Lululemon Athletica’s (Nasdaq:LULU) brand continued to conquer markets around the world in Q3, according to its Chief Executive Officer, Calvin McDonald. I’m bullish on LULU stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

“Our third-quarter results demonstrate the ongoing strength of Lululemon and the tremendous growth potential of the business in both the near- and long-term,” says McDonald. “We are pleased with our early holiday season performance and how the lululemon brand continues to resonate in markets around the world. We are energized by the exciting opportunities ahead, and I’m proud of our teams across the globe for their passion and agility.”

Q3 Solid Performance and Upbeat Guidance

The Vancouver, British Columbia-based athletic gear maker, reported solid Q3 financial results that beat Wall Street estimates on solid holiday sales on Thursday afternoon.

Gross profit jumped 32% to $829.4 million, and gross margin rose 110 basis points to 57.2%. In addition, income from operations increased 26% to $257.9 million. Meanwhile, comparable-store sales rose 32%, while direct-to-consumer net revenue increased 23% to $586.5 million.

The exceptional Q3 performance came on the heels of a solid Q2 quarter, when the company reported a net revenue gain of 61% and a net operating margin gain of 630 basis points to 20%.

At the same time, Lululemon had to lower its MIRROR revenue guidance, as sales are proving to be lower than expected. The company spent $500 million to buy MIRROR, a fitness device, last year.

Quo Vadis President John Zolidis, a long-time follower of the company,

expects demand for the company’s products to remain high, despite some minor setbacks.

“Lululemon’s results continue to reflect strong demand and excellent execution on product and merchandising,” he says. “On the other hand, the MIRROR acquisition is yet another example of how even the best management teams are too easily seduced by new markets they don’t understand and too quick to destroy value with shareholder capital in acquisitions. The long-term growth story remains intact.”

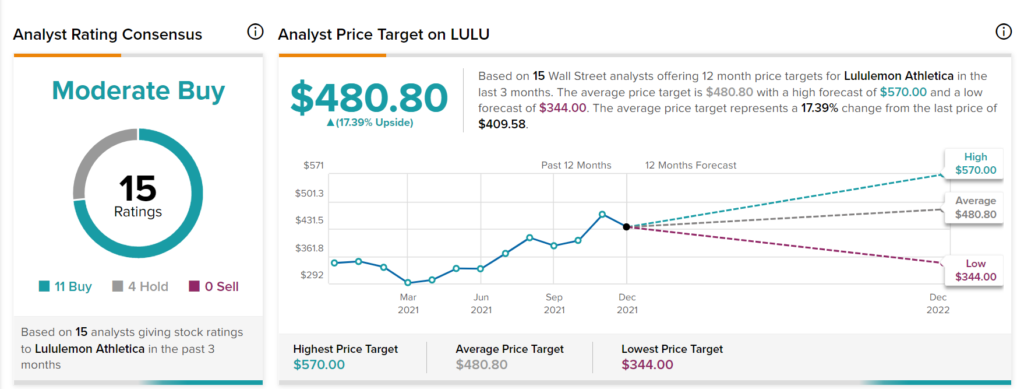

The 15 analysts following Lululemon rate it a Strong Buy, with an average price for the next 12 months of $480.80 (up from $465 last quarter), with a high forecast of $570 and a low forecast of $344. The average Lululemon price target represents a 17.4% change from the last price of $409.58.

Apparently, Lululemon has the right strategy to “resonate” with the world.

Lululemon’s Strategy

Succeeding in the athletic retailing industry takes sound planning. It requires developing the right value proposition and effective execution to spread and maintain the buzz for the brand.

With its Power of Three growth plan and Impact Agenda commitments, Lululemon seems to be doing just that, launching exciting new products across channels and different world regions and developing strategic partnerships. For instance, a couple of years ago, the company introduced new product lines supporting yoga, running, and training, as well as an office/travel/commute category, while also pursuing new opportunities, such as self-care.

Meanwhile, Lululemon has developed the Omni guest experiences – offering an integrated guest experience across channels, inspiring, provoking, and celebrating guests living a healthy and mindful lifestyle. In addition, the company has expanded its reach to fast-growing international markets like China, the APAC and EMEA regions, and online markets in North America.

Summary and Conclusions

Lululemon’s success in resonating in markets worldwide isn’t an accident, but the result of good planning and effective execution. That’s something very few companies have achieved in the athletic apparel market, where fashion and faddism quickly come and go.

Disclosure: Panos Mourdoukoutas owns shares of Lululemon.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >