During most of the last year, small-cap stocks underperformed large caps by a wide margin. However, by the year-end, historically low valuations, coupled with a brightening economic horizon, drew many investors to small-cap ETFs. The Russell 2000 stocks surged from their October lows, though this year has so far seen them underperform once more, despite the positive market sentiment. This leads to the question: Will they be able to stage a comeback, or should investors steer clear of the small caps? Looking at the various currents buffeting the market, it does not seem like a rebound is on the horizon.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Waiting for the Small-Cap Boat to Sail

For most of 2023, the vast majority of market gains were concentrated within a handful of large, mostly tech stocks. However, the rally significantly broadened towards the end of last year, with many analysts expecting the high tide of a brightening economic outlook to “lift all boats” as the bull market wave rushed in. One of the asset classes that money managers have been snapping up were the beaten-up stocks of small-cap companies.

At the end of 2023, the Russell 2000 – the most-followed gauge of small-cap stocks – had its largest performance gap versus large caps since 1998. That has strongly pressured their valuations, with small caps trading about 20% below their long-term valuation averages in December, versus a 15% average premium investors were paying for large-cap stocks.

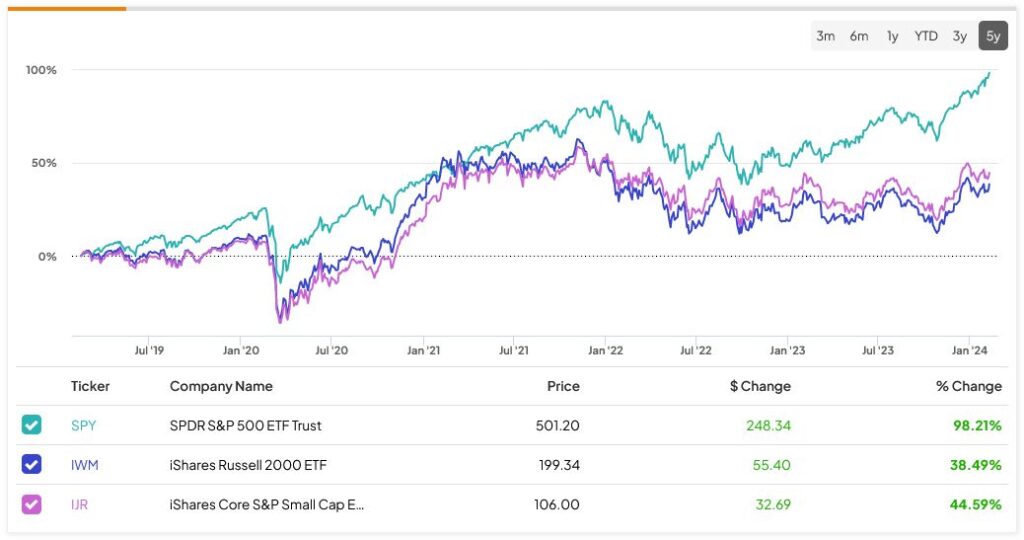

In response to these low valuations, funds, and retail investors have begun flocking into small-cap ETFs, such as iShares Core S&P Small-Cap ETF (IJR) and iShares Russell 2000 ETF (IWM), in anticipation of a turnaround in small caps, as larger market breadth is historically associated with bull markets.

Small Caps Not Invited to the Party

Despite the rally raging on and the S&P 500 (SPX), which has reached multiple new highs this year, market breadth has actually been deteriorating since December. Thus, the “Magnificent Six” stocks – the group that used to be “Magnificent Seven” before losing Tesla (TSLA) this year – have accounted for over 70% of January’s SPX return.

The top ten companies in the S&P 500, all of which – except Berkshire Hathaway (BRK.B) and Eli Lilly (LLY) – are tech firms, wielding a market capitalization of almost $14 trillion. With a third of its weight in the top-ten stocks, SPX hasn’t been this concentrated in 50 years.

