between market performance and business maturity. Currently, it appears that the stock’s exceptional run may have outpaced the company’s underlying progress.

My Hold rating reflects a balanced view of the risk-reward profile. While IonQ’s leadership in technology and strategic positioning is compelling, the premium valuation constrains upside potential and introduces meaningful downside risk. Investors may be best served by exercising patience, allowing the company time to demonstrate continued execution and for the market to recalibrate its expectations accordingly.