Source: S&P Dow Jones Indices

The sectoral performance has indeed seen some convergence, with the IT, Communication Services, and Consumer Discretionary rally joined by other sectors. On the other hand, small caps don’t seem to have received an invitation to the party. In fact, year-to-date, small caps have fallen by 0.1%, while the S&P 500 gained over 6%.

The small-cap Russell 2000 remains the only major U.S. index firmly off its all-time high. Despite an over 20% surge from its October lows, the Russell 2000 is down almost 18% from its last November 2021 peak. The S&P 500 has outperformed the Russell 2000 by 18% in the past 12 months, and by almost 40% in the past three years.

Fundamentals Matter

Since the introduction of the small-cap Russell 2000 index in 1979, there have been multiple periods when it outperformed the large-cap S&P 500. However, these periods became increasingly scarcer and shorter in the past decade. Cumulatively, small caps have been beaten by large caps in the past month, year, three-, five-, and ten-year periods. The only two recent periods of meaningful small-cap outperformance versus large caps in recent years were three months at the beginning of 2021 and two months at the end of 2023.

A large part of small-cap underperformance is due to their considerably higher sensitivity to economic and financial conditions. In the last four years alone, businesses were hit by pandemic-related restrictions, supply-chain troubles, inflation, and high interest rates. The robust job market increased their labor costs, while their low pricing power impacted their ability to maintain margins in the face of higher input and energy outlays. While thankfully we haven’t encountered an economic “hard landing” that analysts feared would crush small caps, they are far from being out of the woods.

Companies in the Russell 2000 index are almost twice as indebted, on average, as SPX members, with over 60% of the small-cap debt load maturing in the next five years. More worrisome, half of the small-cap companies’ debt is floating rate, versus just around 10% for the S&P 500. With the Federal Reserve’s interest rates at their highest since 2000 and expected to remain high for some time, it is hard to imagine how these businesses can fare well even if the economy strengthens more than expected.

Moreover, the percentage of money-losing companies among small caps has risen from 15% in 1994 to over 35% at the end of 2019, i.e., over a third of them were unprofitable even before the onset of the string of unfortunate events starting with the COVID-19 crisis. Now, this proportion stands at over 40%. Meanwhile, as little as 6% of the S&P 500 firms have negative earnings; this percentage has not changed dramatically over the last three decades.

Therefore, it is not surprising that small caps have been underperforming. Fundamentals matter, and the more perilous the economic outlook, the more investors tend to flee over-leveraged and/or unprofitable firms.

De-Risking At The Top

Throughout almost all of modern market history, investors have bought small-cap stocks as their promise of fast growth outweighed their inherent risk and cyclicality. Large caps, on the other hand, were expected to be solid, slow-moving businesses. What they lacked in exciting growth they made up for with stability even during market swings.

However, things have changed unrecognizably since the dawn of this millennium, as technology has been playing an increasingly larger role in our economy and everyday life. This profound change is reflected in the stock market as well. Long gone are the days when SPX’s largest holdings were inert utility, oil, and consumer staple colossuses.

Now, tech giants such as Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), and others are at the front of the market, combining past and expected fast growth with safety secured by their sheer size. These high-tech behemoths now constitute a large proportion of holdings at many institutions such as pension funds and 401(k) plans, among others. Coupled with the economy’s accelerating dependence on these companies’ products and services, these tech leaders have become “too big to fail.”

The Investing Takeaway

This leads to the obvious question: when you combine the safety of size, propped up by strong balance sheets and large cash piles, while also providing for fast growth, why take risks with small-cap stocks?

Of course, this is primarily relevant to small caps as a group. Among many tiny firms that will never grow to be included even in a mid-cap index, there are a few future Apples and Googles, now trading at giveaway valuations, which someday will make their patient investors very, very rich.

However, small caps as a group now offer an inferior risk-reward balance versus their larger counterparts, so buying into a small-cap ETF is probably not a good idea, and, at least for the time being, it does not look like a small-cap rebound is on the horizon. Instead, investors wishing to bet on a small-cap comeback are advised to choose individual companies, carefully reviewing the fundamentals to find better-quality stocks with lower leverage and positive earnings and cash flows.